The winds of change for financial services have been a digital blessing

The music industry has digitally transformed and now that the asset management sector is too. Many industries have put a digital wrapper around their businesses, promoting themselves online via their websites, emails, artificial intelligence, cloud computing, etc.

However, digital transformation is about business transformation and not merely about having the ability to digitally interact with clients and suppliers. We have witnessed the music industry digitally transform and now we are seeing the asset management industry follow suit as more digitised/tokenised funds are being created.

The crypto evangelists are keen to claim that digital assets will replace fiat currencies and that the death of banks is nearing as people turn their backs on using cash. The reality is that despite there being over 13,000 listed cryptos, only a handful of cryptos (including Bitcoin and Ethereum) account for over 52% of the crypto market capitalisation, whereby still dominating this relatively small asset class which is valued at less than $1 trillion.

However, the technology that drives the crypto market is also gradually being adopted by existing traditional financial firms, in addition to new companies, as people begin to realise that times are changing and the technology is able to transform many existing regulated and non-regulated business practises. As commerce increasingly becomes digitised, companies are looking to offer their goods and services on-line and, where possible, automate processes, be more efficient and have a more direct link with their end customers.

In the past, we saw a gradual rise in the number of intermediaries which were established to, in theory at least, protect the interests of third parties. The issue is that these intermediaries (particularly in the financial sector), coupled with a never-ending wave of regulation, has encouraged a mentality in needing to check and double check what regulated firms actually do.

This, in turn, has led to a rise in costs which has an impact on the return received by the final investor. Furthermore, we have seen compliance driving business development in terms of reporting who is allowed to buy what, and how, with a complex web of rules and regulations across a variety of jurisdictions. Yes, we need compliance and strong risk controls to protect investors and maintain confidence in financial markets but unfortunately, to a large extent, the paper-based systems and processes that were historically developed have now become electronic and are arguably no longer relevant for our modern financial services sector.

A very simple example of the way that the financial services sector has changed is that of an 87-year lady visiting one of the few remaining bank branches, close to where she lives, as she wants to open a savings account. Once there, she is told it is not possible to open a bank account in the bank as this process needs to be done on-line.

The bank (one of the four largest in the UK) truly has said goodbye to paperwork and quill pens and the need for a real signature as the elderly lady is basically told that she has to ‘go digital’. But in reality, have the banks indeed become digital or are they the same as many companies in thinking that by having a website and asking people to complete applications on-line is all that is required?

So, in order for a business to be digitally transformed it actually needs to alter its entire method of conducting business and, in turn, redefine how and what it is offering its clients. When a business offers new ways of creating value for its customers or identifies a new target market for its products and services in a way that it has not done before, it has digitally transformed. This transformation is about business transformation, not merely about being able to digitally interact with clients and suppliers.

The music industry is a good example of an industry that has been digitised as opposed to becoming merely digital. Historically, music was sold via a physical record and then via cassettes, and it was not until the 1990s that music was sold in a digital format – CDs, for example. This, in turn, led to Apple releasing the iPhone and iPod where music could be bought in a digital format thus not needing for a physical item such as a record, cassette or CD.

However, the industry did not stand still. It arguably became even more digital when, in 2008, a new Swedish firm that was only two years old launched Spotify and, in doing so, forced even the mighty Apple to go back to the drawing board and create Apple music.

Arguably, the $100 trillion asset management industry – having become digital with the use of emails, together with the cloud, and even deploying AI, Big Data and complex algorithms to actually manage funds – is only just starting to digitally transform and offer digitised products and services. This process could well be set to accelerate as the global economy stutters and fund managers look to target new customers and solve old challenges, such as liquidity of some of the assets and funds managed by them.

