Households could be offered competitive deals again as price cap eases

Households could benefit from the prospect of fixed tariffs below the price cap in the retail market later this year, as the energy sector shows signs of competitiveness again, predicts Cornwall Insight.

The energy specialist predicts the price cap – which establishes the maximum amount a household can be charged for average use – will plummet this summer, with falling gas prices finally finding their way onto people’s bills.

It then expects prices to remain stable into new year amid flatlining wholesale costs.

Dr Craig Lowrey, principal consultant at Cornwall Insight, predicted that stable wholesale costs would lower the concerns suppliers had of losing out over fixed term deals – instead offering rates under or around the price cap.

This would contrast with the typical standard variable tariff – where the unit rate can be changed by the supplier – and would be the first sign of competitiveness re-entering the market, with energy firms offering contrasting deals to customers compared to rivals.

It also would mean they are less worried over a sudden surge in prices – a common reality last year following Russia’s invasion of Ukraine.

He said: “This potential re-emergence of competitive tariff propositions presents an opportunity for households to finally get a grip on their energy bills, having been hit hard by the energy crisis. While this seems positive, fixing energy tariffs is a gamble, the market may go down as well as up, and households run the risk of getting locked into bills higher than the price cap.”

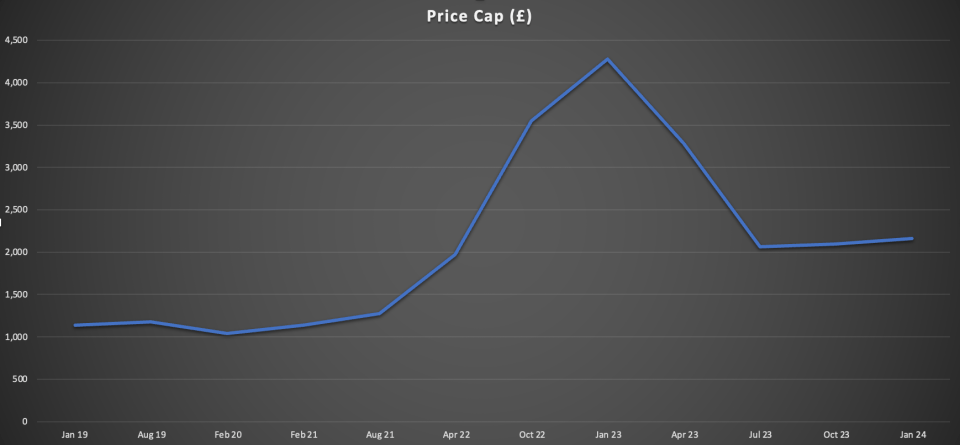

This follows Cornwall Insight unveiling its latest price cap predictions which estimate the price cap will fall from its current level of £3,280 per year to £2,062 per year in July, when Ofgem reviews the price cap next month.

It then expects the price cap to rise slightly in the fourth quarter of 2023 to £2,098 per year before climbing to £2,162 in the new year.

Uswitch noted that this meant the cap would fall below the subsidised rate of the extended energy price guarantee – at first by an average of £438 from July.

Nevertheless, prices would still be roughly double the level established in the price cap before the domestic energy crisis and Russia’s invasion of Ukraine.

Prior to March 2022, the average price cap was between £1,000-£1,200 per year.

Richard Neudegg, director of regulation at the price comparison service, considered it to be a sign that the “energy market is starting to stabilise”, which should “encourage suppliers to start bringing back competitive fixed deals.”

“Competition in the energy market will give consumers the chance to vote with their feet and choose a supplier that best meets their needs for price, customer service or green credentials,” he said.

However, the Uswitch director was less convinced the return of fixed deals would immediately benefit customers – wary that households would lose out if prices dropped again.

He said: “If wholesale prices rise again later this year, a fixed deal could end up being better value especially if priced lower than the cap. However, the opposite could be true if wholesale prices fall further and the cap is lowered again during the fixed term.

“This means that no-one can be completely sure whether sticking with a standard variable tariff or opting for a fixed deal will be cheaper in the long run, and either option should be carefully considered.”