HSBC shares sink to bottom of FTSE 100 despite profits topping City forecasts

HSBC profits have topped the City’s expectations, boosted by the Bank of England hiking interest rates rapidly to tame historically high inflation, the firm said today.

The Asia-focused lender notched $3.1bn (£2.74bn) in profits over the three months to September, much higher than analysts’ consensus forecast.

HSBC’s net interest income surged as it passed on higher rates to borrowers.

The Bank has hiked interest rates seven times in a row, including two back-to-back 50 basis point hikes, to 2.25 per cent. It is expected to raise them by at least 75 basis points next Thursday. Inflation is running at more than five times its two per cent target.

HSBC’s net interest margin, a key source of revenue for banks, widened 38 basis points over the last year and 22 basis points over the last quarter alone.

That sent net interest income up more than $1bn (£884m) in September, the firm announced today.

Despite the higher net interest margin lift, HSBC’s profits slid more than 40 per cent over the last quarter, driven lower by a big write down after it ditched its French banking business and a $1.1bn (£973bn) build of reserves to deal with an uptick jump in defaults caused by the cost of living crunch.

A more than $2bn (£1.77bn) hit from the sale of its French bank dragged the lender’s bottom line into the mire.

HSBC has been embroiled in a demerger campaign launched by its biggest shareholder, Chinese insurer Ping An, over the past year or so.

Ping An wants HSBC to split out its Asia business to unlock value for shareholders, many of whom are Hong Kong retail investors who were starved of payouts during the pandemic as a result of UK regulators blocking banks from redistributing profits.

Today’s earnings will strengthen Ping An’s break off argument.

Profits in the Asia business came in at $3.51bn (£3.1bn) in the past quarter. However, the Europe business, which houses HSBC’s UK’s operations, swung from a $630m (£557m) profit to a $1.57bn (£1.39bn) loss over the same period.

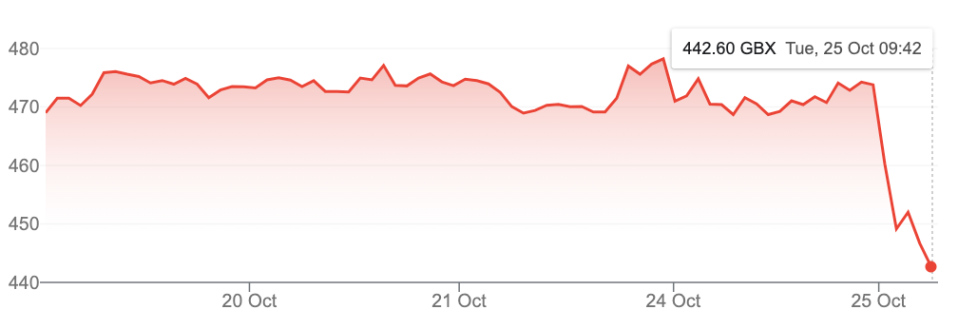

HSBC’s London FTSE 100-listed shares tumbled to the bottom of the premier index, shedding more than six per cent.

HSBC shares slid at the open today

Britain’s biggest bank today has kicked off third quarter UK bank earnings season.

Analysts will be scrutinising the sector’s earnings for signs of whether the economic downturn and cost of living crunch is forcing Brits to raid their pandemic savings to maintain spending.

The City is keen to see how the Bank’s campaign against historic high by tightening financial conditions is lifting lenders’ bottom lines.

Banks are also expected to set aside millions in reserves in preparation for an uptick in loan defaults caused by inflation eroding household finances.

A surge in loan loss provisions during the Covid-19 crisis dragged US, UK and European banks’ profits down sharply. Profits have been lifted over the last year or so as they released those reserves back into their bottom lines.

Fellow Asia-focused lender Standard Chartered updates markets tomorrow, while formerly majority state-owned NatWest published earnings on Friday.

HSBC today named Georges Elhedery, a former head of its investment bank, as its new chief financial officer in a surprise move that leaves him in pole position to eventually succeed chief executive Noel Quinn.

Quinn, 61, said under his stewardship, HSBC has “retained a tight grip on costs, despite inflationary pressures, and remain on track to achieve our cost targets for 2022 and 2023”.