Ethereum upgrade boosts institutional interest, while Coinbase takes on the SEC

Data from CryptoCompare shows that the price of the flagship cryptocurrency Bitcoin (BTC) started the week with a jump from around $27,000 to a high near the $30,000 mark, which it failed to breach. The cryptocurrency has since corrected to now trade at around $28,000.

Ethereum’s Ether, the second-largest digital currency by market capitalisation, moved in a similar way, jumping from around $1,800 to a high near $1,950, before enduring a correction. Ether is now trading at $1,830 per token.

This past week started with a boost in institutional Ether staking interest, brought on by Ethereum’s Shapella upgrade, which started allowing staked tokens to be withdrawn on the cryptocurrency’s blockchain.

After the upgrade went live on April 12, leading ETH staking services observed a threefold rise in inflows, compared to the previous month.

The upgrade unlocked approximately 18 million tokens valued at $35 billion, which had been previously held in staking contracts. Contrary to concerns that this move might result in substantial selling pressure and a price crash, ETH’s value surged to $2,100 – an 11-month high – before falling below $2,000 amid a wider market downturn.

Another major blockchain-related development came from stablecoin issuer Circle, which unveiled a novel method that promises to be faster, more secure, and cost-efficient than the cross-chain bridges that are currently used in decentralized finance.

Dubbed the “Cross-Chain Transfer Protocol” (CCTP), this technology will initially facilitate USDC transfers between the Ethereum and Avalanche blockchains, with additional chains slated for integration in the latter half of 2023.

Coinbase goes toe-to-toe with SEC

Coinbase, the largest cryptocurrency trading platform in the US, has filed a legal action against the US Securities and Exchange Commission (SEC) seeking regulatory clarity for the crypto sector.

Paul Grewal, Coinbase’s Chief Legal Officer, outlined in a blog post that Coinbase has filed a narrow action in federal court, urging the SEC to provide a clear response to their July 2022 petition for formal rulemaking guidance for the crypto industry.

Meanwhile, bankrupt cryptocurrency lender Voyager Digital has said it received a letter from Binance.US terminating their asset purchase agreement. Voyager confirmed the news on social media, where it expressed disappointment.

Voyager assured its clients that the Chapter 11 strategy permits the distribution of cash and cryptocurrency directly through the Voyager platform. Binance.US cited the “challenging and unstable regulatory environment in the United States” as the reason for its termination, recognizing that this unpredictable circumstance is impacting the entire American business community.

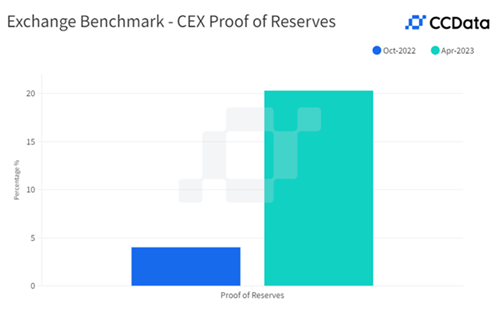

Voyager’s collapse came during a harsh crypto winter, which saw the downfall of other cryptocurrency lending firms. A major event was the collapse of FTX, which led to the adoption of Proof of Reserves to address increasing apprehensions among market players.

According to CCData, 20% of exchanges have embraced Proof of Reserves or a similar approach, and 13% have undergone audits or integrated Proof of Liabilities.

Standard Chartered has meanwhile predicted that the crypto winter has come to an end, suggesting that Bitcoin’s price could potentially hit $100,000 by the end of 2024. Geoff Kendrick, the leader of the bank’s crypto and FX research, pointed to the latest U.S. banking crisis as the catalyst for a Bitcoin price surge, reinforcing its fundamental purpose “as a decentralized, trustless, and limited digital asset.”

UK Treasury seeks input on tax changes for DeFi transactions

The UK Treasury’s tax division, HM Revenue and Customs, is requesting feedback on potential alterations to the taxation of decentralized finance (DeFi) lending and borrowing activities.

By conducting a public consultation until June 22, HM Revenue and Customs intends to create a structure that enhances the alignment of taxes on cryptocurrency assets involved in DeFi operations and streamlines compliance.

Meanwhile, global investment management giant Franklin Templeton has announced that it’s launching its Franklin OnChain U.S. Government Money Fund (FOBXX) on the Polygon (MATIC) blockchain. The first U.S.-registered mutual fund to utilize a public blockchain for transaction processing and share ownership recording.

The fund aims to provide investors with a high level of current income, consistent with the preservation of shareholders’ capital and liquidity. It seeks to maintain a stable $1.00 share price and invest at least 99.5% of its total assets in government securities, cash, and repurchase agreements fully collateralized by government securities or cash.

Each share of the Franklin OnChain U.S. Government Money Fund is represented by one BENJI token. To gain exposure to the fund, token holders can do so through the Benji Investment app.

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various cryptocurrencies.

Featured image via Unsplash.