Tax receipts: Five things we’ve learnt from today’s data

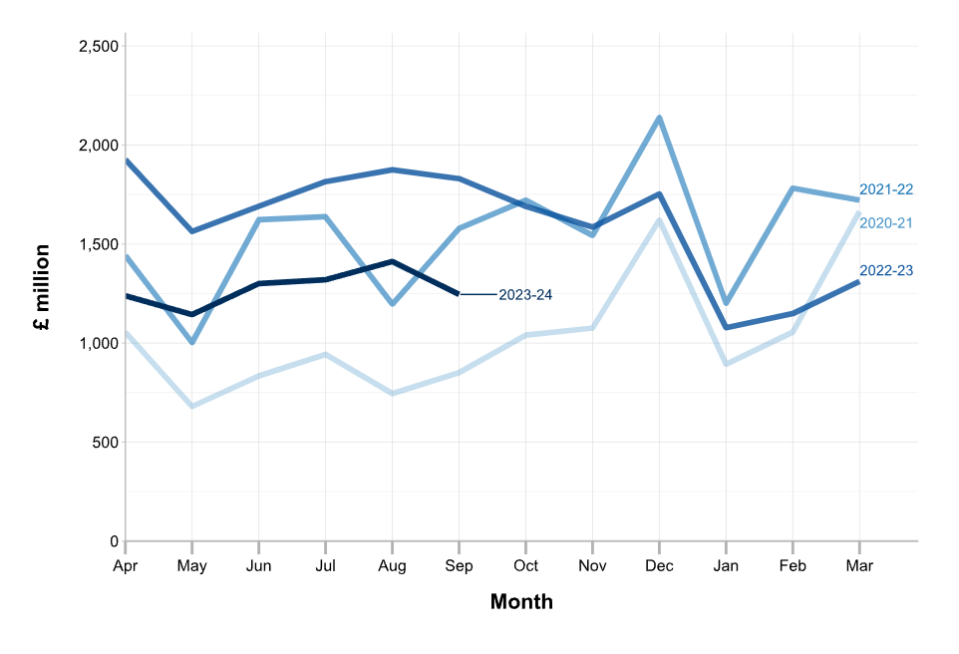

Tax figures released by HM Revenue and Customs (HMRC) on Friday morning showed an upward trajectory in takings between April and September.

City A.M looks at the major takeaways from today’s data.

Total HMRC receipts rise

The boost was mainly driven by an increase in receipts from income tax, capital gains tax and national insurance contributions (£11.5bn), business taxes (£7.7bn), and VAT (£6.8bn).

The biggest percentage gains were made by air passenger duty (25 per cent) and business taxes (22 per cent).

Stamp taxes (£3bn), tobacco (£3bn) and fuel duties (£0.3bn) saw the biggest fall in receipts.

“These figures are proof that the Government is taxing hard-working families through the nose to pay for its own mismanagement,” Liberal Democrat Treasury spokesperson Sarah Olney told City A.M.

“The Conservative Party crashed our economy and then hit people with a massive stealth tax, all in the middle of a cost of living crisis. They broke their manifesto promise not to raise income tax.”

The Conservative Party did not respond to a request for comment.

