Accelerating redundancies ‘big concern’ for UK economy as firms sweat over recession

Accelerating redundancies sparked by businesses sweating over whether the UK economy is on course for a recession are a “big concern” for the country, experts have warned today.

Company layoffs have pushed the volume of unemployed workers available for jobs to its highest level since December 2020, when the UK was in the teeth of tough Covid-19 restrictions, according to research from the Recruitment and Employment Confederation (REC) and consultancy KPMG.

The pair’s candidate availability index climbed to 57.6 points in June, up from 55.6 in May, hoisted upwards by an increase in idled permanent and part-time staff.

“The sharp upturn in candidate availability this month – the highest for two and a half years – is a big concern for the economy reflecting the effects of a sustained slowdown in recruitment along with increasing redundancies across many sectors,” Claire Warnes, partner, skills and productivity at KPMG UK, said.

Recession risks have returned in recent weeks due to concerns about how high the Bank of England will hike interest rates to tame sticky inflation.

Financial markets reckon there’s a chance borrowing costs could peak at around 6.5 per cent, a level not seen since the 1990s. They are currently five per cent, already the highest level in around 15 years.

As a result, firms are being more cautious in their recruitment campaigns, KPMG and the REC said. Vacancies expanded at the slowest pace in 28 months in June.

Hiring is slowing

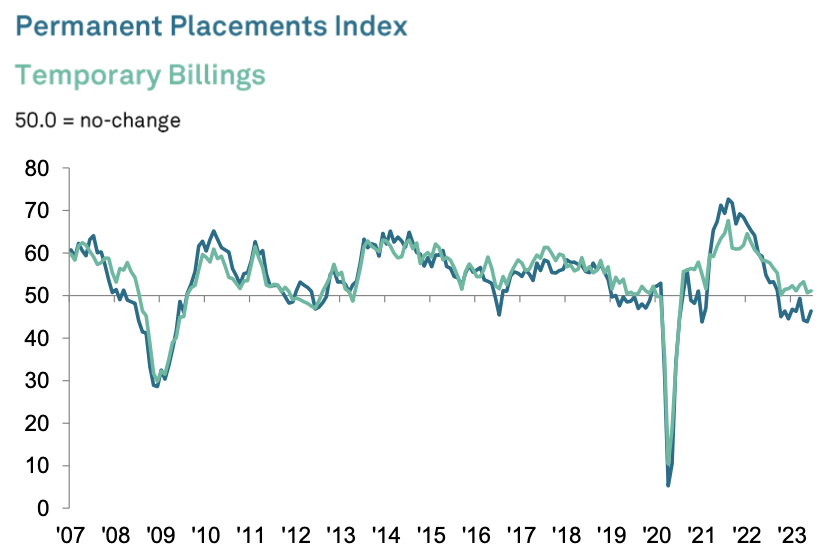

“Employers are also tending towards temporary hires, given lingering economic uncertainty,” Warnes added. KPMG and the REC’s permanent recruitment index climbed to 46.4, below the 50 point threshold that separates growth and contraction. Its temporary reading jumped to 51.1.

Other data from consultancy BDO out last night ran counter to the REC and KPMG’s, with their employment index edging up for the fifth month in a row to 111.96.

Stronger hiring intentions in June reflect the generally more positive outlook from businesses. Buoyant employment levels drove a fifth-consecutive improvement in BDO’s Employment Index, as a 0.60-point increase saw the index rise to 111.96. Overall business confidence jumped to its highest level in 10 months, BDO said.

Nonetheless, people are “reacting to high inflation by stepping up their job search,” Neil Carberry, chief executive of the REC, said.

An uptick in candidate supply is putting downward pressure on red hot wage growth. Starting pay for permanent and part time staff climbed at the slowest rate in over two years, though both are still deep in positive territory at 58.6 and 56.4 respectively.

An official snapshot of the labour market from the Office for National Statistics tomorrow is tipped to show the unemployment rate held steady at 3.8 per cent. Wage growth is forecast to shrink to 7.1 per cent. That release will cover the three months to May.