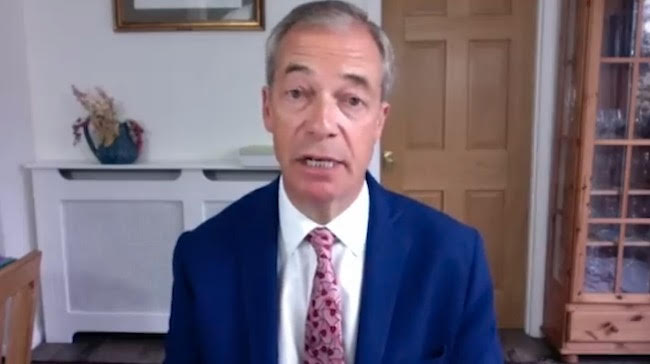

Nigel Farage claims he may have to leave UK after bank accounts closed

Nigel Farage has claimed he may have to leave the UK after his bank accounts were closed.

The former UKIP leader and Brexiteer today posted a six-minute long video on Twitter, stating his accounts had been closed and he was unable to secure banking services elsewhere.

He wrote: “The establishment is trying to force me out of the UK by closing my bank accounts. I have been given no explanation or recourse as to why this is happening to me.”

He added that the action could affect “whether I can even stay living in this country”.

He did not name the banks that had closed his accounts, but according to a Times article published in 2019, Farage banks with private firm Coutts.

“This is serious political persecution at the very highest level of our system. If they can do it to me, they can do it to you too,” Farage, now a GB News presenter, said.

The former politician said he has unsuccessfully approached “six, no seven banks” and “the answer has been no”. He added that he has retained lawyers to fight the decision.

He said the decision to close his accounts could have happened after the banks deemed him a ‘politically exposed person’ or PEP – a person who’s role in public life leaves them exposed to a greater risk of being involved in corruption.

There is no suggestion this implies wrongdoing, as Prime Minister Rishi Sunak is also considered a PEP.

Peers debated the measures in 2021, with some complaining of suffering “delays and significant loss of services because of the poor and inconsistent interpretation” of the rules, designed to prevent and detect money laundering.

But Farage also went on to argue: “The banks themselves are part of the big corporate structures in this country. These are the organisations who did not want Brexit to happen”.

He also suggested it could be due to Labour MP Chris Bryant alleging in parliament that Farage had “received large sums of money directly from the Russian government” – an allegation he denies.

MPs can make statements in the House of Common free from the risk of libel action.

Solicitor Adham Harker, from Brett Wilson LLP, said: “There is a possibility this is linked to a transaction of some sort that has been deemed to be suspicious, even if entirely legitimate.

“Farage’s suggestion that it derives from some consideration in financial mismanagement at the bank to do with politically exposed persons (PEP) is also a possibility.”

He told City A.M.: “It is far more likely there is an entry on a fraud database that is causing banks to flag up that this is a person they do not want to offer a bank account to.

“This is not unique to PEPs. We work for a lot of clients who find themselves on a fraud database through no fault of their own – they often find out when applying for a mortgage.”

Coutts Bank and Bryant have been approached for comment.