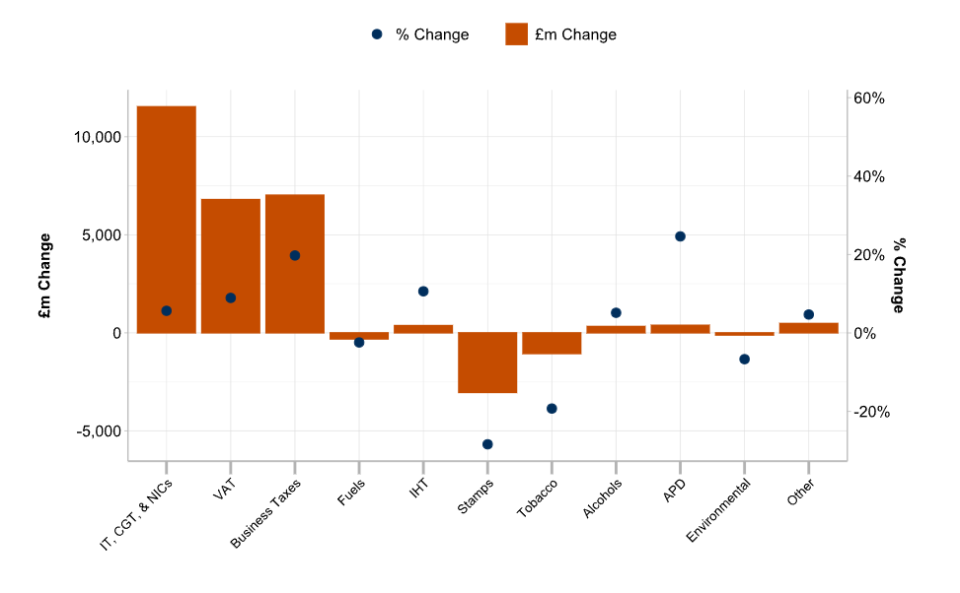

IHT receipts jump by £400m

Inheritance tax (IHT) receipts rose by £400m on last year between April and September, coming in at £3.9bn.

June saw the highest monthly total on record at £795m, which HMRC said could be attributed to the recent rise in interest rates that it must charge on overdue tax bills.

HMRC added that recent interest rises also may have encouraged the personal representatives of some estates to pay any tax due sooner than they otherwise would have done.

The Institute for Fiscal Studies (IFS) predicts IHT revenues will rise to £10.3bn in 2027-28 and more than double from their current level by 2032-33.

“The increasing levels of wealth held by subsequent generations of retirees, combined with the planned freeze of inheritance tax thresholds until April 2028, means that we expect inheritance tax revenues to increase sharply over the coming years,” David Sturrock, a senior researcher at the IFS, told City A.M.

“While OBR forecasts take into account current government policies and the outlook for asset prices, they do not account for the fact that subsequent generations of older people are significantly wealthier than their predecessors.”

John Glencross, chief executive of Calculus, commented: “IHT receipts have maintained an upward trend, remaining elevated due to the extended freeze on IHT thresholds until at least April 2028.

“One area that advisers and investors could consider helping mitigate against IHT is the Enterprise Investment Scheme as it offers complete inheritance tax relief, provided the shares are held for a minimum of two years and are held at the point of death.”

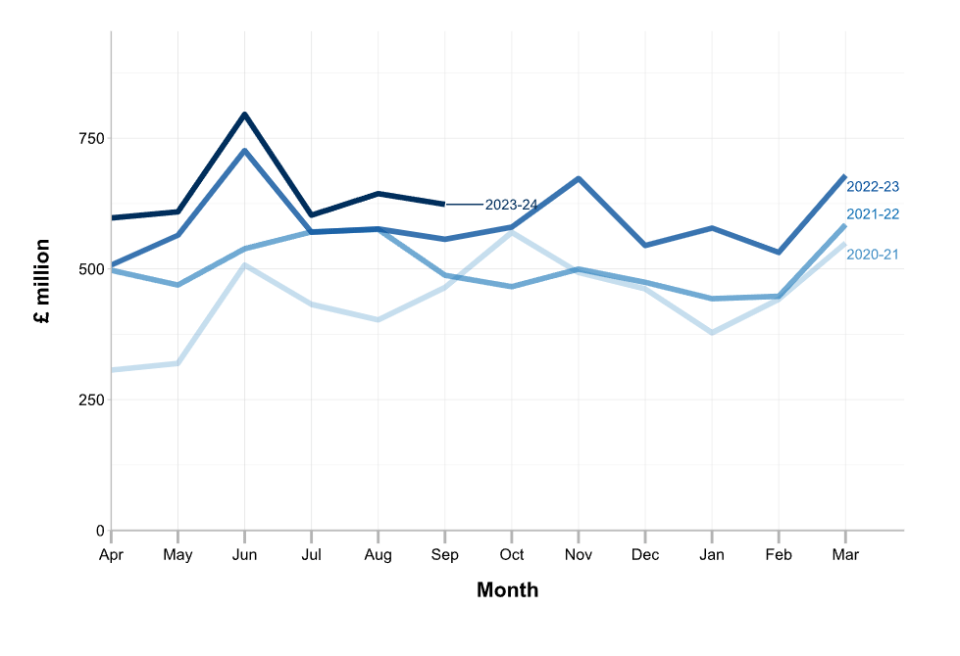

Business taxes hit a fresh high

Monthly business taxes surged in September, with a record £14bn collected in corporation tax.

