UK to shake off mild recession by end of this year, City analyst predicts

The UK economy will experience a very mild recession and could be out of it by the end of this year, a top City economist has forecast.

International energy prices have marched back down the steep hill they climbed after Russian president Vladimir Putin sent troops into Ukraine in February last year. On some measures, gas prices are below pre-Russia Ukraine war levels.

As a result, the outlook for the UK economy “has greatly improved,” according to Samuel Tombs, chief UK economist at consultancy Pantheon Macroeconomics.

The sharp drop in energy costs in recent weeks has blown the gloomiest predictions about the UK and European economies out of the water.

Analysts in the summer were warning of blackouts and businesses mothballing production due to sky-high energy bills.

However, Tombs, who has been a bit more upbeat than his peers over the last year, raised his expectations for output this year.

He now expects “GDP to hold steady” in the summer and then rise 0.2 per cent in the winter.

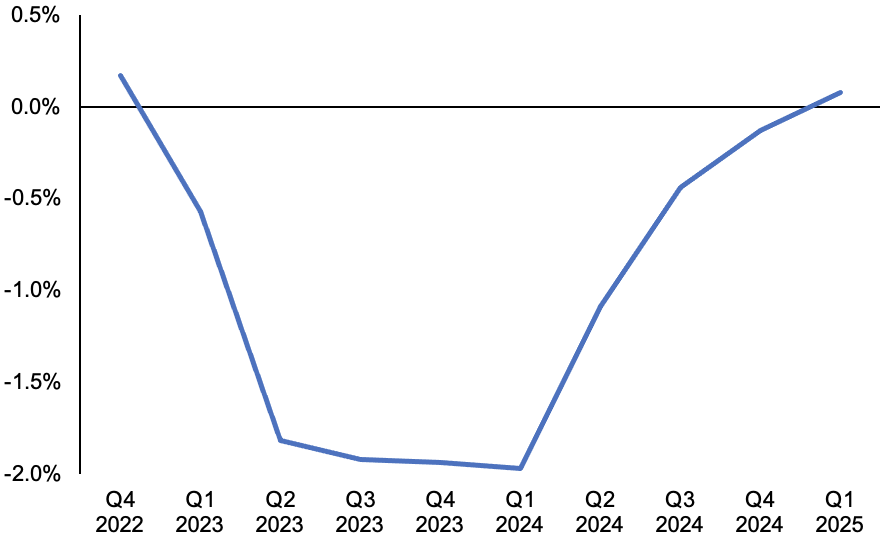

The revisions mean Britain will be in recession for three quarters of the year and that the economy is on course to shrink 0.8 per cent in 2023, up from Tombs’s previous forecast of a 1.5 per cent contraction.

Tumbling energy prices have also cut the cost of the government’s energy bill support package, handing chancellor Jeremy Hunt an extra £11bn or so to play with at 15 March’s budget.

That newfound kitty means “the chancellor [could] reallocate funds from limiting consumer energy prices to supporting households in other ways,” Tombs added.

Economists are likely in unison to revise up their projections for the UK economy this year over the coming weeks due to good news on energy prices.

The Bank of England stands out as the gloomiest of the bunch, forecasting back in November the UK will suffer the longest recession in a century.

BoE’s forecast looks way too bleak now

Governor Andrew Bailey and the rest of the monetary policy committee’s new projections, which are set to be released alongside their next interest rate decision on 2 February, will probably be a lot more optimistic.