Bank of England could cut rates to offset deep recession, deputy governor hints

The Bank of England may have to cut interest rates if the UK economy slumps into a long, tough recession, a senior official at the monetary authority predicted today.

Sir Dave Ramsden, a deputy governor at the Bank, told the Bank of England Watchers’ conference today that if households and businesses are under greater financial pressure than expected, “then I would consider the case for reducing Bank Rate, as appropriate”.

The remarks add to a growing body of evidence indicating the monetary policy committee (MPC) is coming to the end of its aggressive rate hike cycle to tame inflation.

Earlier this month, Ben Broadbent, another deputy governor, told investors their expectations for borrowing costs are too high, warning if they hit five per cent, it would shave a similar amount off the economy.

At the Bank’s meeting earlier this month, it took the rare move of signalling to markets it will not send rates to the more than five per cent priced at the time.

Governor Andrew Bailey and the rest of the MPC have kicked borrowing costs higher eight times in a row, including a 75 basis point rise at their last meeting, the biggest move in 33 years, to three per cent.

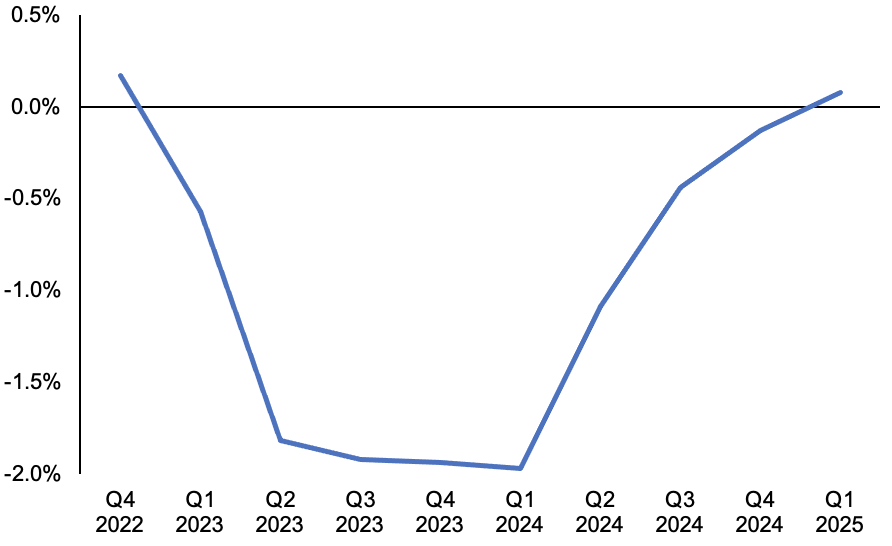

Bank of England’s GDP forecasts are bleak

Most investors expect the Bank to send rates up 50 basis points on 15 December.

Ramsden did concede his preference is “towards further tightening”.

Threadneedle Street has been raising rates for months despite ratcheting up its recession warning at each MPC meeting this year.

Earlier this month, it predicted Britain would tumble into the longest recession on record at two years, knocking nearly three per cent off of GDP.

The hiking cycle is required to prevent inflation embedding into the economy over the long run, the Bank argues. Prices are up 11.1 per cent over the last year, the fastest acceleration in 41 years.

Chief economist Huw Pill today dismissed suggestions the Bank should pay interest on a fraction of lenders’ reserves at the central bank. Doing so could reduce the cost of covering losses on the QE programme to the taxpayer, but would suck money out of the banking system.

Yesterday, minutes from the latest US Federal Reserve meeting hinted at a slowdown in rate rises.

The Fed has cumulatively tightened financial conditions at the fastest pace since the early 1980s, including four back to back 75 basis point hikes.

The minutes open the door to a 50 basis point rise in mid December. Fed officials noted their actions are damaging the US economy and a slowdown could be required to avoid dealing unnecessary damage to businesses and households.

Details from the European Central Bank’s latest meeting released today indicated it could raise rates 75 basis points for the third time in a row at its next meeting.