Shell could start profit slowdown as Labour pushes to expand windfall tax

The historic profit run from oil and gas titans is expected to slow down this week, when Shell unveils its latest results.

Producers are grappling with both inflation and suppressed demand amid growing expectations of a global recession.

Shell has warned ahead of its third quarter update this week that earnings will likely be dented by a sharp hike in refining costs and weaker natural gas trading.

In an update earlier this month, it revealed indicative refining margins dropped to $15 a barrel compared with $28 a barrel in the previous three months of trading.

The energy giant will update investors on its performance this Thursday, the first in a wave of results from oil and gas giants over the coming days.

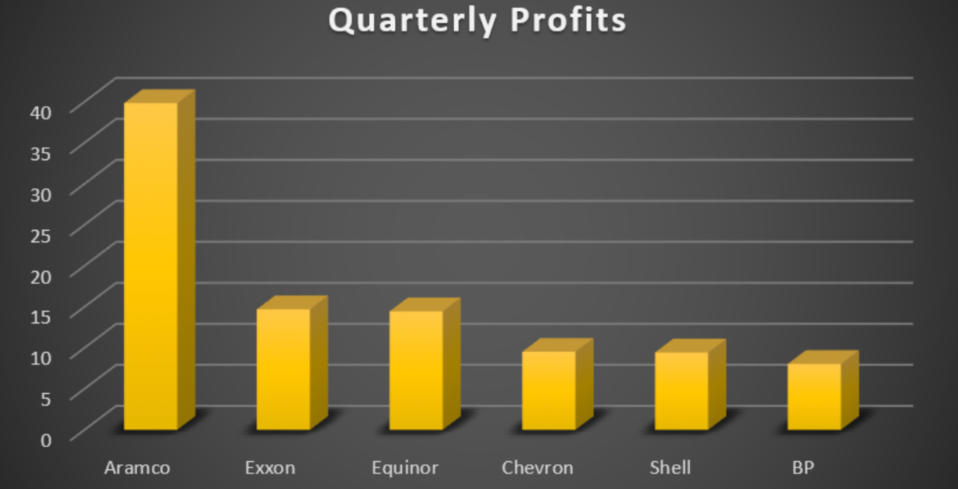

Rivals BP, Chevron, Exxon Mobil, Equinor and Saudi Aramco will also announce their results over the coming days – offering markets a flurry of data on the latest conditions in the fossil fuel sector.

The London-based energy giant announced record profits of over $20bn in the first six months of trading this year, including a record $11.5bn in its second quarter.

This was powered by soaring oil and gas prices however, since then, fears of an economic downturn and a slide in oil prices has hampered profits.

Prices across commodity markets are starting to ease with Europe topping up supplies ahead of winter, lowering fears of supply shortages and a potential energy crunch.

However, Shell is still expected to reported strong profits for the quarter, and is also expected to conclude a $6bn buyback for its shareholders this week.

This raises the prospect of more pressure from the Labour party for the windfall tax to be extended over the coming months.

Shell and BP under windfall tax pressure

The Government has recently announced proposals to cap revenues from renewables, drawing the ire of green energy producers.

This includes Scottish Power and SSE, which both told City A.M. the levy risks jeopardising investment.

Meanwhile, Chancellor Jeremy Hunt refused last week to rule out further interventions in the energy sector.

Hunt told Parliament that “nothing is off the table” as the Government looks to stabilise markets, and recoup funds following historic spending on the pandemic and energy crisis.

He said: “I am not against the principle of taxing profits that are genuine windfalls. But … in the energy industry, it is a very cyclical industry and there are businesses that have periods of feast and famine, and you have to be very careful that you don’t tax companies in a way that drives away investment.”

The Energy Profits Levy, which was unveiled by former Chancellor Rishi Sunak in May earlier this year, imposes a further 25 per cent levy on domestic oil and gas producers over the next three years.

This is on top of the 40 per cent special rate of corporation tax North Sea operators pay, meaning 65 per cent of profits are now taxed.

Operators include specialist traders such as Harbour Energy and Neptune Energy, alongside household names such as BP and Shell.

Labour is pushing to backdate the tax, and apply it to profits from January 2022 rather than May.

It also wants to get rid of the government’s tax relief scheme for oil and gas companies, which provides up to 91 per cent tax savings for companies that invest in domestic projects.

Industry body Offshore Energies UK told City A.M. that expanding the windfall tax could jeopardise further investment in the North Sea.

However, they played down the prospect of the levy being expanded and said it would be hard to make definitive judgements about theoretical increases in the tax.

A spokesperson said: “That is a definite risk, but taxes and investment incentives are complex, especially if they are entirely theoretical.”

Commenting on the industry’s tax take, the group added; “The UK offshore industry is proud to have paid nearly £400bn in taxes over the last five decades and will contribute billions more to the UK economy in this and future years.”

BP and Shell have pledged to spend £18bn and £25bn on low-carbon energy projects respectively in the UK over the coming decade.