Bank of England to hike interest rates for 14th time in a row to 2008 high of 5.25 per cent

The Bank of England this week is tipped to hike interest rates for the 14th time in a row as it extends its fight against roaring inflation.

Members of the nine-strong monetary policy committee (MPC) are expected on Thursday to back a 25 basis point increase to the UK’s official interest rate, which would send it to 5.25 per cent, its steepest level since March 2008.

Such a move would mark a slowdown from June’s larger 50 basis point jump, a decision taken by the MPC in response to higher than expected core and wage inflation.

There is likely to be some dissent within the group, with one external member, Swati Dhingra, possibly calling for borrowing costs to remain unchanged.

Just a couple of weeks ago, money markets thought Bank governor Andrew Bailey and the rest of the MPC would repeat last month’s chunkier rate increase.

Deutsche Bank analysts said a strengthening pound and rapidly falling energy prices means the Bank can afford to ease off the brake a bit.

The Bank is almost certain to revise down its inflation projections in a new set of forecasts this week, indicating Prime Minister Rishi Sunak may meet his goal of halving the cost of living to around five per cent by the end of the year. Growth may receive a downgrade.

There is a chance the MPC will go harder to make sure inflation is finally killed off.

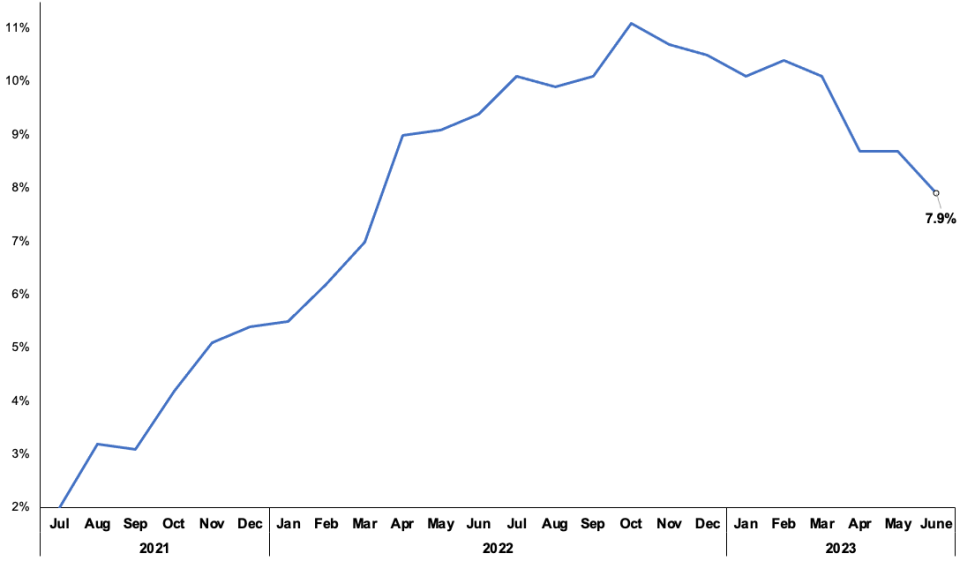

UK interest rates have risen steeply…

“A hike is almost guaranteed. But the magnitude of the hike remains highly uncertain, given the Bank’s June surprise 50 basis point hike,” Deutsche Bank said.

Core and services inflation – which the Bank monitors closely – are still very high at around seven per cent. Wages are also rising at their joint fastest pace on record.

Although the Bank has already tightened borrowing costs at its fastest pace since the 1980s, launching its first rise in December 2021, markets think yet more pain is to come for families and businesses.

Traders reckon two more rate rises are in the pipeline and that they will peak at 5.75 per cent. Cuts aren’t expected until the second half of next year at the earliest.

Experts have voiced their concern about the Bank going too hard in taming inflation at the expense of economic growth. UK GDP is very close to slipping into recessionary territory. Output flatlined in the three months to May.

Interest rate changes take longer to impact the UK economy due to more homeowners since the 2008 financial crisis opting for fixed rate mortgages instead of contracts tied to Bank Rate.

A clutch of survey data of late has suggested the MPC’s prior rate rises are now squeezing economic activity.

Purchasing manager indexes last week showed private sector output is growing at its slowest pace in six months and is just about above the 50 point growth threshold. Data from the CBI today shows private firms expect growth to stall over the coming quarter.

… in order to tame scorching inflation

Last week, the International Monetary Fund said the UK will squeeze out the second lowest rate of GDP growth in the G7 this year of 0.4 per cent, beaten only by Germany.

Mortgage lenders in June and early July – before the rosier than feared inflation print – jacked up rates in response to market rate expectations climbing to as high as 6.5 per cent.

That is expected to have chilled demand in the UK housing market. Bank of England data today is likely to show mortgage approvals fell to around 49,000 in June from over 50,000 in the previous month.

Higher rates may have motivated potential buyers “to rush through the approval process ahead of further anticipated increases in mortgage rates,” Nomura analysts said.

Markets are leaning more in favour of the mortgage demand slowdown story, pricing in a 0.5 per cent monthly drop to the Nationwide house price index out on Tuesday.

More results from Britain’s largest banks this week, including HSBC tomorrow, are tipped to illustrate additional players in the sector are benefiting from the Bank’s tightening cycle.

Last week, Barclays, Lloyds and Natwest all said their net interest margin – the difference between what a bank charges borrowers for loans and pays out to savers – fattened up in the first six months of this year.

However, customers yanking their cash from lenders and parking it in vehicles with higher returns partially eroded margins in the latest quarter. The sector has come under pressure from MPs to pass on the Bank’s rate rises quicker.

Shares in Barclays, NatWest and Lloyds Bank all closed lower last week, underperforming the FTSE 100, which added 0.4 per cent to close at 7,694.27 points.