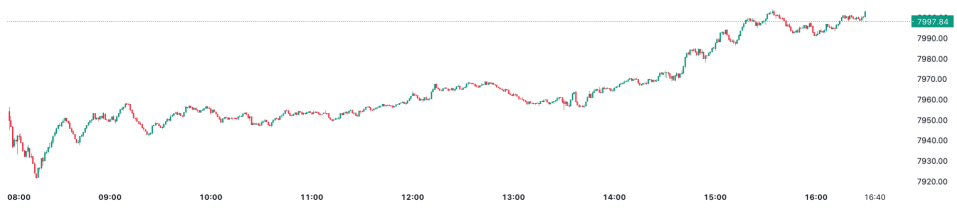

FTSE 100 close: London index breaches 8,000 mark for first time ever despite Barclays tumbling

London’s FTSE 100 today breached the 8,000 point mark for the first time ever despite Britain’s biggest banks tanking after Barclays posted a big profits drop.

Today’s move higher crystalises the premier index’s bullish start to 2023 that has seen it surged more than seven per cent.

The new year rally builds on advances that saw the FTSE 100 leave its Wall Street and European rivals the S&P 500, Dow Jones and Stoxx 600 in its wake.

London’s top stock index hit an intraday high of just over 8,003 points, before paring back gains to close up 0.55 per cent at 7,997.84 points.

Its domestically-focused mid-cap peer the FTSE 250 added 0.77 per cent to finish at 20,172.59 points.

“It’s redemption day for the FTSE 100 as it breached the 8,000 mark after a long spell in the wilderness,” Laith Khalaf, head of investment analysis at AJ Bell, said.

Market watchers have bashed the London market for years due to it having so few big tech companies on it. However, a heavy exposure to so-called “old economy” stocks like commodity giants Shell, BP, Glencore and Rio Tinto have propelled the FTSE 100 higher.

Gains came despite traders ditching shares in Britain’s biggest banks today on fears the sector is headed for a smaller than forecast profit take.

Barclays posted results this morning showing profits dropped eight per cent and came in lower than analysts’ expectations mainly due to a near £500m build up reserves to cope with surge in defaults amid the economic slow down.

“Barclays has been pulling the many levers under its control in order to lessen the impacts of further credit impairments and another year of heightened litigation and conduct costs. Together, these had a material impact,” Richard Hunter, head of markets at interactive investor, said.

It was the worst performer on the top index today, shedding nearly eight per cent. Its high street rivals followed suit. NatWest and Lloyds each shed around two per cent.

Ladbrokes and Coral owner Entain topped the FTSE 100 after pumping more than four per cent higher.

Figures out this morning from the Office for National Statistics revealed inflation in the UK dropped for the third month in a row but has now been running in the double digits at 10.1 per cent in January.

That has raised hopes that the Bank of England will stop hiking interest rates soon, sending the pound more than one per cent lower against the US dollar.

Higher borrowing costs tend to boost a country’s currency by making it more attractive to buy assets denominated in said currency.