Eurozone inflation breaches forecasts to hit record 10.7 per cent

Eurozone inflation has surged past expectations to 10.7 per cent this month in a further sign the European Central Bank (ECB) will have to keep heaping misery on businesses and households to tame prices.

Prices continued to climb rapidly in all the bloc’s major economies, signalling the effects of the ECB’s pivot from years of ultra-cheap money to tighter financial conditions have yet to feed through.

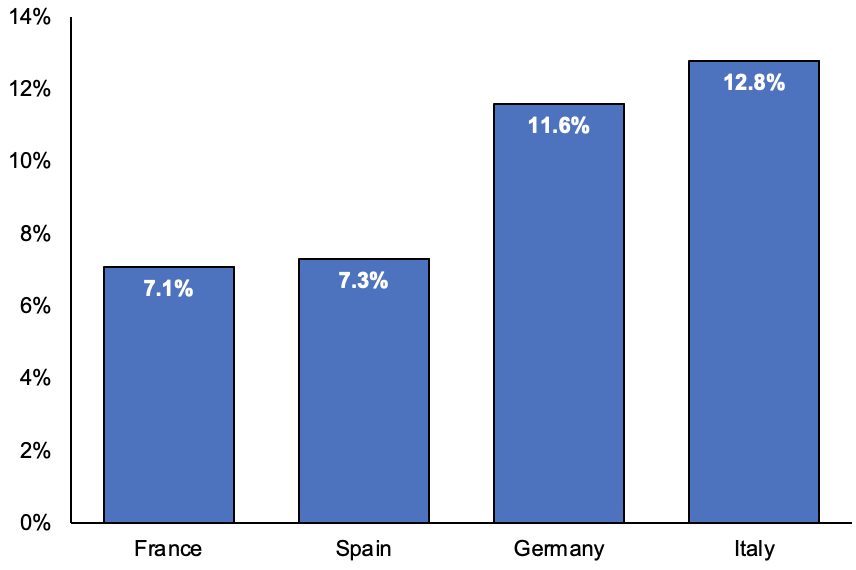

Inflation in Germany, the eurozone’s economic powerhouse, hit 11.6 per cent this month, up from 10.9 per cent in September.

In France and Italy, prices rose 7.1 per cent and 12.8 per cent over the last year respectively, both rates up sharply from the previous month, according to Eurostat.

The headline rate is the highest since the creation of the euro in 1999. Analysts had expected inflation to hit 10.2 per cent.

Last week, ECB president Christine Lagarde and the rest of the governing council lifted borrowing costs 75 basis points for the second time in a row and signalled more rate rises are coming.

Inflation rates in Europe’s biggest economies

In July, the ECB lifted borrowing costs for the first time since 2011 by 50 basis points. Two larger rises have lifted rates to 1.5 per cent. They had been negative for several years before the first rise.

Analysts in recent weeks have been mulling whether the ECB and other central banks will cool rate hikes to avoid dealing unnecessary damage to their respective economies.

However, today’s inflation overshoot raises the risk that the central bank of the 19 countries using the euro will have to keep hiking at that pace or risk inflation embedding in the area’s economy over the long term.

“These numbers make an ECB-pivot—a 50 basis point rate hike in December after two 75 basis point hikes in September and [and October]—less likely,” Claus Vistesen and Melanie Debono, eurozone economists at Pantheon Macroeconomics, said.

Core eurozone inflation, a measure on underlying price pressures in an economy, climbed to six per cent in October, indicating there could be a “more sustained lift to inflation expectations and wage demands, which the ECB already are alarmed about,” Vistesen and Debono added.

Russia’s invasion of Ukraine has rocked international energy markets, sending gas and oil prices up steeply.

The eurozone has been heavily reliant on Russian energy supplies for years to power economic activity.

Energy costs in the currency union climbed more than 40 per cent over the last year.

The Kremlin has responded to western sanctions by sucking supplies out of the market, forcing European countries to source alternative suppliers.

Flows through the Nord Stream II pipeline, the main gas thoroughfare from Moscow to Europe, have plummeted in recent months.

That has resulted in a big uptick in demand rubbing against weaker supply.

Economists have warned the eurozone economy will be plunged into a long and deep recession caused by businesses scaling back activity in response to higher costs squeezing their finances. Consumers are also forecast to flash spending as their spending power is eroded by higher prices.

But, separate figures out today from Eurostat revealed the bloc’s economy grew 0.2 per cent over the three months to September.

If the ECB continues to hike rates steeply, that will heap more pressure on corporate and household balance, which could be the recession trigger experts have projected.

The world’s largest economies are grabbling with a tough inflation surge driven by higher energy prices and strong demand for workers sparking against weaker supply.

Prices are up 10.1 per cent in the UK, likely forcing the Bank of England this Thursday to lift rates 75 basis points to three per cent. That would be the biggest hike since 1989.

The US Federal Reserve is expected to sign off a similar move on Wednesday.