Ofgem must hold firm on financial rules for suppliers after energy crisis, MP warns

Ofgem needs to hold firm on financial requirements for suppliers as the sector recovers from the energy crisis, warned the deputy chair of a leading Westminster panel of MPs.

Sir Geoffrey Clifton-Brown, a long-standing Conservative politician and member of the Public Accounts Committee, told City A.M. restoring confidence in the energy market remained a “dilemma”.

He believed the regulator needed to get the balance right between encouraging innovation and protecting consumers from future market volatility.

“The whole idea of the regulator was to promote more companies to go into the market, but they were doing that with a very light touch. Now, I think they will have to scale that back a bit and ensure the robustness of companies coming into the market in future that they can actually cope in this volatility and they have got the wherewithal,” he said.

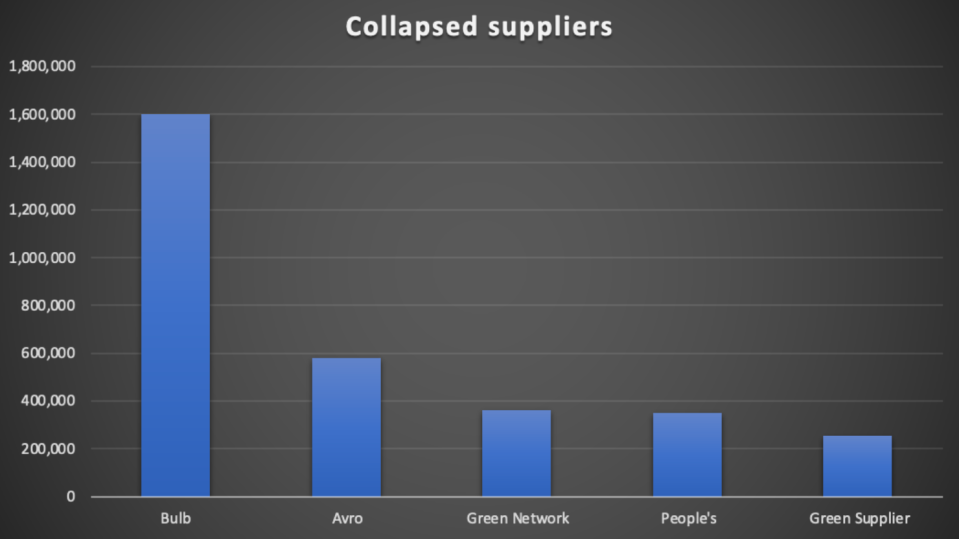

This follows the collapse of nearly 30 suppliers when wholesale prices soared amid rebounding demand from the pandemic in autumn 2021 – as well as the de-facto nationalisation of Bulb Energy, which was propped up on life support through transfusions of taxpayer funds totalling over £3bn.

The problem was exacerbated by a further spike in February 2022 after Russia invaded Ukraine, which fuelled record household bills, vast government support packages and further energy firm collapses.

The price cap is expected to remain at nearly double pre-pandemic levels despite recently easing. Source: Cornwall Insight

Clifton-Brown recognised Ofgem wanted to “promote competition” but believed there was no “point getting companies to come into market and then fail” – which customers would eventually foot the bill for through their energy bills.

Overall, the cost of ferrying customers from fallen firms to surviving suppliers rose to £2.7bn – affecting nearly 4m households – contributing to a record energy price cap of £4,279 per year in January.

For context, the price cap typically remained within £1,000 – £1,200 per year prior to the crisis.

While 73 suppliers entered the market between 2010 and May 2022, at least 65 suppliers exited the market over the same period.

“Some small companies in the market I think thought that this was a very easy way to make money and didn’t realise actually how much capital they need to have to be able to run a robust organisation,” he said.

The Cotswolds MP was speaking with City A.M. following the Public Accounts Committee’s publication of its report on the energy sector crisis – including the bailout of Bulb and its eventual acquisition by Octopus Energy.

The committee criticised Ofgem’s role in the crisis, warning that it failed to ensure energy suppliers were financially resilient and had sufficiently hedged, while also raising concerns over the recovery of the taxpayer funds committed to funding Bulb,

Ofgem recently unveiled capital adequacy rules as part of its bid to clean up the market, but this has been challenged by suppliers in the industry.

Utilita Energy has been granted permission by the Competition and Markets Authority to challenge the introduction of minimum capital requirements, news that was first reported in The Financial Times.

Energy retailers are currently constrained by a 1.9 per cent profit limit on customer bills, with Shell the latest supplier to exit the market amid concerns over profitability in the sector.

As it stands, the Big Six – consisting of British Gas, Octopus, Eon, Ovo, EDF and Scottish Power – have a more than 90 per cent share of the market.

Bulb was by far the biggest of the UK’s collapsed suppliers

When approached for comment, an Ofgem spokesperson told City A.M. “protecting consumers is our top priority.”

They said: “We have raised the bar for all energy companies with measures that include financial ‘stress testing’, tightening rules around the protection of credit balances and renewables levies and strengthened ‘fit and proper’ controls for senior managers.

“We can and do decline licence applications by new energy companies where we are not convinced the organisation is resilient enough to weather the volatility of the current energy market. We also require organisations to assess their management control frameworks and provide assurance to Ofgem.”

A department for Energy Security and Net Zero spokesperson said: “Placing Bulb into a Special Administration regime was the only viable option to ensure Bulb’s 1.5m customers were protected, while providing best value for the British taxpayers. We will continue to do this and have put in place protections to safeguard any credit balances.

“We are reviewing the committee’s report and will respond to their recommendations in due course.”