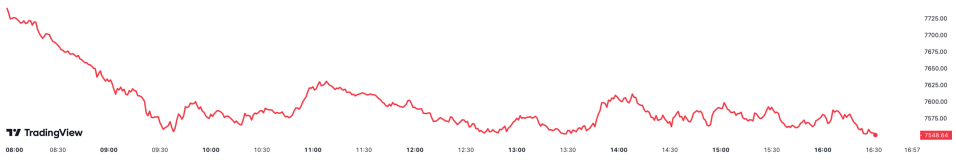

FTSE 100 close: Silicon Valley Bank collapse drags London index into red despite HSBC sale

London’s FTSE 100 was dragged down into a global market sell off today driven by fears over how far the effects of the collapse of tech-focused Silicon Valley Bank could ricochet through the financial system.

The capital’s premier index slid more than two per cent to close at 7,548.64 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, fell 2.75 per cent to below the 19,000 point mark.

Europe’s top indexes also dropped sharply today. France’s Cac 40 was down over two per cent, while Germany’s Dax slipped nearly three per cent.

US stocks meanwhile opened higher, with all three of Wall Street’s top indexes up around one per cent.

Markets sold off sharply at the end of the last week after tech-focused lender Silicon Valley Bank collapsed, sparking fears over whether companies have lost their cash at the bank.

Bets on US interest rates that soured due to the Federal Reserve raising borrowing costs steeply to combat inflation led to Silicon Valley Bank’s demise.

FTSE 100 opened sharply lower today

Despite the takeover reducing the risk of SVB’s failure rippling through the UK financial system, market sentiment was weaker today.

“After a mixed session in Asia, European markets have opened lower with the FTSE MIB in Italy leading the declines while the FTSE 100 is also under pressure, dashing hopes of a market rebound,” Victoria Scholar, head of investment at fund manager interactive investor, said.

HSBC was among the biggest fallers after the purchase announcement today, shedding more than four per cent.

Other FTSE 100 listed lenders followed the Asia-focused lender on its spiral. Standard Chartered had more than six per cent clipped from its share price, while Lloyds Bank trimmed more than four per cent.

Fellow financial stocks dragged the FTSE 100 lower today. Insurer Aviva was down more than five per cent. NatWest dropped around 4.3 per cent.

On the mid-cap index, Virgin Money was trading near the bottom, down a shade under nine per cent.

London’s top index’s new year rally has nearly run out of steam after the SVB driven losses. It is still up nearly two per cent so far this year, but is trading far away from the 8,000 point mark it breaches last month for the first time ever.