UK’s cost of living crisis will swipe over £2k from Brits pockets with some groups expected to feel squeeze of recession even more

The UK is just halfway through a cost of living crisis that will swipe £2,100 year from incomes with living standards remaining at pre Covid levels until at least 2028, a report out today has revealed.

The cost of living crisis which, when combined with a tough recession, will leave households worse off than they were before the pandemic, a new report out today reveals.

Take home pay is predicted to drop after a two year squeeze ends in 2024 The fall represents a combined seven per cent drop in spending power, according to the economic think tank the Resolution Foundation (the Foundation).

The report warned Brits to brace for the cost of living crunch that made families poorer last year to burn throughout 2023, eventually causing real incomes to fall at a faster pace than after the 2008 financial crisis.

A combination of higher prices, tax hikes and elevated mortgage rates will erode household incomes in 2023, the Foundation said.

While those factors gathered pace last year, they are set to continue, leading Lalitha Try, researcher at the Foundation, to warn that “Britain is only at the mid-point of a two-year income squeeze”.

Sluggish pay and economic growth since the banking crash has left Brits exposed to sharply rising prices.

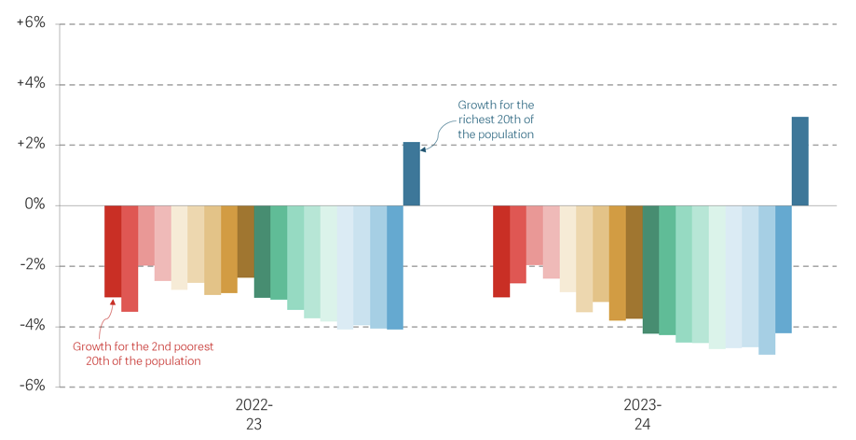

The richest households will be the only group to escape the historic living standards erosion, with the Foundation calculating their real incomes will actually rise over two per cent this year and next year.

Every other income group is set to suffer an at least two per cent drop in their take home pay in each of the next two years.

Rich households are set to escape the living standards crunch

“Rising interest rates this year and next will drive a surge in savings and investment income, much of which will be captured by the richest five per cent of households,” the report said.

Prime minister Rishi Sunak yesterday doubled down on his commitment to halve inflation by the end of the year, although experts were forecasting it to do so back in November.

Wealthier families tend to have more cash stashed away in savings accounts and own financial assets which yield regular income.

“The rising interest rates that drive… higher mortgage bills also raise the incomes of some households who see their savings and investment incomes rise. For the top five per cent, these income boosts are sufficient to offsets the drop in real earnings,” the Foundation said.

Middle income and poorer households’ financial wealth tends to lower than richer families, meaning they are set to shoulder a relatively bigger hit from the cost of living crisis.

Rishi Sunak and Chancellor Jeremy Hunt’s £55bn worth of tax hikes and spending cuts last November will leave average Brits’ poorer, as will the government’s rolling back of energy bill support from April and higher mortgage rates.

But, the government signing off on a series of one-off payments to poorer families, uprating benefits by over 10 per cent and the energy bill price cap has averted a living standards catastrophe, the report said.

Child poverty rates are likely to increase markedly in 2023 as a result of those factors, the Foundation said.

A Treasury spokesperson said: “Tackling inflation is this government’s number one priority, we have a plan that will help to more than halve inflation this year and lay the foundations for long-term growth to improve living standards for everyone.”