Ofwat clamps down on water companies with proposals to regulate dividends

Water companies could be prevented from making dividend payments if their financial resilience is at risk, under potential new reforms to the scandal-ridden sector.

Ofwat set out the proposal today, which would enable the watchdog to take enforcement action against companies which don’t link dividend payments to performance, or take account of customer service, and environmental targets.

It would also target companies failing to be transparent about their dividend pay-outs.

The regulator will also aim to boost the attractiveness of investing in water and wastewater companies, to enhance the sector while helping to improve the performance of existing companies.

If finalised, the changes would be effective from 1 April 2025.

The consultation will remain open until 29 September this year, and follows a discussion document on financial resilience published in December 2021.

Other reforms proposed included requirements for companies to hold two issuer credit ratings, removing the ability for companies to hold one issuer rating that is significantly higher than the others available.

It believes these proposals will also ensure that companies will be able to weather financial pressures and unexpected shocks to their business, without compromising their delivery for customers.

David Black, Chief Executive, Ofwat said: “It is vital that companies have sufficient financial strength to withstand shocks and surprises. Our proposals today will raise the bar on credit quality and give us new powers to block dividends if a company is putting their financial stability at risk in making them. These changes should also ensure that companies engage with us earlier when they do see any concerns with their financial resilience.”

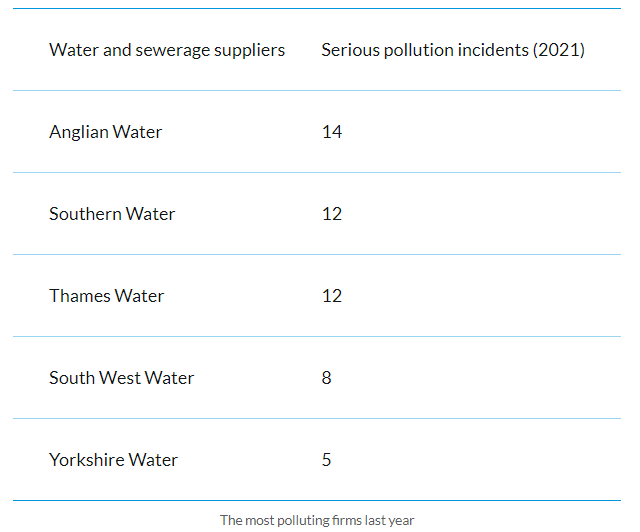

This follows Environment Agency chair Emma Howard Boyd calling for water bosses to go behind bars for the most serious acts of deliberate pollution.

Earlier this month, she slammed the “appalling” failure to stop raw sewage leaking into rivers, and called for tougher measures to deter rule-breaking.

She said: “Water quality won’t improve until water companies get a grip on their operational performance. We plan to make it too painful for them to continue like this.”

Meanwhile, six water companies have been slapped with enforcement cases, with South West Water hit last month with an information request – to determine whether it is complying with its environmental obligations over treating sewage water.

Others facing enforcement cases include Anglian Water, Northumbrian Water, Thames Water, Wessex Water and Yorkshire Water.

Ofwat and the Environmental Agency announced investigations into all water and wastewater companies last November.

This was after several water companies revealed they might not be treating as much sewage at their wastewater treatment works as they should be, and that this could be resulting in sewage discharges into rivers and other environments without permission to do so.

The admissions to Ofwat were prompted by the installation of new monitoring equipment, which are currently being placed over 2,200 wastewater treatment works in England.

Black concluded: “Customers are rightly concerned that companies pay out dividends even where the fall well short of their obligations to customers and the environment. The responsibility for determining dividends ultimately sits with companies and their boards. However, in a sector that provides an essential service, where customers cannot choose their supplier, it is important that customers and wider stakeholders can understand and have confidence in how decisions companies make about dividends relate to overall performance.”