Brace for another financial crisis style recession, Bank of England warns

The UK is set to slump into a recession comparable to the financial crisis, driven by the biggest inflation surge in 42 years, the Bank of England warned today.

Britain’s economy will shift into reverse in the final three months of this year and stay there until the final months of next year, placing it among the worst recessions the country has experienced.

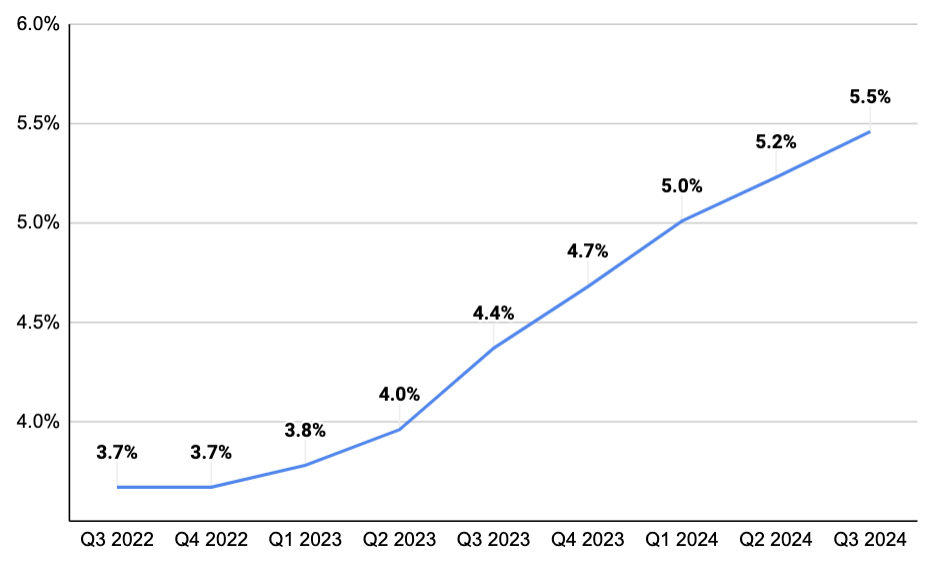

Despite that warning, the Bank’s nine-strong monetary policy committee (MPC) voted 8-1 in favour of a 50 basis point interest rate rise, the steepest hike in its 25 year history.

The move takes rates to 1.75 per cent, somewhere they have not been since December 2008. It is the sixth rate rise in a row, also a first.

“Underlying UK GDP growth has slowed and the UK economy is forecast to enter recession later this year,” the Bank said.

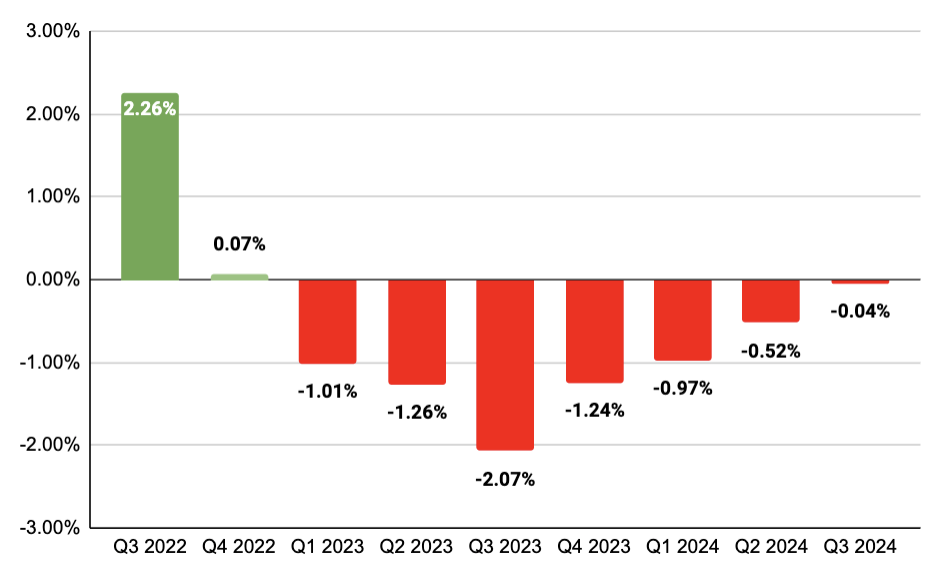

“Output is projected to fall in each quarter from 2022 Q4 to 2023 Q4,” it added, the longest slump since the financial crisis and more drawn out than the Covid-19 pandemic.

