Experts say energy bills will stay high despite gas price slump

Don’t expect energy bills to revert to normal levels this winter, warn experts, despite the recent easing of gas prices across UK and European spot markets.

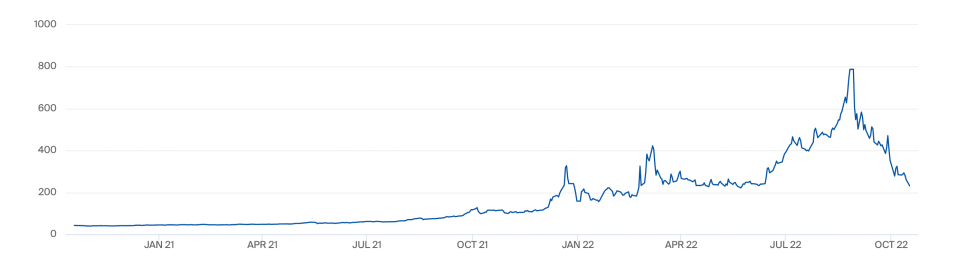

Gas prices are down 16 and 12 per cent on UK and Dutch benchmarks, continuing a downward trajectory that began earlier this month.

On the spot market, gas is trading at £2.32 per therm in the UK, sharply down from £7.88 per therm recorded in August – its lowest levels since June 2022.

This reflects Europe’s successful scramble for gas, topping up supplies to over 90 per cent capacity across the bloc – which has lowered fears of supply shortages this winter.

However, futures markets which track contracts for months ahead remain historically elevated – with prices forecast at over £4 per therm next February in UK markets.

With Russia continuing to squeeze supplies into Europe, and the severity of winter temperatures difficult to predict, concerns remain over market tightness heading into the new year.

Nathan Piper, head of oil and gas research, told City A.M.: “As weather conditions remain windy and mild we are seeing gas prices ease somewhat, helped by high European storage levels. However this could be a temporary respite if the temperature turns colder. In addition, the forward curve indicates that prices will remain elevated into 2023 as gas is secured to refill storage ahead of next winter.”

This meant the Government’s Energy Price Guarantee would still cost tens of billions, despite being slashed to just six months rather than two years.

Cornwall Insight and Auxilione are both predicting the energy price cap will rise to over £4,000 per year in April – reflecting the ultra-high cost of season ahead contracts.

The cap has become relevant once again following new Chancellor Jeremy Hunt’s decision to reduce the timeframe of the support package – meaning as it stands households will be hit with massive bills based on the cap next spring.

Prices to stay high despite supply scramble

While there is growing optimism over supplies, prices are likely to remain elevated over the coldest months of the year.

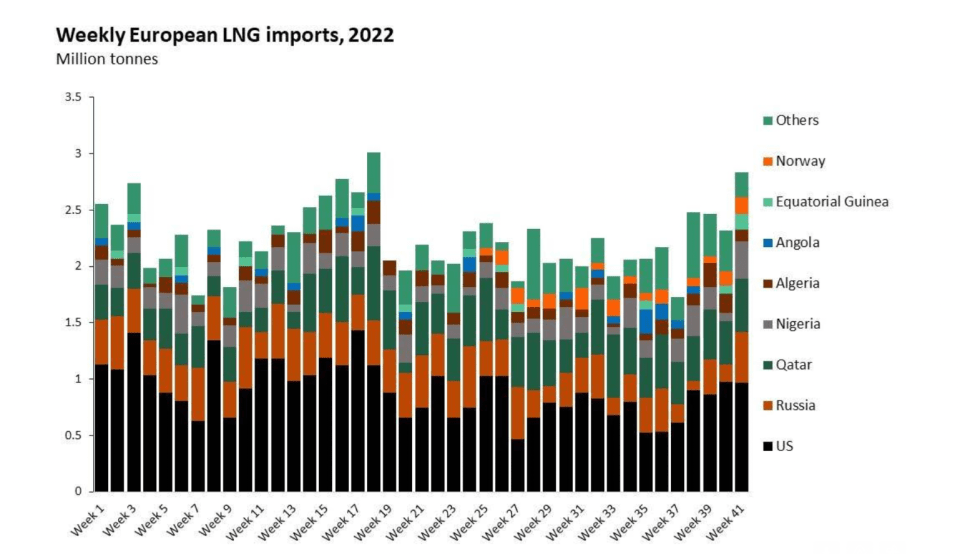

The continent has become increasingly dependent on costly liquefied natural gas from the US and Gulf states to meet its energy needs.

This will keep prices high, while there are also concerns over the lack of re-gasification capacity for LNG.

Currently, dozens of ships carrying supplies are circling the coasts of Spain, unable to secure slots to unload.

News agency Reuters has reported there are more than 35 LNG-laden vessels drifting off Spain and around the Mediterranean, with at least eight vessels anchored off the Bay of Cadiz alone.

This has raised the prospect of a suspension of bookings, with ships potentially looking for alternative ports outside Europe to offload their cargo.

It is also not clear what the outcome will be from various political factors remaining undetermined and continuing to loom over markets.

For instance, talks within the European Union (EU) over a potential gas price gap to tame soaring prices and slash Russian war revenues following the invasion of Ukraine have dragged on for weeks.

The consequences of a cap could be vast and polarising – with extreme outcomes possible such as effectively strangling Russian President Vladmir Putin’s grasp over the energy or potentially crashing markets with vendors ditching Europe over concerns about price control.

Many member states have pushed for a price cap, but the bloc has not yet reached consensus on whether to cap the price of gas for end users.

Several countries, including Germany and Netherlands, remain fundamentally opposed to a gas price cap.

They fear it could exacerbate the energy crisis by failing to address the EU’s fundamental supply issues.

Other countries are pushing back on the idea due to the significant negative impact it could have on the supply-demand balance.

Member states will meet in Brussels on later this week to discuss the price cap idea further.

Ole Hansen, head of commodity strategy at Saxo Bank, told City A.M. that Russian President Vladimir Putin’s ability to “shake the market” had already been limited with just one line from Russia in operation.

This follows Nord Stream pipeline being effectively shut down over a dispute concerning a turbine before later reports of leaks and explosions, while the Ukraine pipelines are wrapped in a legal tussle with state provider Naftogaz.

Hansen even suggested there was not “the potential risk of a spot price collapse” amid the influx of LNG and the mild start to autumn.

Supply shortage fears persist over winter

Nevertheless, there are still concerns over supply shortages this winter.

The IEA warned in its gas report earlier this month that Europe’ must slash its consumption by more than a tenth to prevent the risk of power rationing and widespread blackouts this winter.

Meanwhile, the National Grid’s chief executive John Pettigrew confirmed the operator’s worst case scenario of three hour blackouts on weekdays in January is possible if gas imports are reduced.

Speaking at the Financial Times’s Energy Transition Summit, John Pettigrew said the company would have to impose rolling power cuts on “those deepest darkest evenings in January and February” if generators failed to secure enough gas from the continent to meet demand, particularly if the country suffers a cold snap.

Rystad analyst Nikoline Bromander argued Europe “prays for a mild winter” and that it remains overly dependent on overseas suppliers to meet its needs.

The expert said: “Europe itself takes steps to introduce a price gap, but details remain vague, causing markets to continue to take a wait-and-see attitude. Until then, with the gas withdrawal season approaching fast, market participants will be hoping to avoid any major supply outages and abnormally cold weather which would hit certain European nations, such as Germany, at the worst possible time.”