GDP: Strong services sector sees UK economy return to growth in August

The UK economy returned to growth in August as the strength of the services sector prevented activity from contracting for a second month in a row.

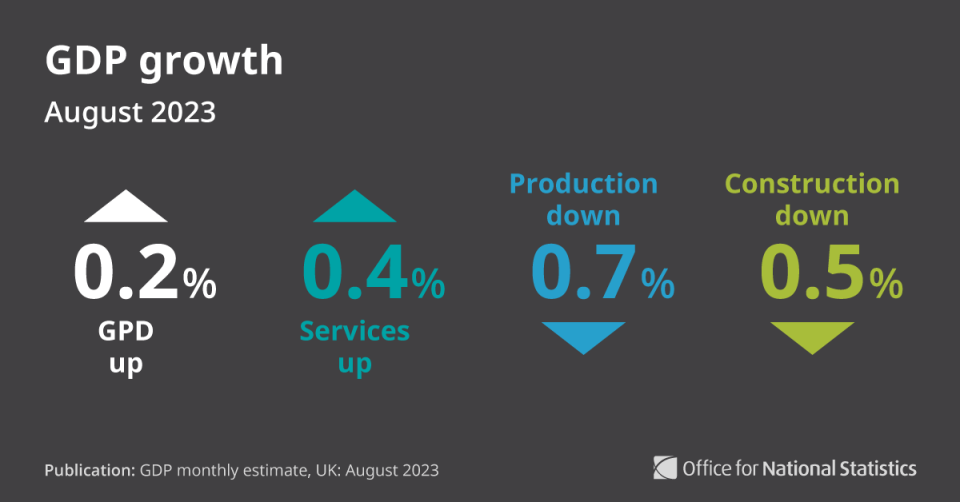

According to figures from the Office for National Statistics (ONS), the economy grew 0.2 per cent in August, in line with economists’ expectations.

The services sector grew at 0.4 per cent, the main contributor to GDP growth. Consumer facing services however dipped into contraction while the production sector fell by 0.7 per cent in August.

The construction sector meanwhile fell by 0.5 per cent in August. Businesses cited heavy rainfall and low temperatures for delays in work.

Commenting on today’s GDP figures for August, ONS Director of Economic Statistics Darren Morgan said: “Our initial estimate suggests GDP grew a little in August, led by strong growth in services which was partially offset by falls in manufacturing and construction.”

Within services, the education sector improved significantly compared to July, when many teachers were on strike. Professional, scientific and technical activities was the strongest sub-sector, which grew by 1.2 per cent in August.

Arts, entertainment and recreation meanwhile fell by 7.4 per cent in August, with consumers reining in the spending under the impact of higher interest rates.

ONS figures revised down the UK’s performance in July, with the body now estimating the economy contracted by 0.6 per cent fall rather than 0.5 per cent. Wet weather and strike action were to blame for the sluggish performance.

Across the three months to August, GDP grew by 0.3 per cent compared to the three months to May, with growth in all three sectors.

“Across the last three months as a whole the economy has grown modestly, led by car manufacturing and sales, and construction,” Morgan set.

Chancellor of the Exchequer Jeremy Hunt said: “The UK has grown faster than France and Germany since the pandemic and today’s data shows the economy is more resilient than expected. While this is a good sign, we still need to tackle inflation so we can unlock sustainable growth.”

Despite the slight growth in August, the outlook for the UK is not very rosy. New forecasts from the International Monetary Fund earlier this week suggested the UK would be the worst performing major economy next year, growing at just 0.6 per cent.

Slowing growth in the UK reflects the impact of the Bank of England’s interest rate rises. The Bank has lifted rates to a post-financial crisis high of 5.25 per cent in an attempt to bring down stubborn inflation.

Many economists think much of the impact of those rate rises is still to be felt, creating a gloomy outlook for the remainder of this year and next.

Yael Selfin, chief economist at KPMG UK said: “The UK economy continues to feel the strain from elevated prices and high interest rates, with the full impact of past tightening still to be felt. Homeowners are under continued pressure from the rise in mortgage costs, with renters sharing the burden as landlords pass on their costs.”

Ruth Gregory, deputy chief UK economist at Capital Economics, said “the economy is not in recession, but it doesn’t have much underlying momentum either. And the drag from higher interest rates will continue to grow.”