How Petra Diamonds plan to use tech to battle rise of lab-grown alternatives

The diamond industry is facing historic challenges having been rocked by the rise of laboratory-grown alternatives to natural gems and concerns over the ethics of extracting precious gems and minerals from developing economies to meet Western demand.

Lab-grown alternatives, which have grown in popularity in recent years largely because of their ethical appeal and cheaper price point, are threatening traditional firms like Petra Diamonds.

London-listed Petra is the owner of one of the world’s most productive mines historically but last month the company posted revenues down 44 per cent for the year.

But chief executive Richard Duffy has a plan – he believes introducing blockchain technology could solve consumer concerns over ethics and neutralise the advantages of artificial rivals.

How? Using a blockchain could allow diamond sellers to confirm the emissions footprint and the quality of working conditions at their mines so as to convince ethically conscious buyers that the diamonds have been sourced soundly.

Duffy told City A.M. that while this information was not yet immediately available to customers, it could be rolled out within two years for larger diamonds.

“It’s potentially in a year or two. On the smaller stones, it might take a bit longer because you’re talking about a higher number and volumes. But I don’t see why it shouldn’t be available in a couple of years on the carat-plus size ranges,” he said.

Duffy was “very confident” Petra could already demonstrate all of its diamonds are ethically mined – with the company signed up to the Gemological Institute of America’s origin programme, which certifies the provenance of diamonds.

Petra is also a signatory of the Kimberley Process alongside rival producers with the group responsible for stemming 99.8 per cent of the global production of conflict diamonds – which are mined in war zones to fund insurgencies.

The company is currently weighing up different blockchain technologies to allow them to link diamonds from extraction to polishing more easily for customers.

This includes ‘Tracr’, operated by mining giant De Beers, and ‘Diamond Journey’, which is overseen by Sarine.

However, he urged the industry to coalesce around a shared set of standards to make it easier for consumers.

“I’m hoping that we as an industry will align around a common standard which is easier for everybody. But even if we don’t, we still have technologies available that will allow us to ascertain and prove the provenance and origin – which I think is important,” he said.

Concerns around the ethics of mining rare gems and minerals have sharpened recently, with Amnesty International reporting dangerous conditions at cobalt and copper mines in The Democratic Republic of Congo, alongside forced evictions as companies expand industrial operations in the country.

Earlier this summer, corporate watchdog, the Business and Human Rights Resource Centre (BHRRC) identified 102 alleged abuses in 2021 and 2022 linked to Chinese mining interests spanning 18 countries.

Nevertheless, Duffy is confident about the ethical basis of his products – important not just from a social perspective but a marketing one too.

He explained: “I think it’s increasingly important for end users to understand what they’re buying and where it’s come from.”

Petra currently has three operating mines – two in South Africa, including the Cullinan site, which was home to the diamonds in the crown jewels, and one in Tanzania, a source of very rare pink diamonds.

The ethics and historic allure of its diamonds could be decisive for Petra against the challenge of laboratory-grown alternatives.

Typically lab-grown alternatives are 60 per cent to 85 per cheaper than natural alternatives, with Queensmith reporting a 2,860 per cent increase in interest over the past five years.

Last month, Petra posted an underwhelming full-year results – including a 44 per cent slump in revenues, which dipped to $325.3m and a net loss of $64.5m – a 194 per cent swing from last year’s $69m profit.

Duffy blamed this on the “subdued” nature of the diamond market amid economic turbulence in Asia, and operational challenges at its mines – leading to needed refurbishments.

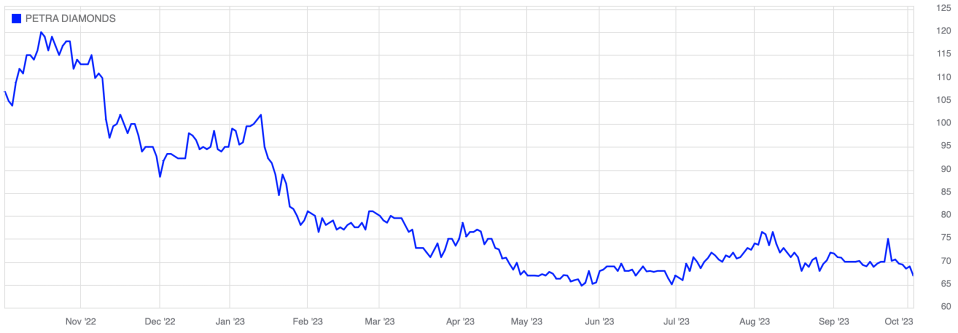

Its current trading price of 67p per represent a near 33 per cent decline this year on the FTSE All-Share – with Duffy confirming his focus was doing all he could to “manage” the company through a subdued period.

He also confirmed the company remains open to M&A activity to bolster its market position.

“I think we’ve always said that if there’s industry consolidation, we are well placed to participate. I don’t think that’s changed,” he said.