LNG cargoes await supply squeeze as Europe readies itself for tough winter

Dozens of liquefied natural gas (LNG) cargoes have been in slow transit across Europe in recent weeks, awaiting the prime opportunity to unload their valuable resources.

The European Union has topped up supplies across the bloc to nearly 94 per cent of capacity ahead of winter, according to the latest data from ASGI+.

This, alongside warmer than expected winter weather, has eased demand and resulted in re-gasification plants in Europe being unable to further receive new cargoes.

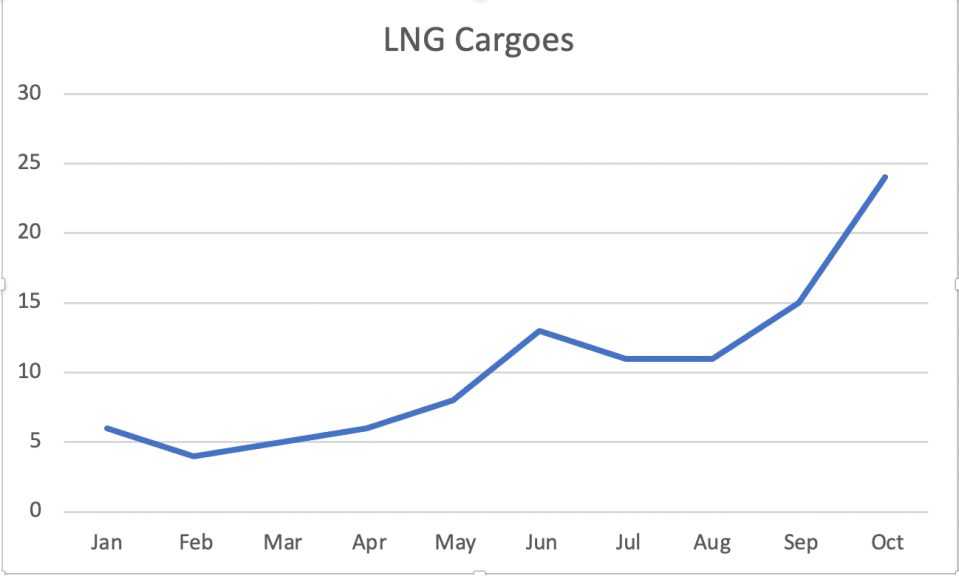

Rystad Energy has reported 24 LNG cargoes are currently floating off the continent’s coasts, a sharp spike since the summer.

Nathan Piper, head of oil and gas research at Investec, told City A.M. this charmed situation was unlikely to last, with demand expected to rebound over the coming weeks.

He said: “The combination of the world’s largest LNG importer, China’s zero covid strategy and short term mild weather conditions in Europe are combining to reduce short term LNG demand. However we believe this is likely to be a short lived phenomenon as seasonally normal winter temperature push up gas demand for heating in Europe and to an extent Asia.”

LNG cargoes were now biding their time, floating in the Atlantic Ocean and Mediterranean, waiting for the highest bids for their supplies when conditions eventually worsen.

Ole Hansen, head of commodity strategy at Saxo Bank, argued Europe was also constrained by its lack of storage capacity, and that LNG providers would benefit from the waiting period.

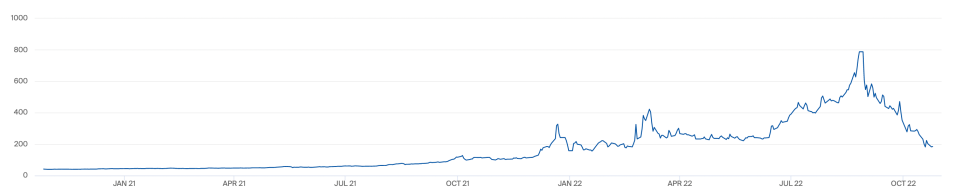

He said: “For now, and unless these LNG tankers find another buyer, most likely in Asia, a significant part of the global fleet has been turned into floating storage sites, to the benefit of not only LNG tanker owners who charges a fee per day, but also the owner of the gas who can buy spot gas around €100 and sell it for delivery at a future data at a higher price through the futures market. An example being the peak winter contract for February deliveries which is currently trading around €40 above the current spot month.

“It highlights the urgency in building regasification plants and pipeline capacity that looks to the West for supplies instead of East.”

Europe pushes for supply security this winter

Europe has cut down its dependence on Russian supplies of gas from 40 per cent of imports to just nine this year, and also brought in measures to phase out Kremlin-backed coal and oil supplies.

It has instead relied on domestic energy generation, Norwegian supplies, and LNG from the US to meet its energy demands.

However, outages at French nuclear power plants, droughts at key dams near Norwegian hydroelectric plants, alongside explosive leaks on the closed Nord Stream pipeline reflect the volatility facing the troubled continent this winter.

With demand from Asia robust, there will also be competition in the coming months from Japan, China and Korea for supplies.

The International Energy Agency’s (IEA) chief executive Fatih Birol expects Europe to make it through winter with “economic bruises” but stave off blackouts unless there are further “surprises.”

However, the Paris-based climate group has also encouraged the continent to further reduced demand with energy saving measures and potential rationing, warning supplies could be as low as 20 per cent of storage capacity by February,

Rystad energy analyst Nikoline Bromander expects Europe will have enough gas to “survive” this winter “unless it gets very, very cold.”

However, he warned the continent was “not out of the woods yet”

He said: “The temptation in Europe will be to take a sigh of relief and acknowledge the hard work and tough decisions on demand and supply that have been taken.'”

Reflecting expectations of trouble ahead, even with spot prices descending to year-lows, the futures contracts for November through to February remain historically high.

Meanwhile, the National Grid has raised the possibility of three-hour rolling blackouts in a worst-case scenario in January, while Cornwall Insight is predicting the price cap for households will peak above £4,000 per year in April next year.

Across the channel, the European Commission has announced emergency measures last week which include member states collaborating to jointly procure gas for the first time.

The EU will also develop a new gas price benchmark for LNG to reflect its rising importance in Europe’s gas supply mix.

In addition, countries will pool at least 15 per cent of their gas storage needs next year.

However, no agreement has yet been reached on whether or not to cap gas prices amid continued division across the bloc.