Services sector dips under weight of high interest rates as staff layoffs hit fastest pace since early 2021

The UK’s services sector remained stuck in contraction in September for the second consecutive month, with firms laying off staff at the fastest rate since early 2021, according to a closely watched survey.

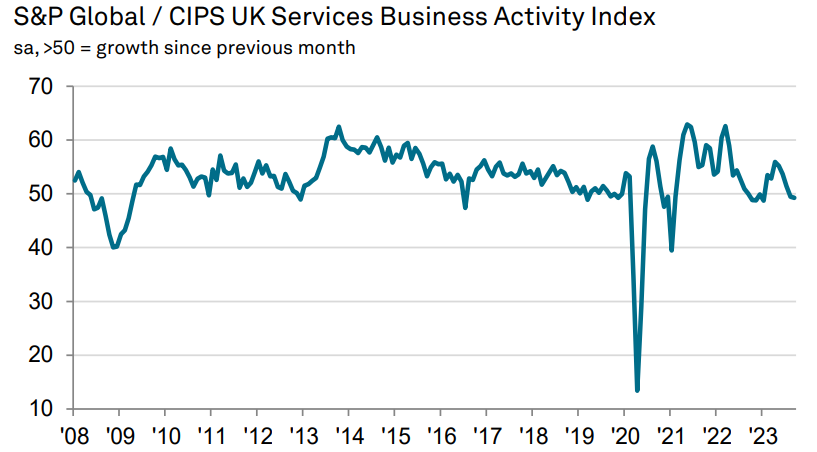

The services purchasing managers’ index (PMI), compiled by S&P Global and CIPS, fell marginally to 49.3 last month, down from 49.5 in August. The 50 mark separates growth and contraction.

Although the reading was at its lowest level since January, it was noticeably better than the earlier ‘flash’ estimate of 47.2 which came out at the end of last month.

“Sluggish business conditions, heightened risk aversion among clients and downward pressure on demand in the wake of rising borrowing costs,” were all cited by firms as contributing to the contraction.

John Glen, chief economist at CIPS, said: “September signalled a change in direction for the services sector. After strong activity in the spring and a sustained summer of business, autumn brought lower rates of new orders and the bright spots of job creation dimmed with the lowest reading since January 2021.

“The UK economy is still showing signs of strain and the impact of interest rate rises are having an effect,” Glen said.

The survey showed that service sector companies were cutting staff, with employee numbers falling for the first time in over two-and-a-half years.

Companies dropping workers noted “squeezed hiring budgets”. Rising wages also meant firms did not replace workers who left voluntarily.

“Service providers responded to lower volumes of new work and falling backlogs by putting the brakes on hiring plans in September,” Tim Moore, economics director at S&P Global Market Intelligence said.

“Some firms noted that strong wage pressures had led to the non-replacement of voluntary leavers. Measured overall, service sector payroll numbers decreased at the fastest pace since January 2021,” Moore continued.

There was more positive news on inflation, with input prices easing for the third time in four months. The rate of increase fell to the lowest level since April 2021, mainly driven by falling raw material and shipping costs.

Although average prices charged by firms continued rising at a “robust pace” in September, the rate of increase was the weakest for 29 months.

Firms cited “greater competitive pressures” with some suggesting stumbling demand had encouraged discounting strategies to stimulate sales.

The upward revision to both manufacturing and services PMI for September meant that the final composite PMI came in at 48.5, slightly lower than August but significantly higher than the earlier ‘flash’ estimate of 46.8.