UBS agrees to buy Credit Suisse to avoid “unthinkable” consequences

THE SWISS government last night brokered a discount $3bn (£2.6bn) deal that will see UBS rescue Credit Suisse from bankruptcy and avoid “irreparable” damage to the global financial system.

In an extraordinary press conference last night, the Swiss President said deposit outflows on Friday at Credit Suisse on Friday meant it was “no longer possible to restore the necessary confidence” in the bank and that a “stabilising” solution was required.

“This solution is a takeover of Credit Suisse by UBS,” Alain Berset said, adding that the historic bank’s failure would have had “unthinkable consequences for Switzerland and the international markets.”

The deal, to be completed by the end of the year, will bring to an end a 176-year history at Credit Suisse.

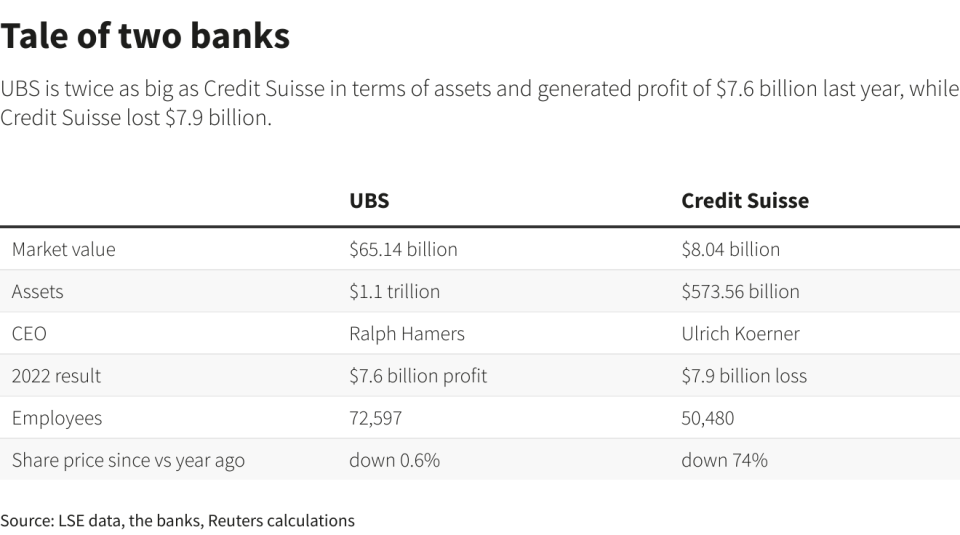

The lender suffered a dramatic share price collapse last week after its largest shareholder, the Saudi National Bank, said it would not inject any further capital into the bank, which lost around £7bn last year.

There were already fears in the aftermath of Silicon Valley Bank’s collapse in the United States would signal further bank failures.

Yesterday the Swiss financial authorities said that recent measures – including Credit Suisse drawing on a nearly £50bn credit facility provided by the Swiss National Bank – had not been enough to “restore confidence.”

In order to get the deal across the line the Swiss authorities have provided UBS with insurance in the form of an almost £8bn loss guarantee on a clearly defined part of Credit Suisse’s portfolio.

Last night UBS chair Colm Kelleher said the deal represented an “enormous” opportunity. He will remain as chair of the surviving entity, which will continue to be known as UBS, and the bank’s boss Ralph Hamers will also stay on.

Axel Lehmann, the Credit Suisse chair, said that “given recent extraordinary and unprecedented circumstances” a merger was the right call.

It was not immediately clear what the impact would be on Credit Suisse staff.

Kelleher said he would run down the firm’s investment bankign division, but in a statement Credit Suisse said that “UBS has expressed its confidence that the employment of the staff of Credit Suisse will be continued.”

The deal merges Switzerland’s two largest banks, both of which are globally systemic institutions, in the largest banking merger since 2008.

The UBS deal is a last ditch attempt to save Credit Suisse which has faced deposit outflows of over CHF10bn a day late last week, according to two people familiar with the matter.

The bank had a “horrifying” 2022, facing scandals, talent outflows and posting a mammoth CHF7.3bn loss.

More recently, it faced intense speculation about its future after it revealed it had “material weaknesses” in its financial reporting and its top shareholder ruled out further investment.

Its share price fell as much as 30 per cent last Wednesday before the Swiss National Bank issued a CHF50bn liquidity lifeline in an attempt to maintain confidence. However, this did little to arrest Credit Suisse’s share price collapse as it still fell another 10 per cent during the rest of the week.

The cost of insuring company bonds against default also shot up.

Regulators will also hope that the deal will assuage market concerns and stave off further financial instability. Many analysts warned that the collapse of Credit Suisse could be a “Lehman moment” for the global banking sector, which is facing the most serious period of instability since 2008.

Bank indexes around the world have fallen in the wake of the collapse of Silicon Valley Bank and the turmoil at Credit Suisse.

The European Stoxx 600 banking index fell 11.5 per cent over the course of the week while the US KBW index fell 11.1 per cent