Cost of living pressures set to ease as inflation tipped to fall again

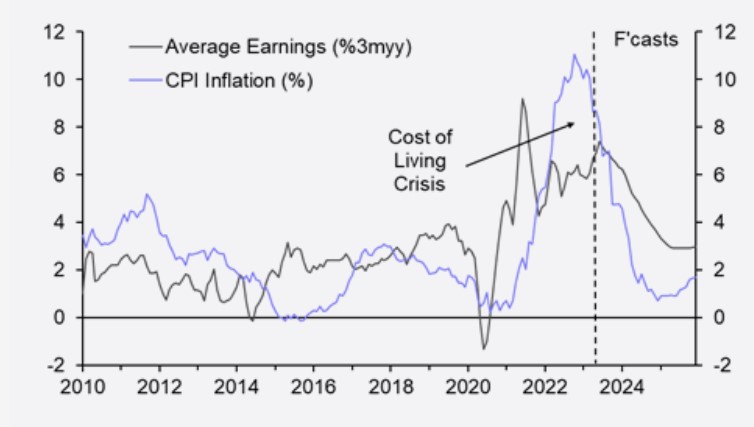

Cost of living pressures facing households are set to ease, as experts predict inflation will fall below wage growth for the first time since last April.

Official figures out on Tuesday are tipped to show that wage growth hit 7.4 per cent in the three months to June on an annual basis, up from 7.3 per cent last month.

This would make it the fastest level of wage growth on record, as workers have demanded higher wages to compensate for soaring inflation.

A day later, July’s inflation data will be released with markets predicting the headline rate of inflation will fall to 6.7 per cent, from 7.9 per cent last month. The fall will primarily be driven thanks to a steep fall in energy prices, following a 17 per cent cut to Ofgem’s energy price cap.

Core inflation is expected to remain more stubborn, with it falling ever so slightly to 6.8 per cent from 6.9 per cent last month.

Rising wage growth and falling inflation will mean workers are in line for the first increase in real wages for 18 months.

When inflation is higher than earnings growth, households have to deal with a reduction in real pay as they are not able to buy as many goods as they could before.

Capital Economics forecast that inflation will remain below wage growth until at least the end of 2025, although it warned that households will be feeling the pain for years to come.

“The cost of living crisis will leave the level of real wages below where it was before the pandemic,” UK economist Ashley Webb said. She said the level of real wages will be below its recent peak in December 2021 by the end of 2025.

While the data should be good news for households, the level of wage growth is likely to be far too strong for the Bank of England’s liking.

Markets are almost certain that when the Bank’s ratesetters meet again in September, they will opt for a 25 basis point increase.

As wages rise to compensate for the loss of spending power, inflation can embed itself in the economy with businesses then raising prices in return to offset higher fixed costs.

Andrew Bailey, governor of the Bank of England, and chancellor Jeremy Hunt have both called for wage restraint to help tackle rising inflation.