Klarna amps up super-app aims with price comparison tool

Klarna is looking to become an “assistant for each and every step of your shopping journey”, one of the fintech firm’s top bosses told CityA.M. today, as it ramps up efforts to become a ‘superapp’ with a new price comparison tool.

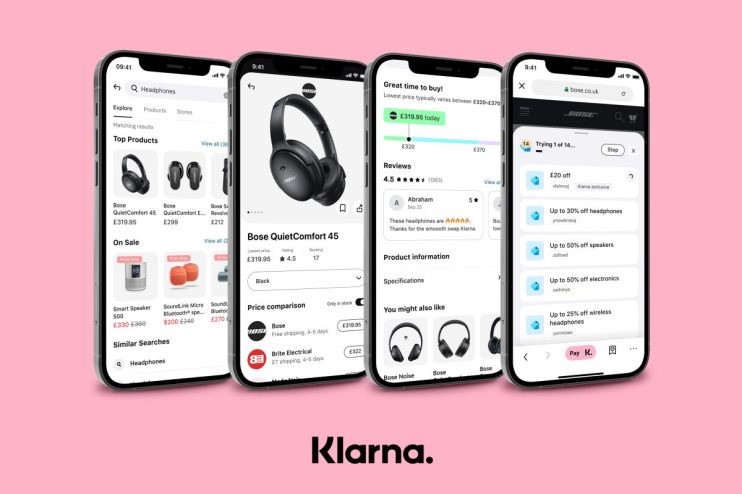

The Swedish buy-now-pay-later firm has launched the search and compare tool in its Klarna App to enable shoppers to compare prices between retailers.

The move marks an acceleration of Klarna’s attempts to reach superapp status as it broadens its reach beyond payments and into wider retail.

Price comparison is set to put the firm in competition with Google or Amazon, as well as unlocking another revenue stream for Klarna.

It “could not come at a better time”, given shoppers were “feeling the pinch of rising costs of living” amid historic levels of inflation, David Sandstrom, chief marketing officer, said this morning.

“The long-term vision is for Klarna to become the world’s biggest affiliate network in the world,” he added.

The feature will also boost the fintech’s affiliate revenue, a key pillar “as we steer towards profitability,” Sandstorm said.

Last year, Klarna clinched its largest acquisition to date when it swooped up the Swedish price comparison website, PriceRunner.

The feature is available from today, just in time for Black Friday amid retail’s ‘golden quarter’ ahead of Christmas.

Klarna launched a similar tool in the US last month and today it is available to app users in the UK, Sweden and Denmark.

Earlier this year, the buy-now pay-later giant revealed that losses more than tripled in the first six months of the year as it was hit by soaring employee costs and rising credit losses as it ramped up its expansion in the US.

The firm chalked the losses up to the costs of the integration of PriceRunner, an increase in “employee costs” and rising credit losses across the group on the back of a major growth push in the US and UK.

The mounting losses were published amid a turbulent period for the fintech giant after it was forced to slash its headcount by ten per cent in May as fintech and tech firms globally are hit by a major downturn.