OPINION: The public must be correctly informed over Hunt’s roadmap for a CBDC or face the prospect of ‘SpyCoin’

So, what is being proposed, here?

The UK Government will release a CBDC (Central Bank Digital Currency) roadmap today. CBDCs have been on the radar of the Bitcoin community for years, but while the government has been laying the foundations, the British public has been gaslit.

What is more concerning than the technology being proposed is how few people in the UK have heard of or understand what a CBDC is. For those in doubt, it is programmable money.

They were first discussed and proposed as early as the late 1990s, with early attempts at digital currencies issued by central banks in the 2000s. However, in the past decade, with the rise of cryptocurrencies, the increasing digitisation of economies, and a growing demand for more efficient payment systems, the concept of CBDCs gained more widespread attention and serious consideration by central banks.

Now “Britcoin” is on the horizon as the UK Treasury announces plans! This will inevitably lead to further misunderstanding between controlling, centralised money wholly owned by the government and ‘Bitcoin’, the decentralised protocol untarnished by bad monetary policy. For this article, I will refer to the Digital Pound as ‘CDBCs’ or ‘SpyCoin’.

Several news outlets have started to convince the public that this will ‘serve the vulnerable’, ‘have intrinsic value’ and be ‘fully trusted’. Don’t be fooled by the toxic positivity; this is spyware designed for control and, finally, as a method to ditch physical cash.

Central Bank Digital Currencies (CBDCs) have been gaining traction globally as governments explore new ways to digitise their economies. However, not everyone is on board with the idea of CBDCs, and there are valid concerns about their potential impact on the economy, privacy, and security.

Chancellor Jeremy Hunt is an admirer of the 99-year-old investing legend Charlie Munger, who recently showered praise on the authoritarian leader Xi Jinping for putting the kibosh on Bitcoin. While many governments decry China’s autocratic ways, they are projecting their motivations. The Chinese are in full stride, sprinting towards the finish line with the launch of their own digital yuan CBDC, and the UK are using them as a template.

The crux of the issue is that theorists assume central banks must become retail deposit takers for their CBDCs to reach widespread adoption. But, taking retail deposits has been a staple of European banking since the days of yore. With the advent of CBDCs, retail banks have been sensing the winds of change, which is why some have been toying with providing cryptocurrency options to their clients. However, it’s important to note that CBDCs are not the same as cryptocurrencies and do not operate on an open network controlled by users like Bitcoin does.

CBDCs will be touted as a way to streamline a porous system, make it more efficient, environmentally friendly, and eliminate tax evasion and illicit use of cash. However, the opposite could also be true. The implementation of CBDCs could introduce significant risk to the financial system. The government has never launched a successful large-scale digital project. In contrast, Bitcoin (not to be confused with ‘Britcoin’) boasts a 14-year track record using open-source code, withstanding attacks from hackers and adversaries. The CBDC proposed by the government will be fully centralised and have a single point of failure.

Chancellor Hunt needs to fully comprehend the peril of the government’s control over money through CBDCs. He fails to grasp the connection between the government’s ability to access personal data, including intimate details, and the completion of the panopticon loop achieved through CBDCs. Hunt believes that robust laws and effective governance will suffice to keep the situation in check.

What is programmable money?

Programmable money refers to a type of digital currency or asset that can be programmed with specific rules and conditions for how it can be used, traded, or transferred. Our money will be programmed with specific rules and conditions to regulate how they are used and to ensure that they align with government policies and objectives.

Programmable money can have a range of attributes that can be programmed into it to restrict or control how it is used. Some of these attributes include:

- An Expiry date

- Spending restrictions

- Transfer restrictions

- Tracking

- Geolocation restrictions

These are just a few examples of the many attributes that can be programmed. The specific qualities will depend on the goals and objectives of the program, as well as the regulatory and legal frameworks in place. However, relying solely on strong laws is insufficient.

Laws can be changed or disregarded by a government with a strong right or left bias that desires to become more authoritarian, thereby putting our rights and freedoms at risk. Further the government will likely authorize a wallet app that you’ll use on your phone/laptop to be able to use the new CBDC.

In China these wallets can be locked if the government decides you are not a good citizen. Could a future UK government ever exploit wallets and CBDCs like the Chinese do?

Today’s decision by Hunt could have unforeseen consequences for the citizens of the UK. The Tories are not likely to be in power when this is fully implemented.

Concerns

CBDCs will result in a loss of privacy, they are likely to require a vast amount of personal information to be collected, stored, and shared among government agencies, financial institutions, and technology companies. This presents a significant risk to citizens’ privacy and could lead to potential breaches and exploitation of personal data.

Another concern is the potential for monetary control and manipulation by central banks. CBDCs would give central banks unprecedented control over the economy and individuals’ financial lives. This could lead to potential abuse of power and manipulation of the monetary system, undermining the independence of central banks and the financial system’s stability.

Moreover, CBDCs would also pose significant risks to financial stability, as they would create a single point of failure in the financial system. In the event of a cyber attack, technical malfunction, or other disruptive event, the entire financial system could be brought down, leading to a catastrophic loss of trust and confidence in the currency.

CBDCs could also lead to greater economic inequality, primarily benefiting those with access to technology and digital financial services. Those who are digitally excluded or have limited access to technology would be left behind, exacerbating existing inequalities and reducing financial inclusion. All of the above can also be applied to Digital IDs which will inevitably need to be introduced to support the CBDC infrastructure.

The government’s track record

The UK government has faced criticism for its handling of spending on several major projects, including track and trace and the development of the National Health Service (NHS) digital infrastructure. Some of the specific criticisms include:

- Over Budget

- Lack of transparency

- Missed deadlines

- Technical problems

- Inefficient procurement processes

These criticisms have led to concerns about the overall effectiveness and efficiency of government spending, and have fueled calls for greater accountability and transparency in the use of taxpayer funds.

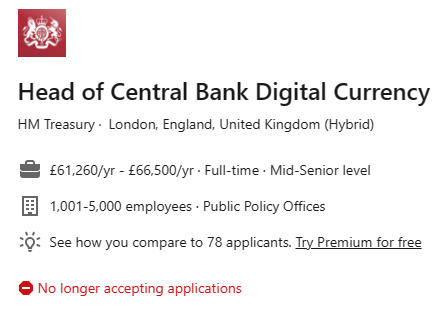

Now take into account the job description and salary of the Head of Central Bank Digital Currencies recently posted by HM Treasury, and it looks like we have another doomed project…

With the technology at the fingertips of the government, it would not be too much of a stretch to see circumstances in the future where your money is in jeopardy. We know social agendas of governments are not often correct, and now they have announced programmable money.

Conclusion

Can we opt out, or will life be made so difficult that the only way to live a normal life will be to comply? The bottom line is money is being used to make us comply and if we do not then the threat is financial censorship. This will be sold to you with many benefits, but all is not what it seems.

While CBDCs offer the potential for greater efficiency and convenience in digital transactions, they also present significant risks to privacy, financial stability, and economic equality. The government must carefully weigh these risks against the potential benefits and engage in open and transparent discussions with all stakeholders before deciding on the adoption of CBDCs in the UK.

Members of the public are now being invited to give their views on the digital pound as part of research and development being done by the Bank.

CBDCs are being promoted as a solution to enhance the efficiency of a flawed system. This is a historical shift in money and how our civilisation will run, yet very little has been discussed.

The public must be correctly informed and not be psychologically manipulated into accepting a false narrative.