British factories on the mend as recession u-turn gathers pace

British factories are performing better than expected in another sign the economy is on course to perform a screeching u-turn and avoid a recession, a closely watched survey has shown.

S&P Global and the Chartered Institute of Procurement and Supply’s (CIPS) final purchasing managers’ index (PMI) for the UK manufacturing sector nudged higher from an earlier estimate to 49.3 points last month.

That reading was above the consensus forecast but still below the 50 point threshold that separates growth and contraction, meaning factory activity dropped in February.

Experts said the figures send another signal that the UK economy was performing much better than people had feared it would at the turn of the year.

“UK manufacturing showed encouraging signs of resilience in February. Output rose for the first time in eight months, boosted by weaker cost inflation and reduced supply chain disruptions,” Rob Dobson, director at S&P Global Market Intelligence, said.

Manufacturers eased price increases last month due to a combination of supply chain pressures unwinding and easing cost inflation and fears over whether consumers would continue to put up with higher prices amid elevated interest rates.

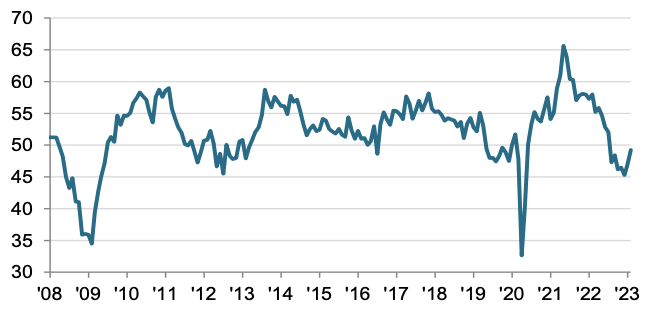

Factory output is rebounding after falling quickly last year

“Reduced pressure on supply chains filtered through to the trend in input prices during February. Although average purchasing costs rose again, the rate of inflation eased for the fifth month running and to its lowest since July 2020,” S&P Global said.

A batch of better than expected figures out recently have indicated the UK may swerve a much-tipped recession.

PMIs have also topped expectations, the as have inflation and consumer confidence figures.

Investment bank JP Morgan last week said a recession is now not its most likely scenario.