UK dodges recession but economy still poised to be below pre-Covid-19 size until end of 2024, BCC forecast

The UK is poised to avoid a recession this year but suffer a slow burning economic slump that will leave GDP below its pre-pandemic level until the final months of next year, new forecasts out late last night claim.

Stronger than expected household spending despite sky high inflation plaguing families’ finances will put the economy on a better than feared path this year.

Although GDP is on track to shrink 0.3 per cent this year, Britain will swerve the technical recession definition of two straight quarters of negative growth, according to the business lobby group the British Chambers of Commerce (BCC).

The forecasts are the latest in a batch of numbers that signal the economy is performing much better than experts had warned at the turn of the year.

BCC economists scaled up their GDP forecasts massively from a 1.3 per cent contraction this year.

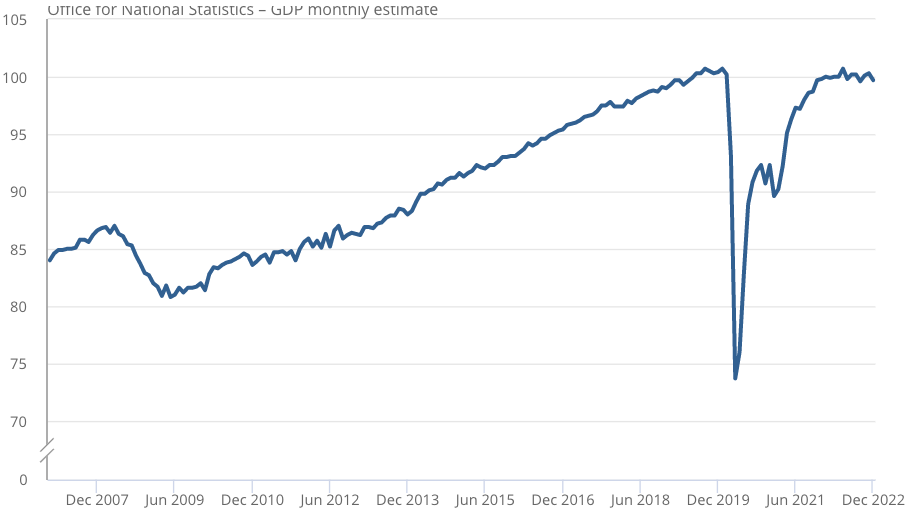

Avoiding a recession is nothing to brag about, the BCC cautioned, adding the country is treading through a long period of stagnation that will leave the economy smaller than before the Covid-19 crisis until the final quarter of 2024.

Only Britain in the G7 has an economy below its pre-Covid size.

Growth stays below one per cent in each year until 2025, a huge drop even from the sluggish decade after the financial crisis.

Alex Veitch, director of policy at the BCC, said: “Although the economy should now avoid a technical recession, the stark reality is that businesses face a very difficult year ahead.”

UK economy still smaller than before pandemic

A looming corporation tax rise to 25 per cent from 19 per cent is likely to prompt businesses to mothball investment, forcing capital spending growth to flatline at 0.2 per cent this year. Overall investment is on course to contract more than one per cent, the BCC said.

Chancellor Jeremy Hunt is reportedly mulling launching a watered down and time-limited successor to the 130 per cent investment allowance at the budget next Wednesday.

Any such decision would be designed to incentivise companies to plough money into building new factories and equipment to reduce their corporation tax bill.

Wage growth will trail an average inflation rate that will stay above five per cent for most the year, pushing household spending 0.2 per cent lower, the BCC forecast.

In response to that demand reduction, businesses are likely to ditch staff, pushing the unemployment rate to a peak of nearly five per cent.