Scorching inflation raises fears of Christmas spending slump

Scorching inflation hobbling Brits’ finances has triggered a spending squeeze that could bleed into Christmas, research out today reveals.

Surveys out from Barclaycard and the British Retail Consortium (BRC) show retail sales volumes likely fell in October.

While the organisations measured a jump in consumer spending of 3.5 per cent and 1.6 per cent respectively, when accounting for inflation, which climbed to a 40-year high of 10.1 per cent in October, spending likely dropped.

The increases are “being driven by inflationary pressures and [do] not tell the true picture of sales volumes dropping as consumers purchase fewer products per shop,” Paul Martin, UK head of retail at KPMG, who helped compile the BRC’s report, said.

Discretionary spending is undergoing the biggest pullback, driven by consumers’ budgets being gobbled up by higher food, energy and mortgage bills. Essentials spending climbed 5.5 per cent over the last year, Barclaycard said.

Hospitality businesses are on course to be hit hardest by Brits tightening their belts due to spending on non-essentials typically being the first thing to go to shore up finances.

Bars, pubs and clubs notched a 1.7 per cent rise in demand, but, excluding September’s poor reading, that would have been the smallest jump since March 2021, Barclaycard found.

Businesses hoping for a Christmas spending surge to boost their finances could be disappointed, raising concerns over the health of the UK’s drinking holes, cinemas, theatres and other leisure and hospitality firms, which are still grappling with legacy Covid-19 debt.

These firms often rely on the festive spending bump to tip into profit, but around a half of Brits plan on reducing spending over the Christmas period, Barclaycard said.

“Retailers are facing possibly their toughest festive season in a decade as shoppers look to trade down, search out bargains and purchase less to meet the economic challenges ahead,” Martin added.

Experts also said consumers could be mothballing purchases until black Friday on 25 November to bag themselves a bargain.

“With November black Friday sales just around the corner, many people look to be delaying spending, particularly on bigger purchases,” Helen Dickinson, chief executive of the BRC, said.

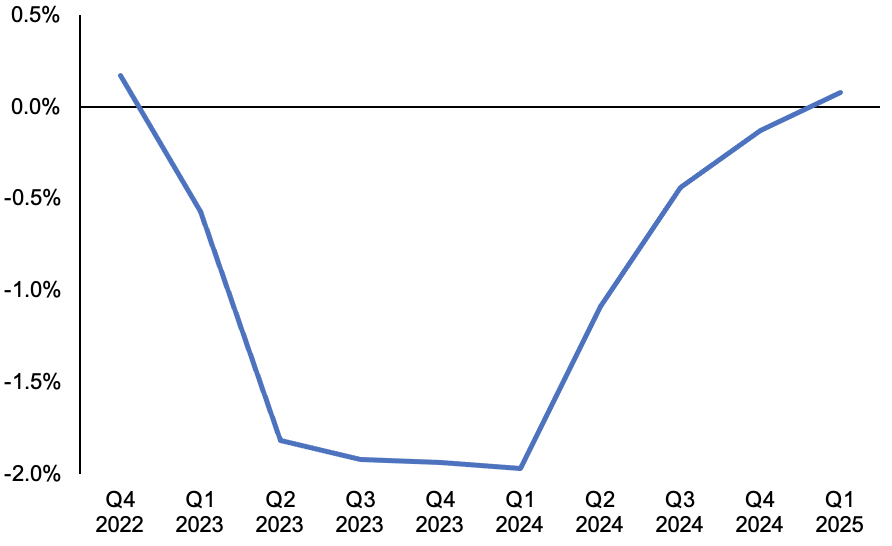

Bank of England’s GDP bleak projections

A consumer spending slump is likely to be the largest factor steering the UK into the longest recession on record at eight consecutive quarters, the Bank of England forecast last week.

UK GDP relies heavily on Brits spending money. But, with pay growth falling behind price rises and the Bank hiking interest rates eight times in a row to get on top of historically high inflation, household consumption is set to skid lower.

New GDP out on Friday are expected to show the economy contracted on a monthly and quarterly basis, indicating the country is in the early throes of a long slump.