Brits hurt by most ‘unfriendly’ mortgage market in the world: lending boss

The UK’s mortgage market is one of the most “consumer unfriendly” markets in the world due to the prevalence of short-term deals, the boss of new mortgage lender Perenna told City A.M.

Arjan Verbeek, chief executive and co-founder at Perenna, argued that the dominance of two-year and five-year deals was actually leaving customers with less flexibility than if they fixed on longer terms.

Although shorter terms are generally cheaper, they are susceptible to rapid changes in interest rates. Customers also revert to a significantly higher standard variable rate at the end of a contract.

As Verbeek said, “all the market risk is on borrowers, because if interest rates go up, the mortgages reset very quickly”.

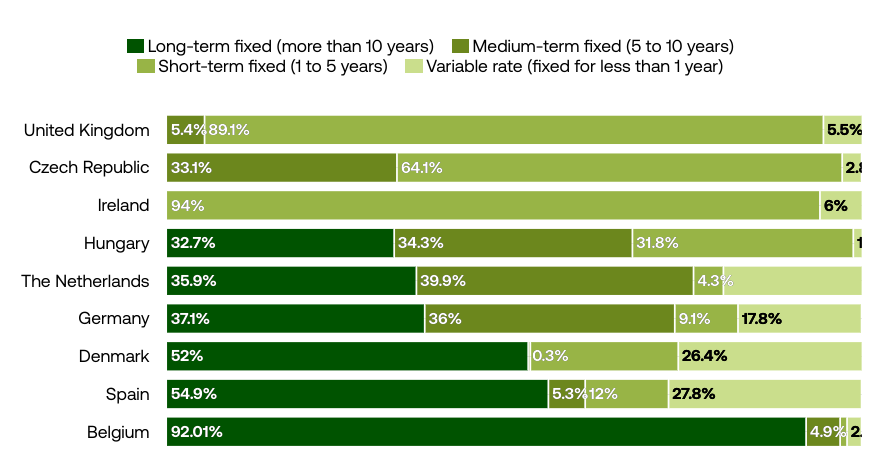

Perenna, which secured a banking licence in September, will offer customers fixed-rate mortgages of as much as 30 years. Although longer term mortgages are common in many parts of the world, they make up less than 10 per cent of the UK’s market.

The Bank of England recently flagged risks over the growing number of homeowners taking out 35-year mortgages. Verbeek said the Bank of England was concerned over the leverage that consumers were taking on.

“The more leverage the consumer has, the more they cut back in spending, which has a particular impact in the UK which is a very consumer spending driven economy,” Verbeek explained.

But he pointed out that in other countries with a greater proportion of longer term deals, such as Denmark, poorer customers cut back on spending less than in the UK because they were more insulated from the interest rate shock.

“There’s no problem with the leverage that they’re taking on because they’re not taking that market risk,” Verbeek said.

Unlike high street banks, which are mostly reliant on short-term deposits, Perenna will issue covered bonds to investors seeking long-term stable income, like pension funds.

“The deposit-based funding model just doesn’t lend itself to create the right products,” Verbeek said, because it means banks have volatile funding costs which are then passed onto consumers.

Perenna is seeking to target under-served segments like first-time buyers, where low loan-to-value ratios can prevent customers from moving onto the housing ladder.

By ensuring that borrowers will not have to pay more, Perenna is willing to offer greater sums to consumers.

“Long, dated fixed-rate mortgages can particularly help segments that are affordability constrained to own a house. This is obviously the first-time buyers,” Verbeek said.