Rishi Sunak hits back at critics of inflation promise but warns government ‘can’t help anybody’ if prices don’t fall

Rishi Sunak has today claimed halving inflation by the end of the year – one of his five promises to the British public – will happen “because of the plans [the government] have put in place”.

Speaking to the BBC’s Sunday with Laura Kuenssberg programme, the prime minister doubled down on a series of pledges he made in his maiden speech of 2023 last week.

Sunak promised to get the debt pile down, grow the economy by the end of the year, tackle the migrant boat crisis and cut NHS waiting lists.

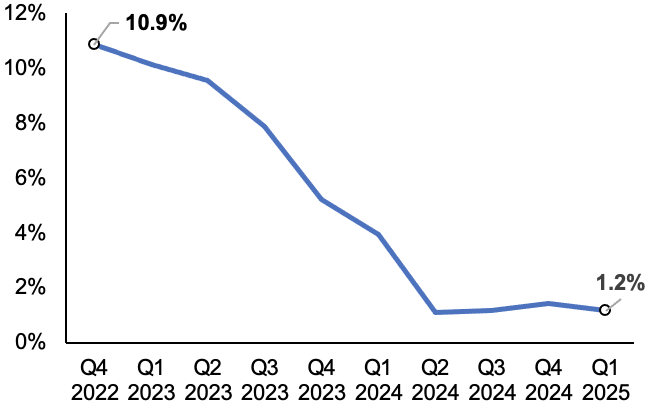

Critics have pointed out that the PM’s commitment to slash inflation – which surged to a 40 year high last year of 10.7 per cent – had already been forecast by the Bank of England and the Office for Budget Responsibility in November.

Inflation is on course to halve by end of this year

Experts have pointed out inflation will naturally fall due to so-called base effects, when high prices drop out of calculations, forcing the headline rate lower.

Energy prices, which have led inflation higher, have also dropped back to pre Russian invasion of Ukraine levels, and experts at Investec and Cornwall Insights think the energy bill cap will this summer actually fall below the government’s April uprated £3,000 peg.

However, Sunak said the decline will be driven by “a function of having a responsible economic policy when it comes to things like pay, when it comes to areas like borrowing”.

The prime minister said the government “can’t help anybody… unless we get inflation down”. Soaring prices are making it more expensive for departments to deliver services.

Sunak is under pressure from health and transport workers to deliver a pay rise that offsets cost of living pressures.

NHS and rail workers have been on strike in a bid to secure wage increases and better protections over working conditions.

“You have to continue to be disciplined,” Sunak added.

The prime minister and NHS unions leaders were locked in negotiations over the weekend in a bid to prevent further strikes. More talks are pencilled in this coming week.

Last November, the prime minister and chancellor Jeremy Hunt raised taxes and cut spending by £55bn to rebalance the public finances.

Reining in the government purse strings will help buttress inflation by sucking demand out of the UK economy.

The government is actually not responsible for keeping inflation low and stable. That responsibility lies at the Bank of England’s door.

Its chief, Andrew Bailey, and the rest of the monetary policy committee, have hiked interest rates nine times in a row to 3.5 per cent, their highest level since 2008, in response to accelerating prices.

Despite those efforts, inflation has run above its two per cent target since July 2021. It is expected to lift borrowing costs again, probably by another 50 basis points, on 2 February to four per cent.