Shop ’till you drop: Christmas spending up despite rampant inflation

Shopping habits die hard as Brits continue to spend across the board in the run-up to Christmas and the holiday season despite historic levels of inflation raising prices.

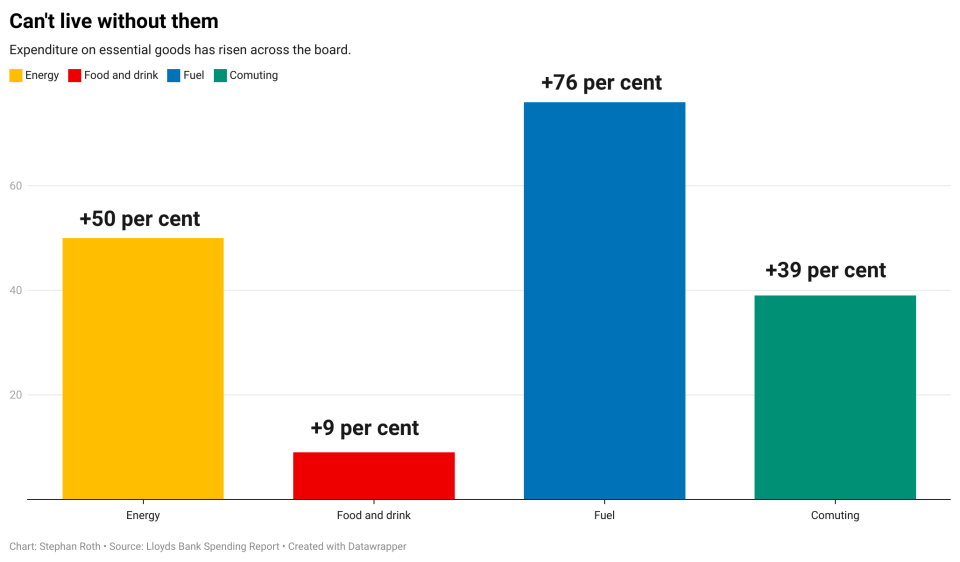

Spending on essentials is up by an average of 43.5 per cent compared to the same time last year, with non-essential expenditure also rising by an average 15 per cent, a report from Lloyds Bank suggests.

“Our data shows that based on debit card spend alone, our customers are facing higher essential costs this Christmas”, Gaby Collins, payment director at Lloyds Bank said.

Energy (+50 per cent) and fuel (+76 per cent) costs in particular have seen the largest growth in expenditure. Last month Ofgem announced a 20 per cent hike to the energy price cap, raising the cap by an additional £700.

The watchdog forecasts that the 18-month support scheme will cost households as much as £42bn, as supply chain disruptions and inflation send bills skyrocketing.

For fuel. The War in Ukraine has forced Brits to suffer the most volatile year on record for fuel prices. Analysis from the Competition and Markets Authority (CMA)’s Road Fuel Market Study indicated that fuel prices jumped 50p a litre from January to July — the largest surge on record.

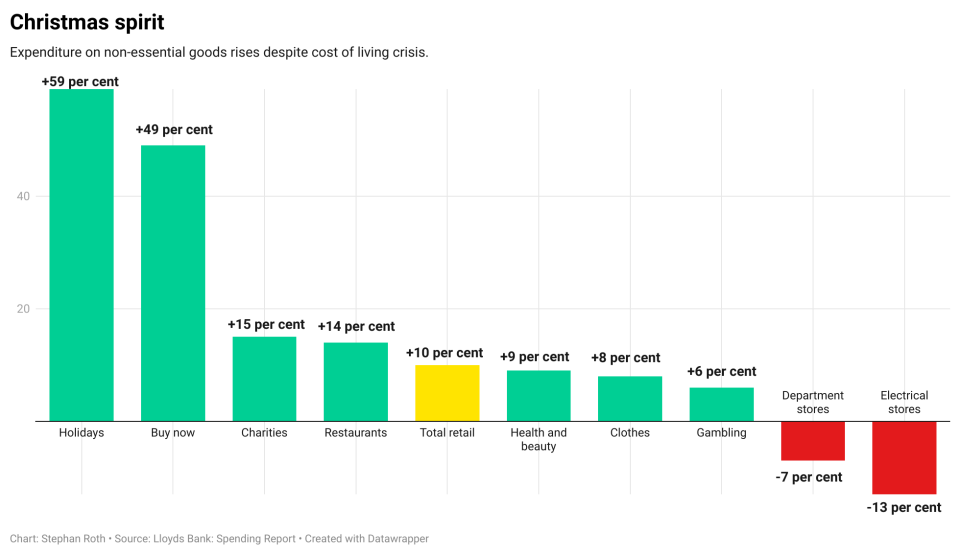

Despite economic and geopolitical turmoil the main cause behind the spending increase, there is still a little Christmas spirit going around the country.

“Despite these higher costs, charity giving has risen as people choose to support causes that are important to them at this special time of year”, Collins said.

On the whole, retail expenditure rose 10 per cent compared to the same period last year.

Pubs and restaurants experienced an uptick of 14 per cent, with the World Cup in Qatar fueling spending and holidays remain stable for Brits — no matter the economic climate.

Figures published by trade body ABTA indicate that 1.2m people are set to depart from Stansted and Luton airports during the Christmas period.

In a show of good faith, charity spending too has risen 15 per cent, as people support the causes they care most about regardless of the price pressure facing everyday citizens.

The only two spending segments down are department and electrical stores. Both segments have been impacted by the rising cost of fuel and energy, with Brits not too keen to commute to stores or purchase electricity-intensive devices.