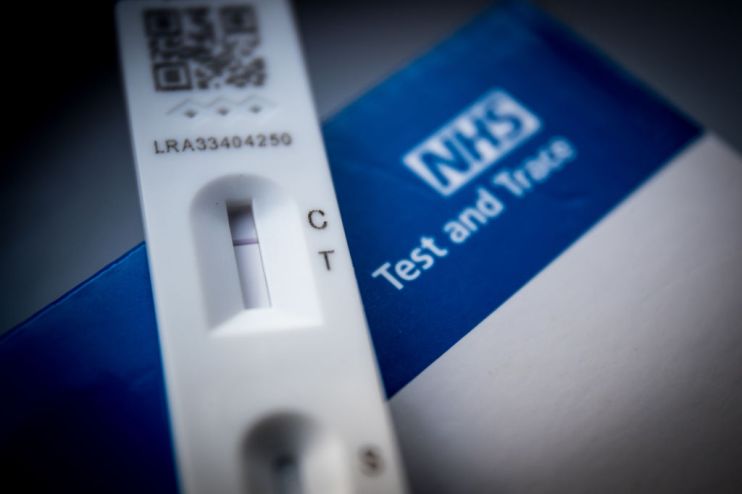

Covid test maker’s shares sink as CEO warns of losses over spat with Government

Covid-19 test provider Abingdon Health’s shares have plunged today as bosses warn losses related to “resolving the lack of payment” by the Government’s Department of Health and Social Care (DHSC).

Boss of London-listed rapid test manufacturer Chris Yates said today that the full-year results were “disappointing in many respects, particularly the distraction of the Judicial Review and the challenges in resolving the lack of payment from the DHSC.”

The CEO lent some relief to investors, saying that he expects next year to “see a return to revenue growth and that our programme of investment will see us begin to generate meaningful commercial traction.”

Shares sank more than 21.5 per cent to just 7.25p per share by mid-morning.

The company, based in York, now expects revenue to come in at £2.8m in the year to 30 June, in comparison with £11.6m last year.

Investors had already climatised to a foreseen ‘Covid-19 cliff edge’, where companies relying on coronavirus for revenue may begin to underperform as the pandemic retreats in the UK.

Abingdon had been hit by this late last year, which prompted a major restructuring and cut nearly 40 staff from its workforce, to a total of 86 employees by the end of July.

City A.M. has contacted the DHSC for comment.