Abrdn’s Asian Income Fund loses 6.9 per cent of value as APAC markets suffer

Asset management giant Abrdn said the value of the assets controlled by its Asia Income Fund plunged 6.9 per cent over the first half of 2022 as markets were rocked by a combination of Covid lockdowns and the ripples of war in Ukraine.

In its half yearly report today, the firm said net asset value per share at the end of the first half hit 240.04p, tumbling from 262.76p six months earlier and down from 257.62p at the same point a year prior.

Bosses said its portfolio of Asian equities had been battered by the turbulence on markets this year.

“Investors confronted not only Europe’s biggest conflict since World War II but also the prospect of a global recession as major central banks moved to fend off inflation amid a spike in commodity prices,” said Ian Cadby, chairman of the firm.

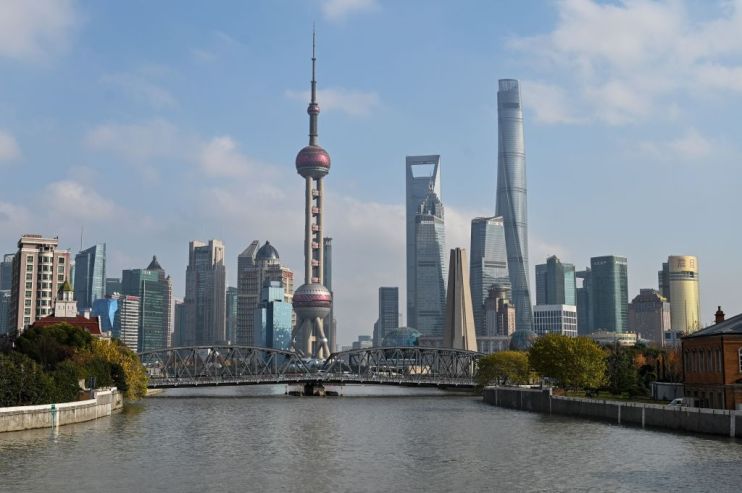

“Much of the action was centred in the West, but Asian markets were not spared the knock-on effects of these developments. Risks emanated from China too – pandemic outbreaks and resultant lockdowns in its major cities and business hubs weighed on domestic activity.”

Cadby added that lingering concerns around the ailing Chinese property market and regulatory risk in the new economy sectors also hampered performance.

Abrdn said moves to lift Covid restrictions across Asia “should prompt market growth in the short to medium term” as it claimed Asian markets have thus far been more “resilient” than US and European markets.

The 6.9 per cent drop came as MSCI’s All Countries Asia Pacific ex Japan Index lost 5.8 per cent of its value over the same period.

Abrdn said the sharper drop in value came as a result of its Asian fund’s reduced exposure to Chinese markets, which saw it excluded from the benefits of China’s rebound.

Abrdn also does not hold shares in China’s internet behemoths Alibaba, JD.com, and Baidu, due to the their refusal to pay out dividends to investors, while a lack of exposure to China’s biggest banks also hit the value of its assets.

Looking forward, Abrdn said “volatility could remain the order of the day” as it warned that China and its zero-Covid policy “is still a source of some anxiety”.