The economy will shed 2.1 per cent over the entire downturn, around the same amount of output lost in the sterling-crisis driven recession in the early 1990s.

On an annual basis, the economy will contract in both 2023 and 2024.

Unemployment is set to peak at over 6.3 per cent, reversing a trend that has seen the jobs market hold up well amid intense economic headwinds.

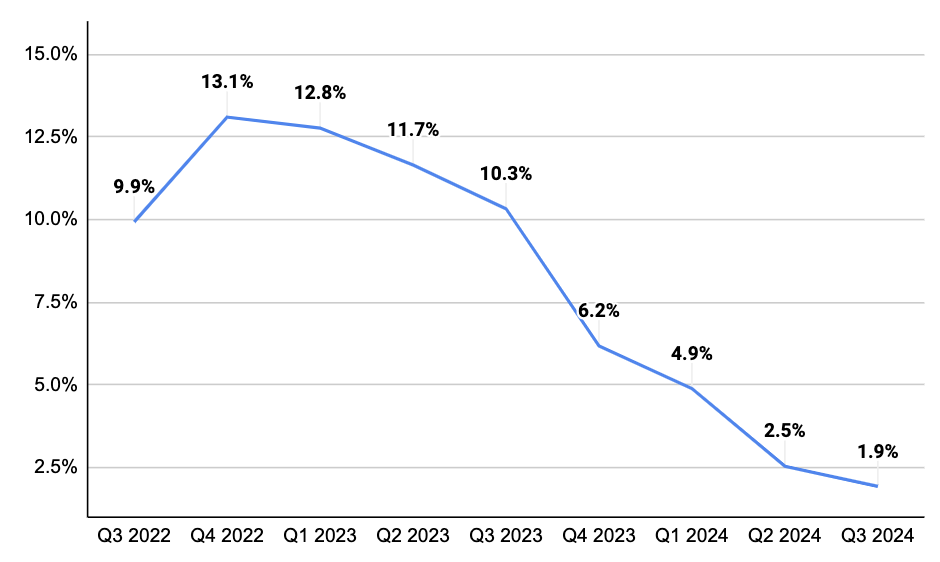

Brits will respond to an inflation peak of over 13 per cent in October eroding their living standards at a historic pace by slashing spending, choking the UK economy, while businesses are likely to rein in production due to higher costs making some activities unprofitable.

The Bank is forecasting inflation will peak at over six times its two per cent target and hit the steepest level since September 1980.

Worryingly, in a year’s time, inflation will still be running at more than 10 per cent and will not return to the Bank’s target until the third quarter of 2024.

A surge in global gas prices caused by Russia’s invasion of Ukraine and Moscow choking gas flows has pushed inflation higher. That price surge is the primary driver tipping the UK into recession.

Higher global gas prices will lift the energy price cap to over £3,500 in October, more than three times higher than a year ago, Threadneedle Street said.

A tight labour market caused by worker shortages will intensify domestic inflationary pressures by forcing firms to pass on pay rises, the Bank said.

Despite weekly earnings climbing over five per cent this year and next, households’ living standards are set to shrink in both 2022 and 2023, at 1.5 per cent and 2.25 per cent respectively, the first time real incomes have dropped in two consecutive years since records began in the 1960s.

That fall comes despite the government ramping up support for the poorest households to cushion the blow from higher energy bills.

Tory leadership hopeful Liz Truss has promised to cut taxes if she wins, while her rival Rishi Sunak is unwilling to reduce taxes until inflation is tamed.

Truss said she will tackle the economy malaise outlined by the Bank “through supply side reforms, dealing with burdensome business regulation and cutting taxes.”

“My tax cuts are necessary, affordable and not inflationary,” she added.

Current chancellor Nadhim Zahawi said: “Addressing the cost of living is a top priority and we have been taking action to support people through these tough times with our £37bn package of help for households.”