Here are the six spookiest charts in global finance right now

With soaring inflation, high interest rates and the risk of a recession looming, 2023 has spooked everyone.

In honour of this ghoulish time of year, M&G has compiled the scariest charts in global finance right now.

Read ahead, if you dare…

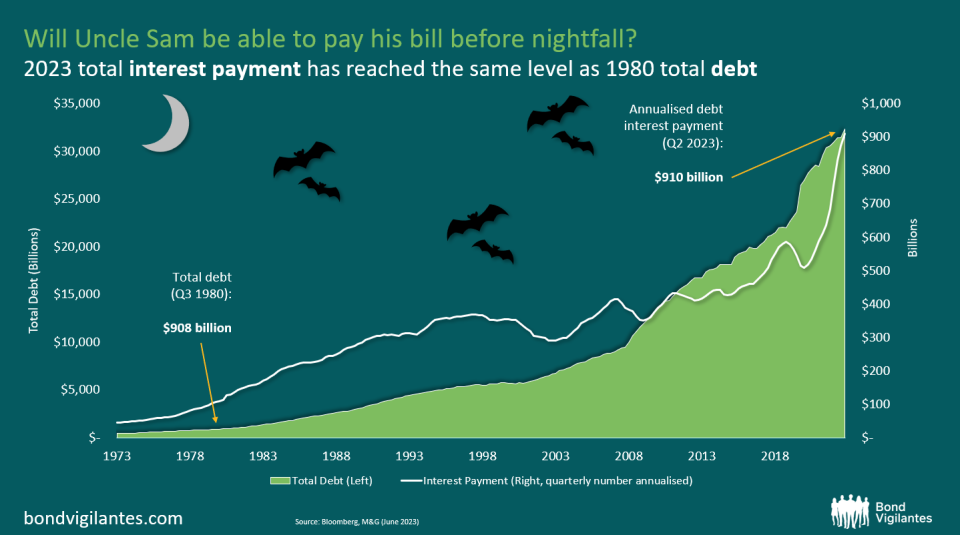

Uncle Sam has a very large bill to pay

The US government has a very large bill to pay due to significant borrowing levels during the pandemic and the steady rise in interest rates which has meant debt interest payments having been rising fast. According to M&G, annual interest payments look like they will soon hit $1 trillion and will likely rise even further as maturing debt will need to be refinanced at higher rates.

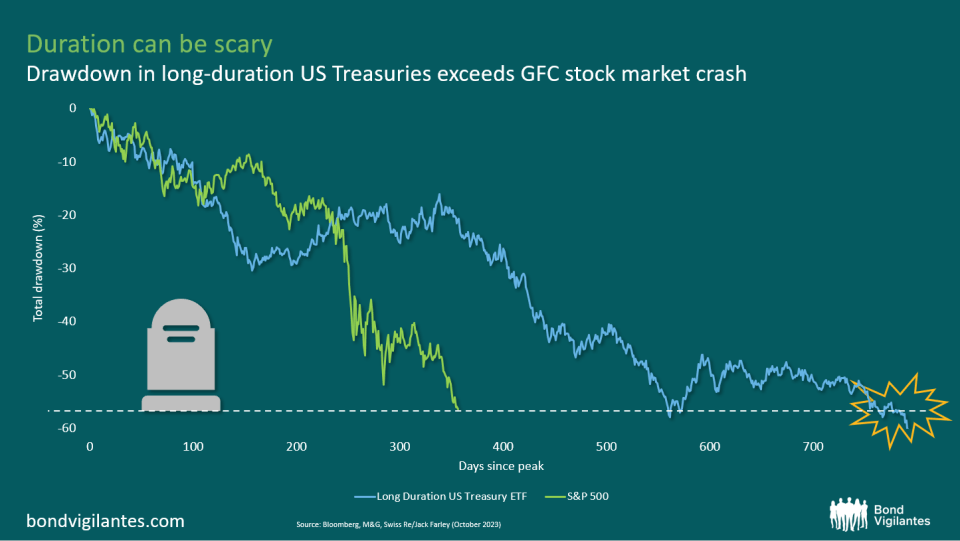

Longer-date bonds leave investors exposed

With excess money in the US economy due to stimulative monetary policy and pent-up demand following the pandemic, inflation has made a spooky return in the recent years, giving investors with longer-dated bonds a stark reminder of just how scary that duration can be scary.

