Interest rates: no rise will be ‘welcome pause’ for banks

The Bank of England’s decision to leave interest rates on hold last week is a “welcome pause” for the high street banks, analysts said.

Higher interest rates, which have increased rapidly to a post-financial crisis high of 5.25 per cent, have boosted banks by increasing their net interest margins— the difference between what they pay out and receive in interest payments.

However, in the summer, major high street banks warned that their margins were being eroded by an increasingly competitive mortgage market and savings market.

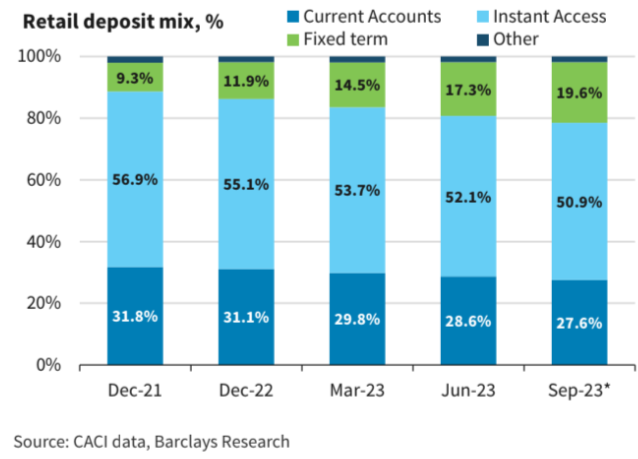

Analysts at Barclays suggested that the Bank of England’s decision to leave rates on hold would slow some of these trends, particularly the shift from instant access to fixed-term deposits.

Savers have increasingly more their funds into fixed-rate accounts because they offer higher interest rates.

“A pause in rate hikes is positive for the UK and its banks, particularly if adverse deposit trends, notably mix shift, can moderate from here as we expect,” analysts at Barclays said.

They also suggested that there was a “building tailwind” from the so-called structural hedge, whereby banks invest customer deposits into swaps, which are now yielding significantly more than a few years ago, as a hedge against falling interest rates.

“This is likely to present a sizable multi-year tailwind to net interest income that should help to offset the effects of rising deposit competition and mortgage margin pressure,” the analysts said.

Tomasz Noetzel, banking analyst at Bloomberg Intelligence, agreed that a pause in rate hikes would likely slow some of the trends impacting bank profitability.

“Deposit repricing and shift towards more expensive time products may now slow,” he said, while suggesting that falling mortgage rates would likely “bolster volume”.