Even as we teeter on the edge of a recession, we will create new opportunities

NECESSITY, as the old saying goes, is the mother of invention. That’s why periods of economic or social upheaval often coincide with exceptional innovation – the rapid development of the Covid-19 vaccine, based on breakthrough mRNA technology, being a perfect example.

Today, the global economy is in precarious shape. Europe, in particular, faces likely recession and the risk of 1970s-style stagflation. Even if overall R&D spending declines – as access to growth capital becomes increasingly scarce – the pace of innovation may remain robust. Because necessity is the mother of invention.

Consider Starbucks Pickup, introduced in New York last winter, less than two years after the city that never sleeps completely shut down. Launched in partnership with Amazon, and like Amazon Go retail stores, customers place and pay for their order via an app, then pick up their oat-milk Frappuccino with virtually no human interaction.

Starbucks has been struggling as it grapples with supply chain disruptions, a tight labor market and a significant sales drop in China due to zero-Covid policies there. For a company that operates over 30,000 locations, it may seem of merely anecdotal interest that it plans to build some 300 new pick-up only shops.

However, the potential of such technology is immense. It could help address challenges linked to worker shortages and wage pressure, which will become especially acute as the global population ages and immigration restrictions intensify. It’s also worth noting that this rollout is taking place just as Starbucks announced the closure of 16 US stores in response to employee concerns about crime and safety.

Sometimes, world-changing innovation is born of necessity and starts small.

Thomas Edison patented the long-lasting light bulb in 1879. But that followed four decades of tinkering by various scientists intrigued by the idea of electric light as a replacement for expensive, ineffective and sometimes dangerous sources like whale oil and kerosene.

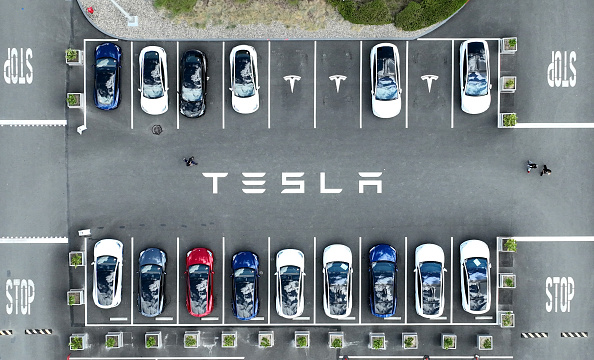

Today, in the most important shift since the Model T replaced the horse and buggy, the auto industry is in the midst of once-in-a-lifetime disruption – on two fronts simultaneously. Technology has reached a tipping point just as we see record climate events and a global energy crisis.

Tesla’s Berlin and Texas factories started production this year. Volkswagen has begun construction of its €2bn gigafactory in Germany, part of its plan to build multiple battery factories. Such moves will help localize supply chains, a major geopolitical pain point, at a time when energy shortages will reiterate the need for clean tech innovation.

The percentage of global consumers looking to buy electric vehicles has for the first time ever reached the majority, at 52 per cent, according to EY.

Self-driving cars are also on the road to reality. In June, GM’s autonomous driving division, Cruise, began a paid driverless taxi service in San Francisco. The service is restricted to late-night hours and faces some teething issues. But being able to charge customers for driverless rides is a milestone for autonomous driving and robo-taxis.

Elsewhere, Elon Musk plans to unveil a prototype of Tesla’s humanoid robot, Optimus, later this year. And the SpaceX Starlink satellites have been crucial for communications during the war in Ukraine.

The best companies can thrive during periods of uncertainty, like today, including by investing in innovation. That requires long-term focus and flexibility, especially financial flexibility. That’s why companies with strong balance sheets and high levels of free cash flow are best positioned to continue to invest through the current cycle – ensuring that innovation never stops, including when times are tough and change is needed most.

Even as markets wobble, recession looms and geopolitical risks multiply, bold new ideas will continue to emerge. Because necessity remains the mother of invention.