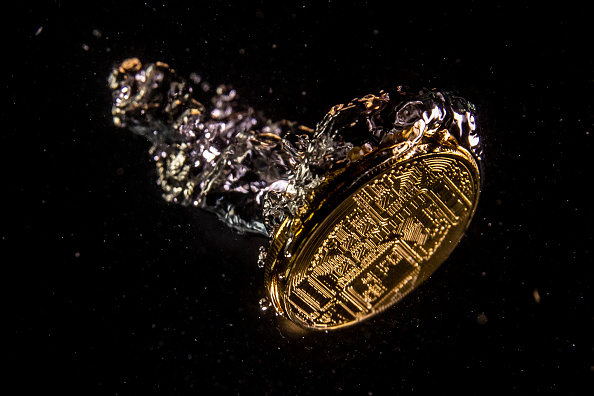

Shakeout continues as the price of Bitcoin shuffles sideways

The week in review

with Jason Deane

While Bitcoin’s price hasn’t really moved this week, the shakeout across the industry is continuing. Voyager and Three Arrows Capital had already collapsed as reported earlier, but this week Celsius filed for Chapter 11 bankruptcy after suspending all withdrawals a few weeks ago.

Of course filing for any sort of bankruptcy really doesn’t fill users and investors with confidence, but Chapter 11 is usually used where the company has a chance of successfully completing the restructuring process and coming out the other side. It seems Celsius might just do it.

Over the last couple of weeks, the company has paid by $718m to various protocols including Maker, Aave and Compound, releasing over a billion dollars of collateral in wBTC and stETH back to Celsius.

This all sounds very complicated – and it is – but it also gives an insight into just how interconnected some of the industry’s major players are.

For example, Three Arrows Capital failed to meet a margin call from BlockFi and its positions were liquidated. This meant that it defaulted on a loan from Voyager, adding pressure to the already embattled organisation and ending in its filing for bankruptcy under Chapter 15. Court documents revealed that Voyager owed Alameda Research $75m, but Alameda also owed Voyager $377m, which, indecently, owns nine per cent of the former.

Phew. I’m glad I’m not the one sorting all that out.

In my view, there is more collateral damage to come, partly because of over leveraged positions and over ambitious lending, but also because so much of this industry is still experimental. Some of this stuff simply doesn’t work and some things we can only seem to collectively learn the hard way.

Bull markets may encourage crazy risk taking, but bear markets reveal what actually holds up.

Of course, the irony that Mt Gox’s Rehabilitation Trustee announced this week that it was preparing to make repayments to investors after the disastrous 2014 collapse hasn’t been lost on me or, I suspect, many others. It seems just as we come close to sorting out one mess, we go and create another one.

But as messy as this all may appear to be, spare a thought for the legacy financial system which is in a far, far worse state.

This week US inflation hit 9.1 per cent, a rate last seen in the early 1980s, matching the current UK rate. The EU is at 8.8 per cent, Belgium at 9.65 per cent and Spain at 10.2 per cent. In fact, there are now more than 35 countries with an inflation rate of over 15 per cent, including Syria, Venezuela, Zimbabwe, Sudan and Lebanon with rates well over 100 per cent.

But, as bleak as it all seems, it’s worth remembering that we are living through one of the most challenging and exciting times in human history. The transition to the next generation of finance will be complicated, painful and full of mistakes, but ultimately Bitcoin’s fundamentals will usher in a new era of inclusion and free trade.

And that’s such an important thing to remember, I’m going to use Joe Biden’s immortal words from his July 8 speech to emphasise the point: “End of quote. Repeat the Line”

Have a great weekend!

Want to learn more about what’s going on in our global financial system and how Bitcoin fits into it? Come to my next free webinar on Wednesday 20th July at 6pm to find out, ask any questions, and grab some free Bitcoin*. Click here to register.

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Yesterday’s Crypto AM Daily in association with Luno

In the markets

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/research

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $933 billion.

What Bitcoin did yesterday

We closed yesterday, July 14 2022, at a price of $20,569.92. The daily high yesterday was $20,789.89 and the daily low was $19,689.26.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $397 billion. To put it into context, the market cap of gold is $11.219 trillion and Tesla is $740.95 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $38,468 billion. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 57.68%.

Fear and Greed Index

Market sentiment today is 15, in Extreme Fear.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 43.63. Its lowest ever recorded dominance was 37.09 on January 1 2018.

Relative Strength Index (RSI)

The daily RSI is currently 49.74. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“Everyone has got to believe in something. Why not believe in something verifiable and unforgeable.”

Hass McCook, Author

What they said yesterday

Landmark moment…

Bitcoin getting more green by the day…

Here come the Yankees…

Crypto AM: Editor’s picks

Q&A with Duncan Coutts, Principal Technical Architect at IO Global

Jamie Bartlett – on the trail of the missing ‘Cryptoqueen’

MPs are falling silent over potential of cryptocurrency

Erica’s ‘Crypto Wars’ handed honours in Business Book Awards

‘Let people invest’: Matt Hancock makes case for liberal crypto rules

Explained: Why the Treasury is so sold on stablecoins

Fears crypto is used to avoid sanctions ‘misplaced,’ says Matt Hancock

The cryptocurrency fundraisers behind Ukraine’s military effort

Crypto crazy couple name baby after favourite digital asset

Peter McCormack: Transforming Bedford FC into a global Bitcoin brand

Crypto AM: Features

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto on the catwalk

Crypto AM: Events

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit 2021 – you can now watch the event in two parts via YouTube

Part One

https://www.youtube.com/watch?v=dvqNMNZTIDE

Part Two

https://www.youtube.com/watch?v=WXhX_-Tr5j0

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:00 BST