Terrible Thursday for Darktrace as shares nosedive by 25 per cent after private equity walks away

Darktrace share price jumped sharply on reports last month that it is in talks with private equity fund Thoma Bravo, although no figure was attributed to the discussions.

However, this morning it was confirmed that these talks had ended with no prospect of an offer being made in the near future, although the option was left open for this to be revisited after 6 months.

With the shares already well below their post IPO peaks of last year there is a sizeable split amongst investors as to whether the company can live up to expectations.

“This means that today’s full year results will likely get lost in the noise of this morning’s announcement that Thoma Bravo won’t be going forward with an offer for the business,” commented Michael Hewson, chief market analyst at CMC Markets in London.

He said this morning that “for the London market the news will be a mixed blessing as it will mean that we get to keep a tech success story, however on the flip side the shares have slipped sharply as the debate continues about its business model.”

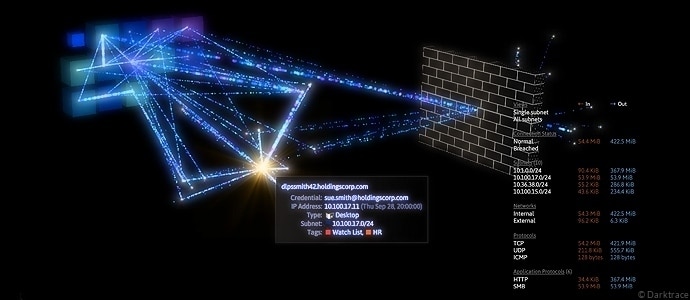

“On the one hand it has been touted as an award-winning pioneer in the cyber-security space, a sector that is more important than ever in these testing times and the Russian invasion of Ukraine,” Hewson continued.

“On the flip side there are questions about its links with Autonomy owner Mike Lynch with some investors questioning how deep these links go,” he added.

Hewson further pointed out that there have also been questions about the amount of money the company spends on R&D, which it is being argued is too low for such an important sector.

Full year revenues came in at $415.5m, a rise of 45.7 per cent from last year’s restated $285.1m, and slightly below expectations.

This shortfall appears to be down to $3.8m of revenue which had been reported in this fiscal year being re-allocated to the 2021 results.

Darktrace said that the increase in revenue was driven primarily by subscription contracts that averaged about 33 months, which has helped boost Remaining Performance Obligations (RPO) for the next three years up to $942m.

Darktrace went on to reiterate its previous guidance set out in July that it expects to see recurring revenues rise between 31 per cent and 34 per cent for the upcoming financial year.

This is down from the 42.6 per cent rise this year which took the sum to $514.4m.

The company posted an operating profit of $7.6m, compared to a loss of $34.7m. After tax and other expenses this number fell to a net profit of $1.5m compared to a loss of $145.8m.

This is despite a sizeable increase in operating costs which have risen to $358.2m with sales and marketing making up $232.8m of that total. The number of customers has risen 32.1 per cent to 7,437, from 5,629.