Sunak’s net zero pragmatism must include plan to beat nimbys after Sizewell C fiasco

Government hopes of finally luring investors to proposed nuclear power plant Sizewell C were dealt a fresh blow last week, when local activists secured a major legal victory.

The very same day Downing Street rolled out the red carpet to prospective backers to help fund the project, the Court of Appeal overturned a previous verdict in the High Court – enabling campaigners Together Against Sizewell C to effectively re-challenge the project’s development on environmental grounds.

Environmental grounds? Really?

Sadly, such madness is not a parody – with campaigners taking advantage of byzantine planning and environmental permitting regimes to slow down energy developments across the country from solar farms, to cable networks and seemingly nuclear power plants.

TASC’s challenge is based on a claim that the government failed to assess the environmental impact of the project when approving it for planning permission earlier this year – which includes concerns around consumption of the local water supply for operations.

Yet, the chief benefits of Sizewell C are fundamentally environmental.

Cheap, low carbon power produced with minimal emissions is what will enable the government to theoretically boost the UK’s supply security and reach net zero, helping to combat global warming in a way that puts the least pressure on households.

This is especially valuable in the context of ultra-high customer energy bills driven by soaring gas prices.

Sizewell C: Any takers?

The Suffolk-based development is a near-identical replica of Hinkley Point C, the EDF-managed power plant in Somerset which is currently under construction.

Sizewell C the potential to power six million homes when completed, and the government is targeting a final investment decision for the 3.2GW site before the end of this parliament.

While the decision is in EDF’s hands, Downing Street hopes the £1bn-plus funds it has committed to the project will be enough for it to be greenlit.

However, the prospect of another onerous courtroom showdown exposes the challenge of pushing through projects in this country, even when vital to the UK’s energy security and national infrastructure.

It is no surprise that prospective operator EDF and the government have so far failed to confirm any commitments for private backing for the power plant, which is expected to cost between £20bn to £35bn.

High profile options such as Aviva, Legal and General, Natwest and BT’s pension scheme have already ruled themselves out of supporting the project – with planning red tape unlikely to boost sentiment towards nuclear power and indicate a pathway for returns on investment.

In a bid to push projects through and to reduce the reliance on potentially hostile overseas partners such as Chinese state-owned vehicles, the government has reformed nuclear financing – so that the taxpayer coughs up for the initial development stages in hopes of attracting third parties later in the development pipeline.

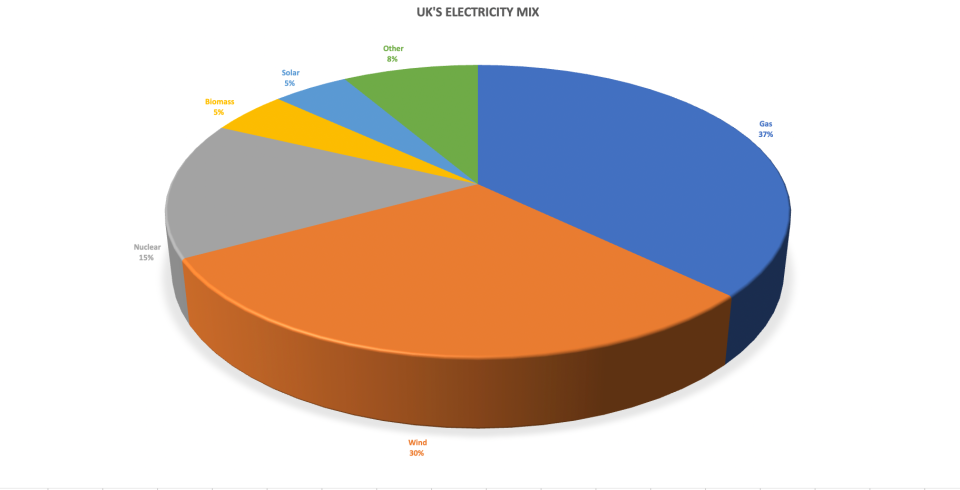

This is supposed to solidify sentiment towards nuclear, in tandem with the energy security strategy which outlines the UK’s commitment to a near quadrupling of the country’s current generation from the power source over the next three decades.

So far, however: no news of investors for Sizewell C.

Sunak must act

It is vital, therefore, that Prime Minister Rishi Sunak’s pragmatic outlook on net zero extends to a realistic reaction towards opposition to green energy projects.

Sunak defended his decision earlier this week to row back green pledges around cars and gas boilers on the basis of needing a proportionate approach to net zero that did not drive-up people’s bills.

The same reasoning should be applied to local resistance, with the government needing to cut red tape and reduce the influence of opposition to ensure nuclear projects can be revived.

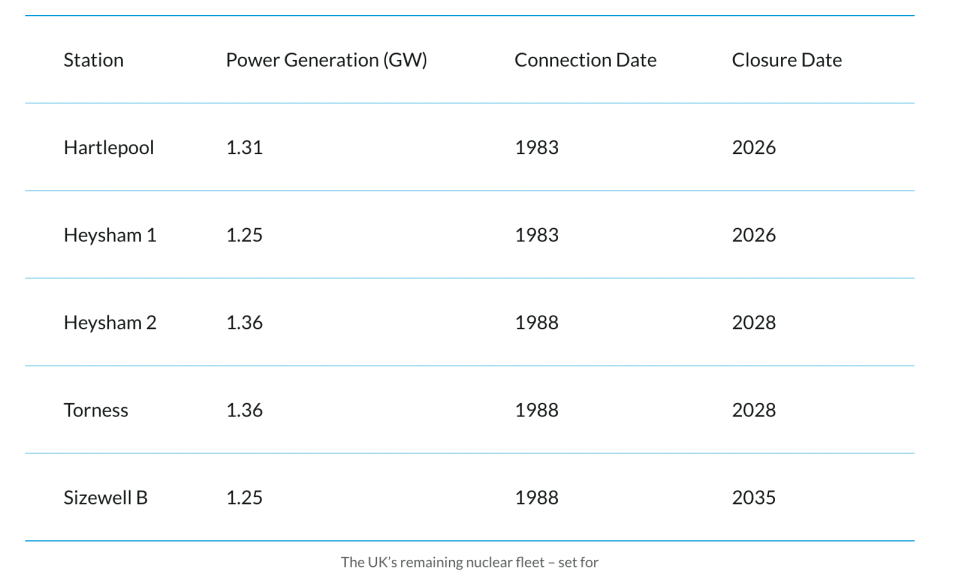

The situation is urgent, with 85 per cent of the UK’s ageing fleet set to come offline in the next 12 years and the government targeting a quadrupling of generation capacity over the next three decades.

Every delay makes net zero more difficult to achieve and low carbon energy security more expensive.

Communities should have some say in new developments, but much like with Sunak’s pledged reforms to onshore wind turbines, when a majority backs projects which will benefit millions of people – the government needs to be able to make bold decisions, even if it upsets older, blue wall voters.

There are legitimate reasons to criticise Sizewell C – for instance, the European pressurised reactor technology is problematic, with outage issues at developments based on the design in China.

Meanwhile, Hinkley Point C, the twin project in Somerset, meanwhile, is set to come in around £10bn over budget and at least five years overdue, with a cost of £33bn and an opening window of 2028.

However, the court case is the worst combination of nimbyism and inconsistent environmental policy.

If Sunak fails to act to prohibit such local obstructions in the future, then net zero will be little more than a pipe dream, with the UK reliant on overseas fossil fuel supplies to meet the country’s needs for decades to come.