Is Adobe set to top forecasts again?

Adobe is preparing to report its fourth quarter earnings on Wednesday, likely looking at a strong performance as demand for its software services rises and its artificial intelligence (AI) business gains momentum.

Analyst consensus estimates expect the Photoshop creator to report earnings of $4.14 per share on revenues of $5.02bn (£4bn), up from $4.53bn (£3.61bn) in the fourth quarter last year.

Adobe has forecast earnings per share of $4.1 to $4.15 on revenues of $4.98bn (£3.97bn) to $5.03bn (£4.01bn).

It could be ending 2023 on a high, having consistently topped Wall Street predictions in every quarter so far this year.

In March, Adobe launched Firefly, its AI tool for generating images, and so far it appears to have impressed, with over two billion images generated in the first six months.

Morgan Stanley analyst Keith Weiss has given Adobe stock an overweight rating, saying it looks as if investors are “very comfortable” with the company’s ability to cash in on AI.

“Bottom line, we continue to see the potential for upside to current FY24 consensus estimates across Digital Media, Digital Experience, and EPS, which should sustain momentum in [Adobe] shares,” Weiss wrote in an investor note.

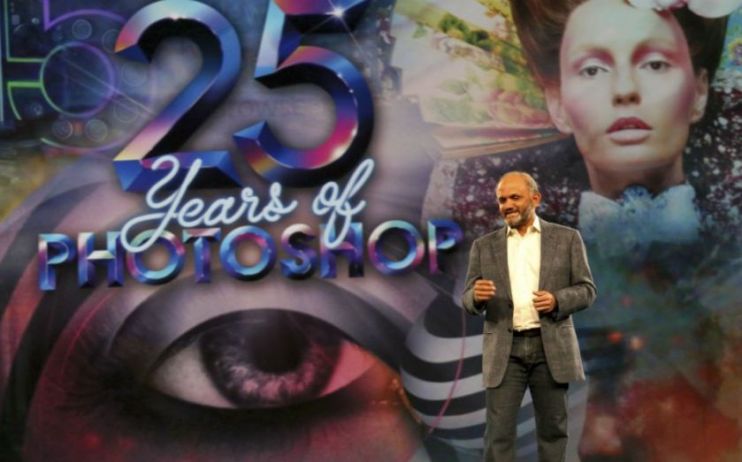

Adobe’s digital media segment, which includes its creative cloud services such as Photoshop and Lightroom, is expected to grow again after a record third quarter which saw revenues of $3.59bn (£2.86bn).

Rising demand for the design software has pushed Adobe’s guidance for digital media revenues up to the $3.7bn mark.

Mizuho Securities, a Japanese capital markets company, said an already “healthy performance” in Adobe’s third quarter would get “much better” in the final three months of 2023.

The stock is up more than 80 per cent year-to-date: