Rishi Sunak and Jeremy Hunt to shun tax cuts in March budget despite £11bn energy windfall

Jeremy Hunt and Rishi Sunak will hold fire on tax cuts at the 15 March budget despite being handed an around £11bn windfall from international energy prices falling to pre-Russia-Ukraine war levels, according to top economists’ predictions gathered by City A.M.

Brits will have to wait until the run up to the next general election, which has to happen before January 2025, for the taxman to put money back in their pockets, experts reckon.

A stalling UK economy, compounded by inflation soaring to a multi-decade and the government’s debt interest bill swelling due to the Bank of England hiking interest rates aggressively has squeezed the country’s finances.

As a result, the Chancellor “really doesn’t have much room to maneouvre,” Carl Emmerson, deputy director at the economic think tank the Institute for Fiscal Studies (IFS), told City A.M.

James Smith, research director of another think tank, the Resolution Foundation, which focuses on lower and middle income families, agreed.

“With crowd-pleasing tax cuts likely to come far closer to the election, and further away from our current period of high inflation, the upcoming budget is not likely to be one where tax policy shifts markedly,” he told City A.M.

Speculation about what tax and spending decisions Hunt will announce in under two months has grown recently driven by a rapid fall in gas prices reducing the cost of the government capping energy bills at £2,500 by around £11bn.

Hopes of a tax giveaway are fading however due to the government still needing to regain the full confidence of the financial markets after Liz Truss and Kwasi Kwarteng’s £45bn tax cutting mini-budget in September.

“It is far too early for the government to swing back into a major give-away Budget, just a few months on from the fallout from Kwasi-nomics,” Smith said.

Hunt reversed nearly all of Truss and Kwarteng’s mini budget on 17 November, putting the tax burden on course to its highest level since the end of World War Two and tightening the cost of living crisis’s grip.

John O’Connell, chief executive of the Taxpayers’ Alliance, told City A.M.: “Taxpayers are fed up of their record high tax bills, with no end in sight.”

The March budget is instead expected to slim down cost of living support packages to target those most in need to rein in government spending. It has already been announced that the energy cap will climb to £3,000 and business energy support will go to sectors most exposed to higher gas and electricity prices.

However, Sunak and Hunt are set to keep motorists’ petrol bills lower by freezing fuel duty again, preventing what would have been an “increase of 23 per cent,” Emmerson said, adding it will cut the government’s revenues by £6bn a year.

Since 2011, successive chancellors have frozen fuel duty despite it meaning to rise by the retail price index, which the Office for Budget Responsibility (OBR) assumes in its forecasts. Tory Treasury Committee chair Harriett Baldwin called on the government today “to more accurately reflect the actual path of fuel duty” to make the OBR’s job easier.

In a speech today, the head of Britain’s biggest business lobby group the Confederation of British Industry Tony Danker will call on the government to implement a permanent successor to the 130 per cent investment relief at the spring budget.

“The government have said they believe in this policy but can’t afford it. That’s because they don’t want the hit to their annual accounts. I don’t think that’s good enough and nor do Britain’s investors,” he is set to say at University College London.

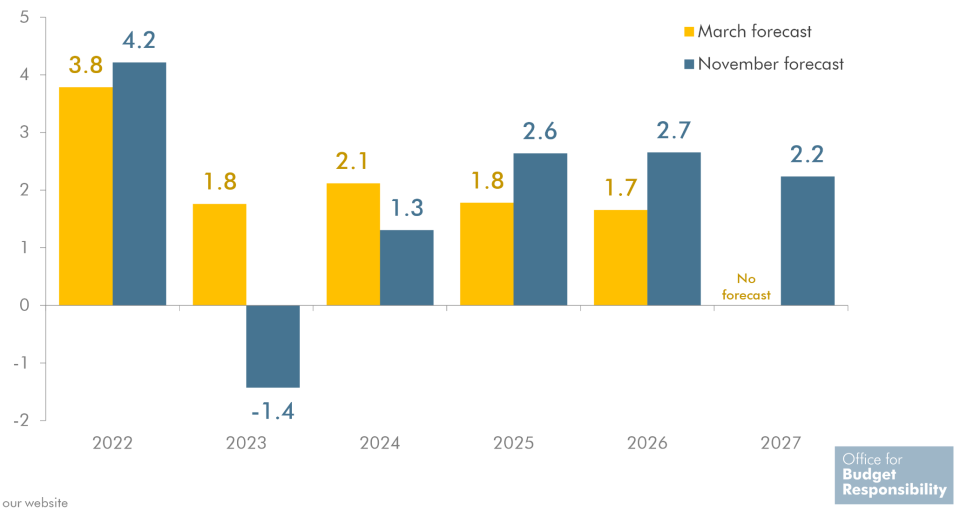

OBR’s November GDP forecasts

Inflation, which has raced to a 40-year high over the last year, has seemingly passed its peak of 11.1 per cent and is now on a downward path.

The quicker than expected drop in energy prices drove inflation lower for the second month in a row to 10.5 per cent in December.

The pair loosened their budget rules last November to getting debt as a share of the economy lower in five years and to not allow borrowing to top three per cent of GDP.

Lower than expected inflation will reduce the amount of money the government will spend on paying off its debt.

“One saving is from debt interest. It is going to increase, but not as much as forecast in the Autumn. Saving could be circa £10bn a year,” Emmerson added.

The OBR back in November forecast the UK’s debt interest bill to top £100bn this year and next, mainly due to the Bank of England raising interest rates to a post-financial crisis high.

A large chunk of the country’s debt is also linked to an old measure of inflation – the retail price index – meaning payouts to investors rise in line with prices.

A Treasury spokesperson told City A.M.: “We do not comment on speculation around tax changes outside of fiscal events.”