Europe risks supply crunch this winter if Russia cuts off gas, warns IEA

Europe will be on the verge of a supply crunch this winter if Russia turns off the taps into the continent, warned the IEA.

The Paris-based climate group predicted that the European Union’s (EU) gas storage could be almost emptied by February in the case of a complete shutdown of Russian gas flows from November.

It revealed that without demand reductions in place, EU gas storage would be less than 20 per cent full in February, assuming a high level of liquefied natural gas (LNG) supply – and close to five per cent full, assuming low LNG supply.

Storage falling to these levels would increase the risk of supply disruptions in the event of a late cold spell towards the spring.

It also calculated that the EU would need to maintain gas storage levels above 25 per cent in the case of a drop-off in LNG inflows.

This means gas saving measures will be crucial to minimise storage withdrawals and keep inventories at adequate levels until the end of the heating season.

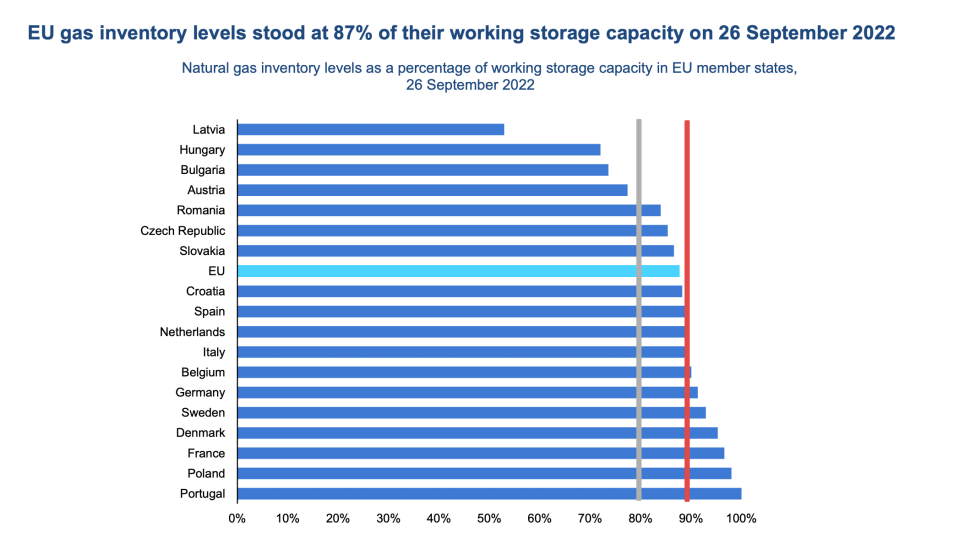

EU gas storage has risen to 89 per cent on average across the bloc, according to ASGI+.

However, if Russia carries out a threat to sanction Ukrainian energy firm Naftogaz, one of the last functioning Russian gas supply routes to Europe could be shut.

Investment group Stifel predicts that Russia will cut off supplies into Europe by mid-November.

IEA: Gas supplies to remain tight into 2024

The IEA’s forecasts were featured in its quarterly gas report, where it predicted global gas markets will remain tight into 2023, as Europe competes with Asia for liquefied natural gas (LNG) supplies.

This is despite an expected tumble in European demand, with a 10 per cent contraction on the continent expected to drive a 0.8 per cent decline in global consumption this year.

Fears of supply shortages have been driven by a Russian squeeze on gas flows into Europe, following the shutdown of the Nord Stream 1 pipeline from Russia to Germany in early September and leaks found on the pipeline system last week, causing explosions and gas bubbles in the Baltic Sea.

This has deepened market tensions and uncertainty ahead of the coming winter, not just for Europe but also for all markets that rely on the same supply pool of LNG.

European natural gas prices and Asian spot LNG prices spiked to record highs in the third quarter of 2022.

This reduced gas demand and encouraged switching to other fuels such as coal and oil for power generation.

The continent has offset the sharp falls in Russian gas supplies through LNG imports, alongside alternative pipeline supplies from Norway and elsewhere.

Europe’s surging demand for LNG – up 65 per cent in the first eight months of 2022 from a year earlier.

This has drawn supply away from traditional buyers in the Asia-Pacific region, where demand has dropped seven per cent in the same period as a result of high prices, mild weather and continued Covid lockdowns in China.

The IEA forecasts Europe’s LNG imports will increase by over 60bn cubic metres (bcm) this year, or more than double the amount of global LNG export capacity additions.

Those will keep international LNG trade under strong pressure for the short- to medium-term.

With China’s LNG imports expected to rise next year amid increased demand, a a colder-than-average winter would result in additional demand from northeast Asia, further adding to market tightness.

Alongside the shift to LNG, the EU and its member states have taken other steps to increase gas security, such as setting minimum storage obligations and implementing energy saving measures for the coming winter.

Keisuke Sadamori, the IEA’s Director of Energy Markets and Security said: “The outlook for gas markets remains clouded, not least because of Russia’s reckless and unpredictable conduct, which has shattered its reputation as a reliable supplier. But all the signs point to markets remaining very tight well into 2023.”