The chart shows that total drawdown in long-duration US treasury bonds now exceeds the peak-to-through stock market crash seen in the 2007 financial crisis. High duration bonds leave investors exposed for longer to the risk of inflation, increasing the risk of the real value of their investment eroding.

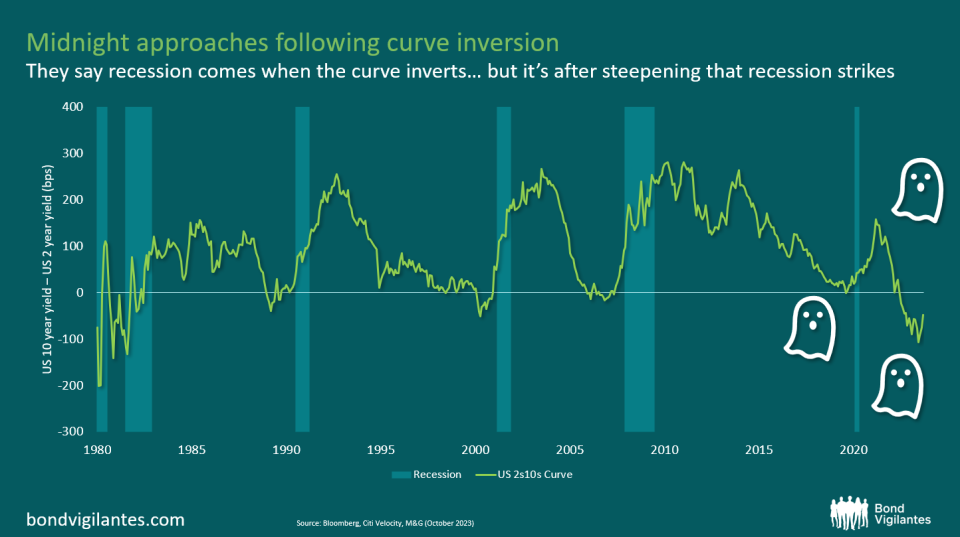

Recession witching hour approaches

For many decades, a recession has always followed in the months following an inversion of the US Treasury curve. When short-term yields are higher than long-term yields, markets are pessimistic on near-term economic prospects and investors are repositioning into longer-dated bonds. This chart shows that the 10-year yield minus 2-year yield is starting to steepen as it has done just before a recession bites.

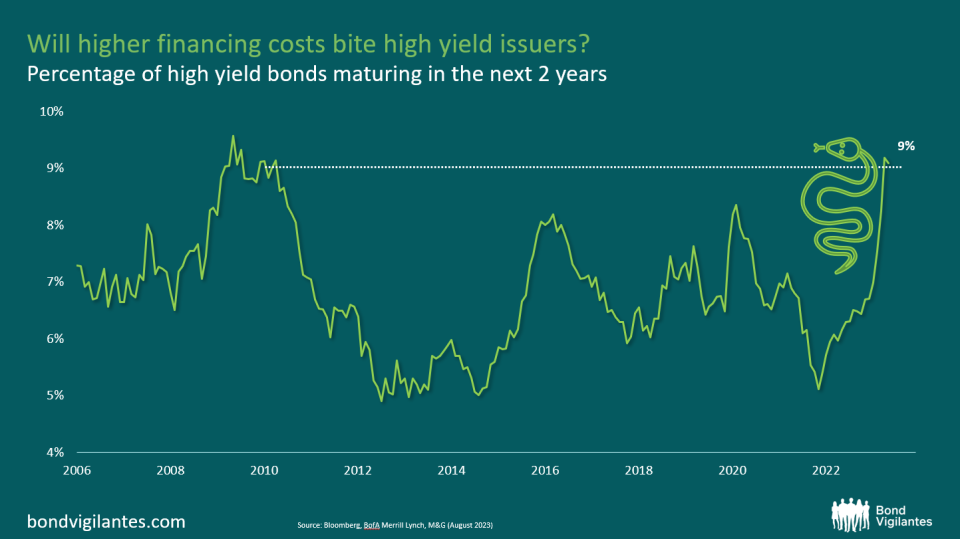

Refinancing risks rise

The option-adjusted spread of the Global High Yield index has now fallen close to its tightest levels since the 2007 financial crisis as we are now 18 months into the hiking cycles of most central banks. M&G‘s Andrew Eve cautioned that with many companies having put refinancing off for some time now, maturity walls are closing in. He noted that nearly 10 per cent of high yield issuers face refinancing risk in the next two years.

