Cost of living crisis forces Brits to abandon saving, with more than one in five taking on EXTRA debt

The cost of living crisis is poised to force Brits to shun setting cash aside each month for a rainy day, official figures out today show.

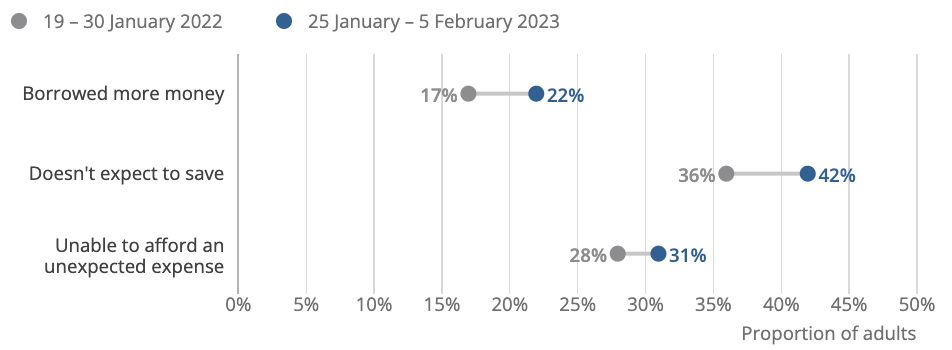

More than four in 10 of the population expect to save no money whatsoever over the next year, according to the Office for National Statistics (ONS).

Inflation has raced ahead over the last year and has been running in the double digits for several straight months, although it has eased from a peak of 11.1 per cent to 10.1 per cent.

Pay growth is failing to keep pace with prices, forcing people to use cash they may have usually saved to fund spending, the ONS’s figures indicate.

For some, living costs have risen too sharply for them to fund spending through their monthly income or by reducing savings.

“More than a fifth of adults in Great Britain (22 per cent, equal to around 11.5 million people) reported borrowing more money or using more credit because of the increased cost of living,” the statistics agency said today.

A greater share of households are under tough financial strain

While the cost of living crisis is putting strain on family finances, it has strengthened incentives for households to raid savings built up during the Covid-19 crisis when the country was locked down.

Economists have hung forecasts of the UK suffering a short and shallow recession on high inflation prompting Brits to use their pandemic savings war chests to keep spending.

Inflation has been primarily fuelled by sky high energy bills, pumped higher by Russia’s invasion of Ukraine.

Poorer people typically spend a greater chunk of their incomes on household bills, meaning the past year’s energy cost rise has forced them to cut back elsewhere or borrow to meet essential living costs.

The ONS said those in vulnerable groups are more likely to get into debt.

Some 45 per cent of people who have borrowed more compared to last year have been suffering higher anxiety levels, the report said.