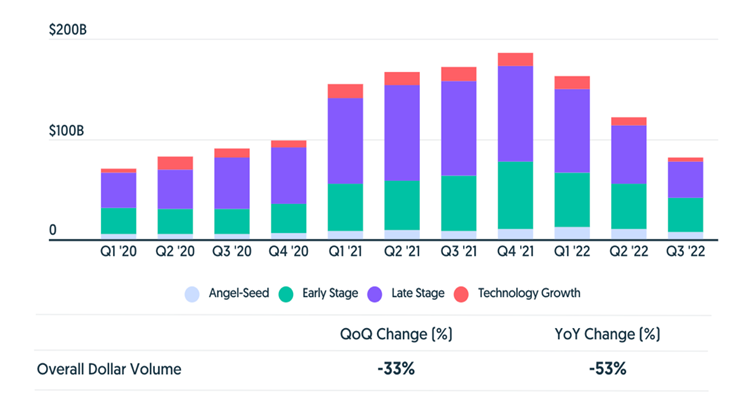

Global Venture Capital funding

Source: Crunchbase

Having seen record amounts of capital flow into Private Equity (PE) and Venture Capital (VC) funds over the last couple of years, volumes have been falling – although there is estimated to be over $1.8trillion of cash available to be invested in the next five years. One of the major challenges that investors must accept before they invest in PE or VC funds is that typically they will need to commit to not being able to have access to their funds for several years.

The lack of liquidity is largely because the underlying investments that the PE and VC fund managers make are into private/unquoted firms. Furthermore, it may not be too long before we see private shares able to improve their liquidity in secondary trading since the Depository Trust and Clearing Corporation (DTCC ), which based in the US and is globally the biggest organisation to settle bonds and equities, has been developing a digitised solution for years using blockchain technology. Project Whitney is just one of its projects looking to use blockchain technology with a view to digitise private securities by offering tokenisation using the Ethereum blockchain. It is hoped that, once successfully implemented, this will help to make the trading of private equities easier and thus they will become more liquid.

Another driver for asset managers to embrace digitalisation is likely to come from regulators and compliance managers as they begin to understand a digitised proposition can enhance the compliance infrastructure and reduce regulatory and business risks whilst offering access to information in almost real time. As a demonstration of digital transformation, the private equity firm, Kohlberg Kravis Roberts (KKR), which manages $479billion of assets, announced that it was to tokenise one of its PE funds. This means that investors will have a secondary market in which to be able to trade a KKR’s fund and, if popular, then no doubt KKR and indeed other PE firms will tokenise other PE funds.

So, given the PE sector is estimated to be worth $7.2trillion then, if other PE managers follow KKR’s lead and digitalise/tokenise their funds, there could be a huge demand for digital asset exchanges such as Archax, SDX, SIX, Tokeny, etc, to trade these tokenised PE funds. In the meantime, other asset managers have already revealed that they, too, are preparing to digitalise some of their mutual funds with announcements coming from JP Morgan, Abrdn asset management Franklin Templeton and Alliance Bernstein. So, how long will it be before we also see VC fund managers digitise some of their funds and so offer greater transparency and potentially more liquidity to a market that is estimated to be worth $584billion by 2027?

The Society for Worldwide Interbank Financial Telecommunications (SWIFT) which provided a secure messaging system for financial transactions for over 11,000 financial institutions in 200+ jurisdictions has recently announced: “Ground-breaking SWIFT innovation paves way for global use of CBDCs and tokenised assets”.

It ought to come of little surprise that SWIFT has been working with banks as to how to handle central bank digital currencies (CBDC) but the fact it is looking to tokenised assets too i.e., securities could prove to be very significant. SWIFT has historically offered a service to enable banks to communicate with each other, so does this announcement mean that it is looking to offer the ability for banks to now transact with each other and thus trade CDBC and digitised assets? If so, will traditional stock exchanges, clearing houses, brokers, FX traders, etc, all face a new competitor?

What is certain though is that the financial services sector, along with other industries, is slowly being digitally transformed and, in doing so, is offering new products and services to new clients.

Jonny Fry writes a weekly analysis called Digital Bytes that looks at how, why and where blockchain technology and digital assets are being used globally in various industries. To receive your free copy, go to www.digitalbytes.substack.com