This Week’s Financial Markets

Looking back to last week, we had a busy week on the calendar. Kicking off the Central Banks was the RBA on Tuesday morning who hiked rates for the 7th consecutive meeting, by 25bps, but sparked some speculation that they could in fact end their hiking cycle earlier than expected. However, with the YoY Trimmed Mean CPI still at 6.1%, that may prove troublesome.

We had the BOE on Thursday, which provided us with a further update on the impending recession facing the UK. This has caused continued pressure on Sterling in recent months despite the hiking cycle that the BOE are on. At the meeting the banks projections showed us that we are to expect a longer and deeper recession than markets originally feared as well as a push back on what markets are currently implying for a terminal interest rate in the cycle. All eyes are now focused on the updated budget on November 17th to see how that may impact the banks current forecasts.

The FED were then out on Wednesday evening, and they ended up hiking by 75bps for the 4th consecutive meeting and the 6th consecutive hike. The press conference provided us with some fresh information that the terminal Federal Funds rate is going to be higher than the 4.6% the dot plot told us back in September, as well as no pivot from them just yet. This then resulted in a hawkish reaction after the initial move to the downside was seen because of a comment in the statement suggesting a lower hike in December. Smaller hikes to continue for longer seemed the theme to come out of the meeting, seeming somewhat realistic given the circumstances.

What’s Ahead?

Looking forward to this week then we are pretty light on the economic calendar. This morning we saw some weak trade data out of China which markets didn’t take too kindly to, as well as a pushback from China’s health commission spokesperson on the rumours from last week that they were considering easing the covid restrictions. These losses have since been pared as rumours have again resurfaced about easing of covid measures.

All eyes this week will be on the CPI print out of the US on Thursday which will give us more of a clue on where the FED need to go from here.

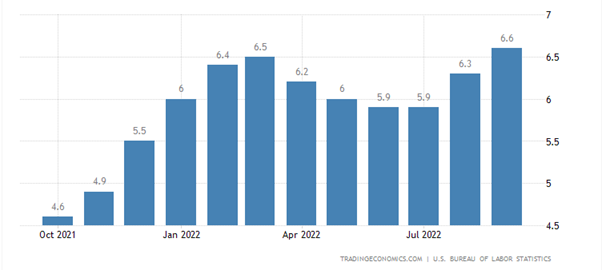

As you can see above back in March-June there was thoughts inflation was peaking however we have since pushed back higher to a fresh peak of 6.6% for the YoY Core CPI print. This month’s data now proves critical as a continuation of this move higher confirms the FED cannot begin to pivot just yet, which should then prove supportive for the dollar and negative for stocks. Market consensus is for a 0.1% decline in the rate which can give us a clue that the hikes are beginning to take effect and start the cooling down of inflation, which should prove negative for USD and push stocks higher. After pretty mixed NFP figures last week, this Core CPI print is now ever more important. The FED do continue to tell us that it is taking a data dependent monetary policy stance, so definitely something to keep a close eye on as we head into Thursday of this week.

On Tuesday the mid term elections begin as they look to reshape congress. The divide between the Republicans and the Democrats on topics like the economy, gun control, abortion, climate change and immigration are back in focus and could well tell us whether Donald Trump decides to run again. Joe Bidens future will also be at the forefront of people’s minds.

Onto Friday now and we see some preliminary GDP figures from the UK to confirm negative growth for Q3, however the data at the moment would suggest that the UK is already in recession. The updated budget on November the 17th will give us more of an idea as to how deep it is likely to be, and how long it may take to get out. Probably bigger information down the line rather than these figures on Friday.

Trade might be quite tricky this week until Thursday, with not a lot of fresh information for us to work with. Cautious into Thursday seems the way to play it.

How to Learn to Trade on Financial Markets?

It’s essential to ensure you have the right skills and knowledge to capitalise on the opportunities presented from a recession and studying a trading course at an accredited, award-winning academy can help provide you with an advantage. The London Academy of Trading has a combination of practical application and theory can provide you with the skills to thrive in financial markets, whilst their 10h/day support can help provide immediate help and advice.