BP posts hefty £2.7bn earnings but misses estimates amid falling gas prices

BP has posted hefty third quarter earnings of £2.7bn ($3.3bn) this morning, fuelled by soaring oil prices, but still missed analyst expectations for the three months of trading due to weak gas trading.

The upturn in underlying replacement cost profit is a 27 per cent increase on last quarter’s earnings of £2bn ($2.6bn), with BP benefitting from higher margins for refining and increased production.

During the third quarter of the year, oil prices rallied following OPEC’s swingeing supply cuts, which benefitted the London-listed energy giant .

However, BP has suffered a steep year-on-year decline, with the company’s earnings dropping more than 60 percent in 12 months – having made £6.8bn ($8.2bn) in the third quarter of 2022.

BP attributes this shortfall to a weak window of gas marketing and trading.

A downturn in profits was inevitable in the context of calming commodity markets after a historic surge last year following Russia’s invasion of Ukraine and reflects trends across the industry.

Last week, Norwegian energy firm Equinor also revealed a sharp year-on-year drop in its adjusted quarterly earnings from £5.9bn ($7.2bn) to £1.9bn ($2.7bn).

Nevertheless, the company still missed estimates of £3.3bn ($4bn) for the quarter from analysts at the London Stock Exchange Group.

Stuart Lamont, investment manager at RBC Brewin Dolphin, said: “BP’s numbers have improved on the second quarter, but they have still missed market expectations. After a tumultuous year or so, with a ‘reset’ to its strategy and the departure of the previous chif executive, the company is focussing on major upstream oil, gas, and LNG assets and slowing investment in renewables.”

The results are the first quarterly announcement since the dramatic exit of chief executive Bernard Looney in September.

Russ Mould, investment director at AJ Bell added: “The company’s gas trading division – which has been going great guns for quite some time – has rather appropriately run out of gas.

“The shock departure of chief executive Bernard Looney for his lack of transparency on past relationships with colleagues leaves the company lacking some direction at a critical juncture where questions about commitment to its net zero strategy are mounting up.”

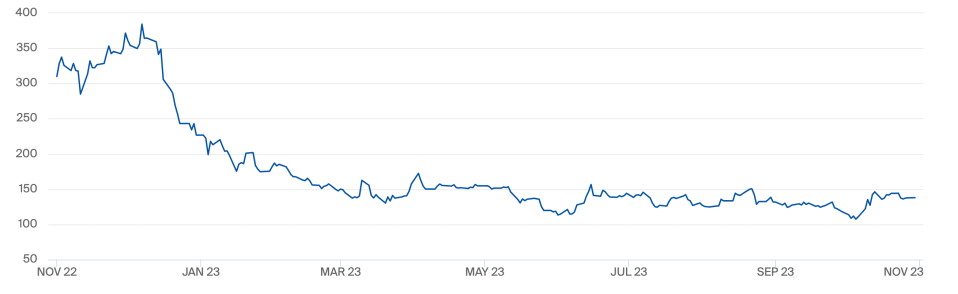

Gas prices have plummeted this year as supply pressures have eased (ICE – UK Natural Gas Futures)

Interim chief executive Murray Auchincloss played down the prospect of the company being approached for a takeover despite a recent flurry of merger and acquisitions from Exxon and Chevron.

“I don’t feel vulnerable, in fact I feel quite confident,” Auchincloss told the Financial Times.

As it bids to appease investors, BP confirmed a new a share buyback programme of up to £1.2bn ($1.5bn) – to be completed by next February.

It has already completed £1.7bn ($2bn) of share buybacks during the third quarter – including the last £185m ($225m) in a £555m ($675m) buyback programme announced in February.

Meanwhile, the £1.2bn ($1.5bn) share buyback programme announced in line with its second quarter results was completed on 27 October 2023.

The company has paid out dividends of £6.5bn ($7.9bn) since January 2022, and repurchased shares worth £13.6bn ($16.6bn) – a more than £20bn handout to investors – according to analysis from Global Witness.

In 2023 alone, BP has paid shareholders £8.2bn ($10.2bn), the group estimates.

BP’s drop in third quarter profits reflected trends across the industry – with year on year slides reported by rival fossil fuel traders

BP has committed £18bn in spending on low carbon energy projects in the UK, in response to criticism over last year’s £23bn bumper earnings powered by record oil and gas prices.

Murray Auchinloss, interim chief executive, said: “This has been a solid quarter supported by strong underlying operational performance demonstrating our continued focus on delivery. “

He also noted the company’s recent start-ups including Tangguh Expansion, BPX’s energy’s ‘Bingo’ central processing facility and the acquired Archaea Energy’s first modular biogas plant in Indiana.

“As we laid out at our investor update in Denver, we remain committed to executing our strategy, expect to grow earnings through this decade, and on track to deliver strong returns for our shareholders,” he said.

BP is listed on the FTSE 100 of the London Stock Exchange, and will open at 526.7p per share in this morning’s trading.

Rival energy giant Shell will post its quarterly results on Thursday later this week.