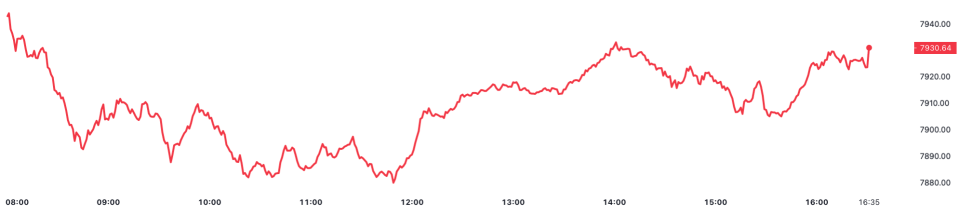

FTSE 100 close: Wall Street sell off spreads to London pushing premier index further away from 8,000 point mark

London’s FTSE 100 was drawn into a sell off on Wall Street last night, pushing it further below the 8,000 point threshold today.

The capital’s premier index fell 0.59 to 7,930.64 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, slid 0.82 per cent to 19,688.98 points.

Investors across the pond ditched US stocks yesterday after a string of hotter than expected inflation and spending data firmed expectations of the Federal Reserve having to keep interest rates higher for longer to tame price pressures.

Wall Street’s top indexes, the tech-heavy Nasdaq, S&P 500 and Dow Jones all notched their worst trading days of 2023 so far.

Downbeat sentiment spread to London, weighing on FTSE 100 shares. Just five companies on the premier index registered gains in early trading before gains picked up in the afternoon.

FTSE 100 finished lower today extending a poor week so far

Victoria Scholar, head of investment at interactive investor, said: “After the FTSE 100 closed Tuesday’s session in the red, European markets have opened lower with the UK index languishing back below the key 8,000 mark.”

Minutes from the latest Fed minute are published later today, possibly amplifying yesterday’s sell off if they signal chair Jerome Powell and other rate setters’ concerns about inflation sticking around.

Britain’s largest mortgage lender Lloyds Bank anchored the FTSE 100 during early exchanges after it posted results today that revealed it set aside more than £1bn to deal with an expected jump in loan defaults caused by the cost of living crisis.

Profits were flat over the last year, in line with analysts’ expectations. Its shares swung back to end the day with a near one per cent gain.

The bank also said it expects the UK to tip into recession this year.

The pound weakened around 0.4 per cent against the US dollar on growing expectations of tighter monetary policy stateside.

Oil prices shed more than two per cent.