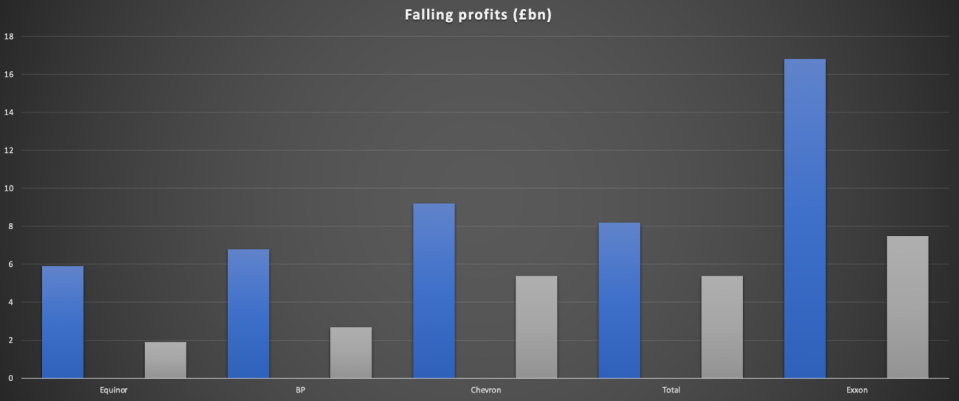

Shell offers £2.8bn in share buybacks as profits slide to £5.1bn as commodity boom eases

Shell is the latest energy giant to post a sharp downturn in profits, unveiling £5.1bn ($6.24bn) earnings over the third quarter — a 38 per cent decline year-on-year.

This reflects a normalising market, after last year’s commodities boom fuelled record results for the world’s major oil and gas players.

Profits are up quarter-on-quarter, rising from £4.2bn ($5.1bn) during trading in April to June, which Shell attributes to robust operational performance and higher oil prices and refining margins.

The FTSE 100 company also remains ahead of rival BP — which posted a 60 per cent decline in profits earlier this week.

However, it is still a hefty slide from the £8.1bn profit Shell recorded in the third quarter of 2022 — which powered bumper £32.2bn profits for the energy giant last year.

Alongside the results, Shell has announced a fresh share buyback programme of £2.87bn ($3.5bn) in its bid to placate investors over cooling markets.

This is expected to be completed before the fourth quarter announcement in three months’ time.

Total shareholder distributions in the quarter amounted to £4.02bn ($4.9bn), of which £1.81bn ($2.2bn) was dividend payments and £2.2bn ($2.7bn) was share buybacks.

This brings buybacks for the second half of 2023 to £5.4bn ($6.5bn), well in excess of the £4.1bn ($5bn) announced at the company’s capital markets day in June.

Shell’s chief executive Wael Sawan said: “Shell delivered another quarter of strong operational and financial performance, capturing opportunities in volatile commodity markets. We continue to simplify our portfolio while delivering more value with less emissions.”

Oil prices have rallied in recent months but remain well below levels posted in the immediate aftermath of Russia’s invasion of Ukraine last year.

Meanwhile, gas prices have significantly eased, with the UK benchmark trading at around £1.25 per therm this week compared to last year’s all-time highs which nearly touched £8 per therm.

Shell’s drop in third-quarter profits reflected trends across the industry – with year-on-year slides reported by rival fossil fuel traders – including BP

Stuart Lamont, investment manager at RBC Brewin Dolphin, said: “Shell’s results are a contrast with BP’s earlier this week, more or less matching expectations on the back of rising profits. Comparisons with last year, when oil prices first began their surge, were always going to be tough, but the company has managed to deliver.

“Another share buyback should be good news for shareholders, but there is little said about its plans to achieve net zero in today’s update – this remains a longer term concern for many, after the company announced its decision to focus on oil and gas production earlier this year. With the geopolitical environment still volatile, oil prices look likely to continue recent rises which should mean a strong final quarter for Shell.”

The company has continued to back hydrocarbon investment alongside its pledges to spend £25bn in the UK on low-carbon energy generation over the current decade.

Under new boss Sawan, Shell has defended the need for oil and gas for decades to come while also slashing its short-term oil and gas reduction pledges — with the chief executive describing radical reductions as “dangerous and irresponsible.”

This has seemingly reassured investors that these oil and gas producers are still committed to their primary operations.

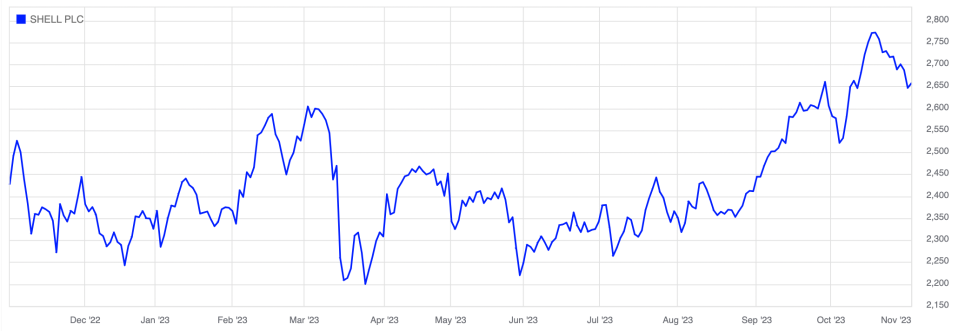

Shell will begin trading at 2,657p per share on the FTSE 100 this morning, with all eyes on investor reactions to the latest announcement.

Shell’s share price has remained robust in this year’s trading (Source: London Stock Exchange)