Brexit has contributed to UK inflation crisis, BoE’s Pill claims

Brexit is partly to blame for UK inflation surging to a 41 year high and engineering a recession, the Bank of England’s top economist claimed today.

Speaking at an event hosted by the Institute of Chartered Accountants, Huw Pill said worker shortages in Britain had been “met by the inflow” of EU migrants while the UK was a member of the bloc.

However, after Brexit, this flow has “changed and disappeared,” resulting in businesses struggling to scale staffing levels to produce enough products to fulfil demand, Pill added.

The disappearance of EU workers could be plugged by inflows of people from elsewhere.

Figures out last week from the Office for National Statistics (ONS) revealed net migration to Britain hit a record of 504,000 over the last year, mainly driven by a huge influx of people coming from outside the EU.

But, many of the incomers came for education purposes, meaning they will not enter the labour market, suggesting worker shortages could persist.

Earlier this month, the Office for Budget Responsibility forecast UK GDP growth will top two per cent each year after 2024, mainly based on an assumption net migration will stay around 200,000 every year.

A big rise of around 900,000 in people not searching for a job since the start of the pandemic has intensified tightness in the jobs market.

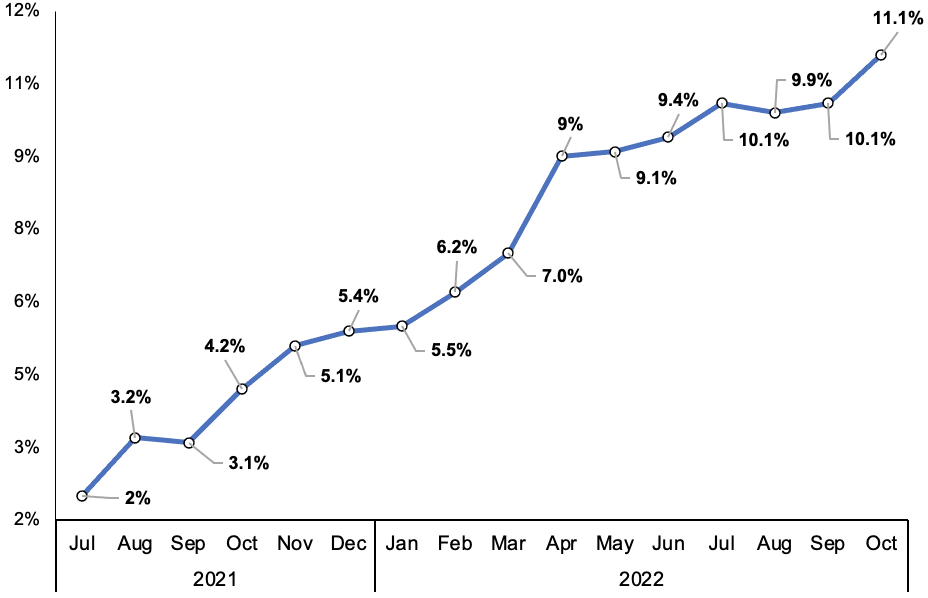

Bank officials argue businesses are hiking wages to attract and retain staff, which is putting upward pressure on inflation. However, pay growth has lagged behind inflation, which is running at a 41 year high of 11.1 per cent, for nearly a year.

Inflation has soared…

The central bank is fearful that rising prices will shape people’s expectations for future inflation, resulting in firms hiking prices and workers demanding pay rises, known as “second-round effects”.

Inflation in Britain is being pushed higher by elevated energy prices caused by Russia’s invasion of Ukraine and strong wage growth, a “worst of both worlds” dynamic, Pill said.

While Europe and the US are likely to tip into recession as well, both are suffering from just one of those factors, not both at the same time like the UK.

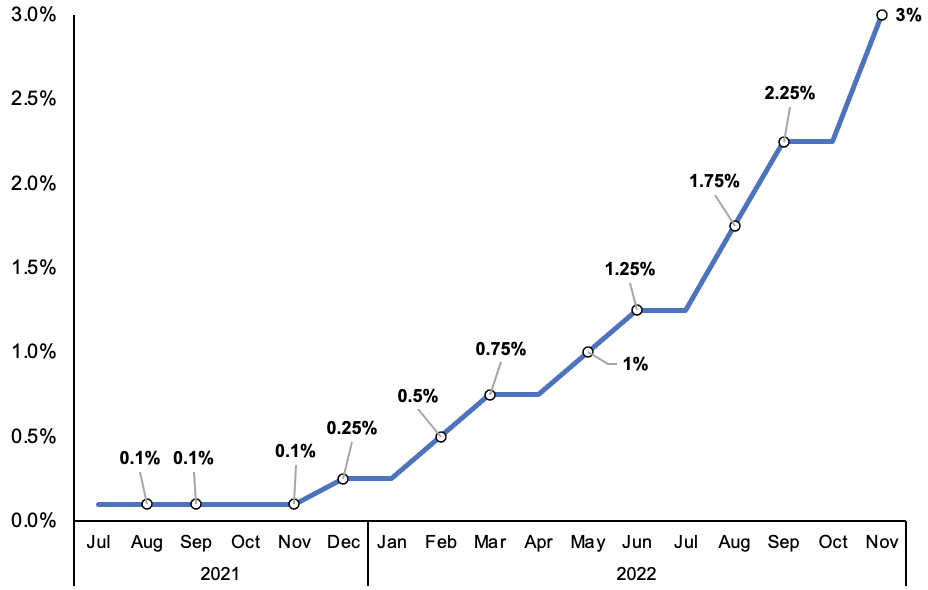

Pill said the Bank has to keep raising interest rates to tame prices. It has already lifted them eight times in a row to three per cent, including the biggest rise in 33 years earlier this month at 75 basis points.

… as have interest rates

Bank adopts full fat Basel rules

The Bank of England also announced today it will apply a full fat version of the next round of the post-financial crisis Basel banking rules in a blow to lenders who had hoped it would make concessions.

The new regulations will impose tighter restrictions on how much capital banks have to set aside on loans.

Critics argue lenders pass on capital reserve requirements through higher interest. Proponents say safety cash is needed to ensure lenders can absorb losses that threaten financial stability.

The Basel regulations were created to prevent a repeat of excessive risk taking that sparked the 2008 financial crisis.

“Alignment with strong international banking standards promotes economic growth by underpinning the competitiveness of the UK as a financial centre,” Sam Woods, chief executive of the Prudential Regulation Authority, said.

Tory City minister Andrew Griffith said yesterday the government could tweak rules that have separated UK investment and retail banking arms as part of a post Brexit Big Bang 2.0