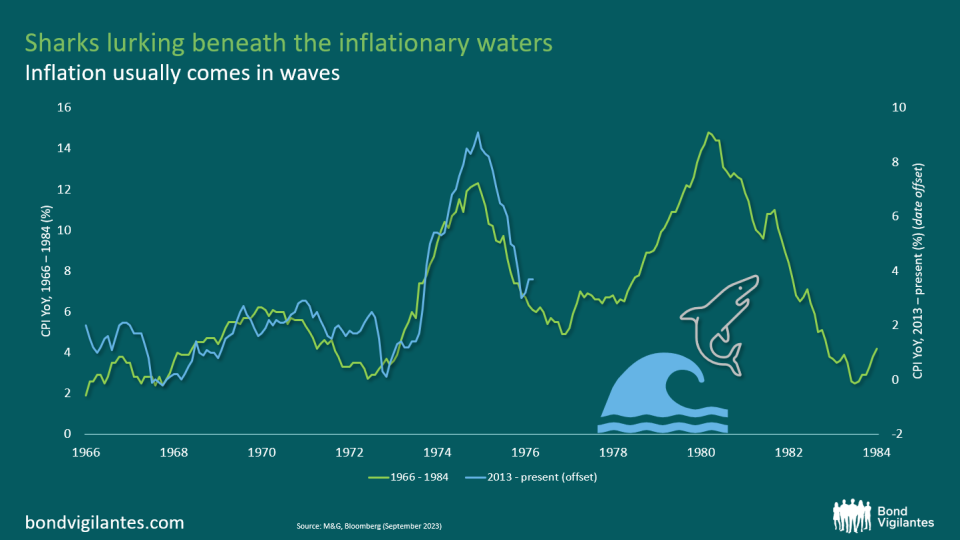

Tides turn on inflation

Inflation usually comes in waves, and the motion of the ocean is starting to look scarily similar to the waves seen back in the 1970s, suggesting a rising risk that inflation is making a comeback.

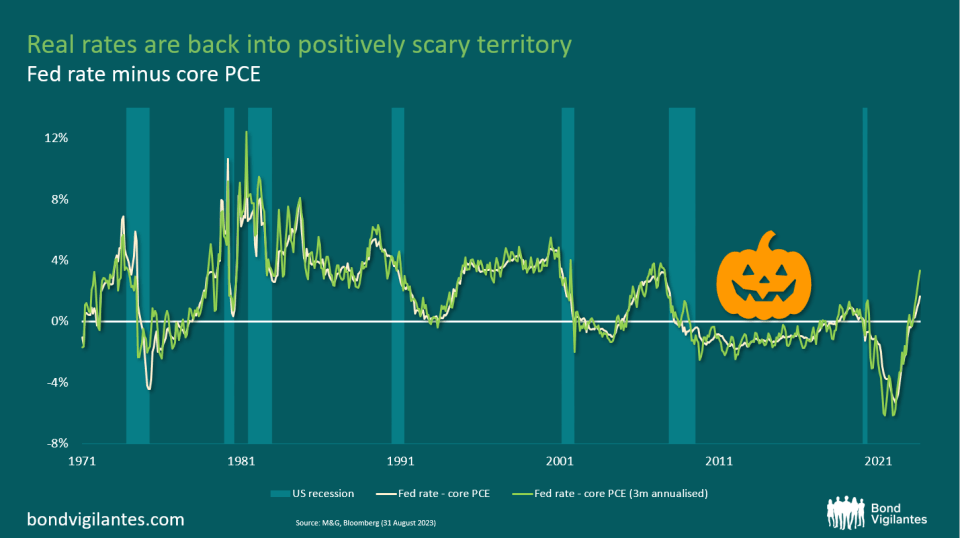

Real rates back into scary territory

One of the key indicators for the risk of recession is the real rate, defined by M&G as the central bank rate minus core inflation. In the US, a real rate above 3 per cent has traditionally been considered a precursor to recession. On a year-on-year basis, real rates are now approaching 2 per cent though M&G noted that looking at more recent inflation dynamics, real rates just crossed the 3 per cent mark.