The total receipts between April and September came in at £43.3bn, up £7.7bn from last year.

The government attributed the fresh high to a rise in corporation tax to 25 per cent from 19 per cent in April, as well as an increase in company profits.

‘Fiscal drag’

Decisions by Conservative governments to keep income taxes fozen since 2021 have caused more people to fall into higher tax brackets despite the rising cost of living.

This process is known as “fiscal drag” and has drawn criticism from economists who accused the Conservatives of implementing a “stealth tax” to bring in more receipts.

Myron Jobson, an analyst at interactive investor, said the latest HMRC figures proved the success of this strategy, with receipts “remaining firmly on the upward trajectory”.

“We’re facing the highest overall tax burden in a generation thanks to the deep freeze of tax thresholds and allowances which, in tandem with wage inflation, means we’ll be more in tax in the years to come,” he added.

“The bumper tax haul […] is a boost for the Chancellor ahead of the Autumn Statement in November. An improvement in public finances could provide the government with wriggle room to announce measures to help Britons maintain and build finance resilience amid the cost of living crisis.”

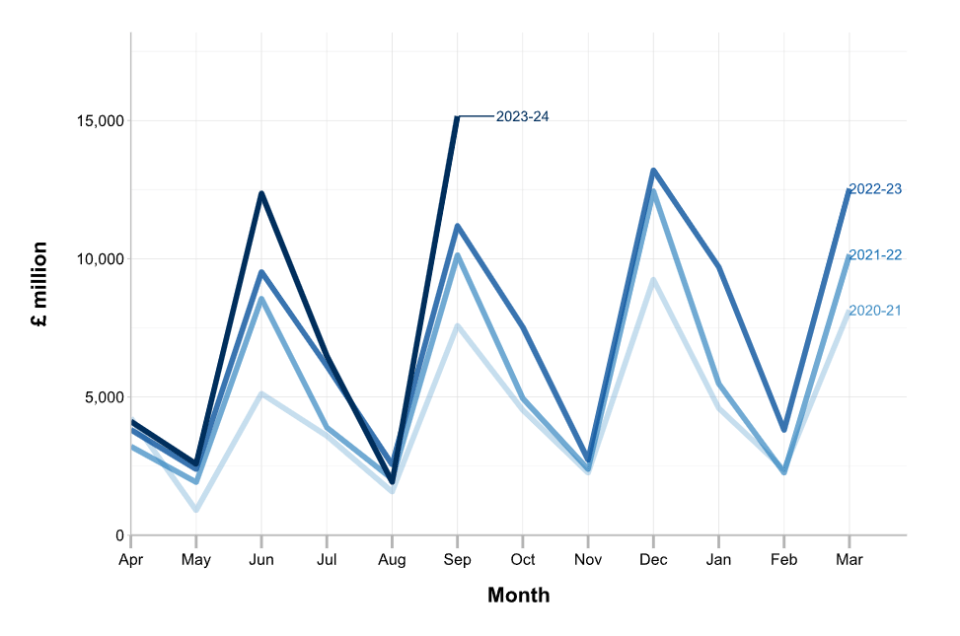

Stamp taxes and ATED receipts dive

Receipts from stamp taxes and annual tax enveloped dwellings (ATED) fell sharply by £3bn, totalling £7.7bn.

HMRC said this drop relates to stamp duty land tax, driven by lower transaction numbers, the lower rate of taxation and a cut introduced in September 2022 that aimed to help first-time buyers get on the property ladder.